They’ve been rivals for more than 10 years.

Both Com2uS and Gamevil have battled for the local South Korean gaming market through the era of candy-bar phones until today. But in a new twist this month, they’re actually joining forces with Gamevil’s deal to spend roughly $65 million for a 21 percent stake in its longtime competitor.

The reason?

Android and iOS have fundamentally changed the global mobile gaming market. They’ve flattened it and games arguably can now cross cultural boundaries more fluidly than they ever have before. Games from European developers like King’s Candy Crush Saga and Supercell’s Clash of Clans can be distributed seamlessly in Asian markets. At the same time, new powerful chat apps like Kakao Talk are wedging themselves between Google’s Android platform and domestic game developers, lessening the power of local studios. So there’s more competition from abroad and weaker leverage for domestic developers.

The deal, which values Com2uS at roughly $304 million, gives Gamevil a majority stake in the company. We hear that more serious talks started several months ago between James Song and Jiyoung Park, the heads of both companies. Only a handful of employees knew about the deal before it closed.

Both companies have seen their stock prices decline over the last year (see below) as both public market investors and venture capitalists have soured on mobile gaming companies. It’s been difficult to see any of the developers break out from the hits-driven nature of the business after some early hope that a hugely dominant studio would emerge.

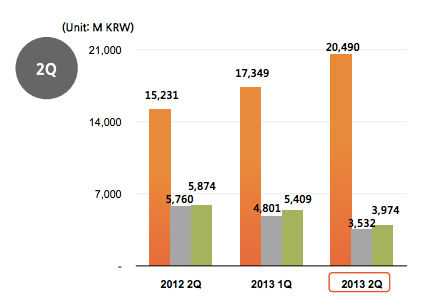

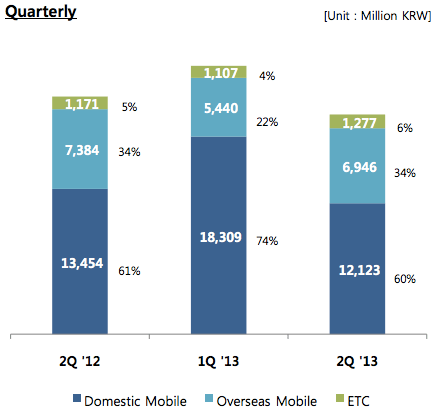

While Gamevil’s revenues have steadily increased year-over-year to $19.1 million in the second quarter of this year, their profits have declined 32.3 percent in the same time because they’ve had to pay more royalties to studios they publish games on behalf of. At the same time, Com2uS said its revenues were down 8 percent year-over-year to roughly $19 million in the second quarter because of poor performance of new games.

Gamevil’s Revenues

Com2Us Shows Declining Revenues

So you can see the argument that both companies might be able to do better together in the face of broad industry shifts. Gamevil’s shares rose 2.2 percent on the news, while Com2uS’ declined slightly.

Also, because Gamevil tends to be more focused on publishing while Com2uS does first-party games, there’s an argument that both companies’ businesses are complementary.

Furthermore, the larger network of players will also help in terms of cross-promotion and marketing. Gamevil says it has 300 million installs while Com2uS hasn’t released its figures.

That said, it’s unclear how the size of the combined workforce might be affected or how the management structure will work out between the two companies, which have about 800-900 employees between them. From what we understand, the companies are going to keep both brands for now.

In any case, it will be interesting to see whether this deal heralds another big consolidation wave for game developers in other parts of the world.