If you’re reading Twitter’s S-1 filing to see where the business stands as it prepares to go public (hey, that’s what everyone’s doing at TechCrunch), you may have noticed a number that comes up repeatedly: “advertising revenue per timeline view.”

What does that actually mean? Twitter says that along with things like monthly active users, ad revenue per timeline view is one of the key metrics it uses to evaluate its business. The company treats timeline views (“the total number of timelines requested when registered users visit Twitter, refresh a timeline or view search results while logged in on our website, mobile website or desktop or mobile applications”) as a measure of user engagement, and it uses ad revenue per timeline view to track its ability to make money from that engagement.

By that measure, Twitter’s ability to monetize is improving. It says advertising revenue per timeline view was $0.80 for the three months ending on June 30 of this year, up 26 percent from the same period in 2012. That number is significantly higher in the United States ($2.17) compared to the rest of the world ($0.30), though the international number is up 111 percent year-over-year.

Why invent an entirely new ad metric (and one without a handy acronym)? Well, Twitter has an unusual advertising model, with advertisers paying to promote tweets, trends, and accounts in users’ news feeds, so the standard ad measurement of CPMs (the cost per thousand impressions) may not apply. The fact that “advertising revenue per timeline view” actually measures revenue for every 1,000 timeline views suggests that this metric may be a proxy of sorts for CPMs.

(It’s probably a little dodgy to compare Twitter’s numbers with traditional CPMs, but hey, just for fun — according to eMarketer, Facebook had an effective CPM of $.071 on mobile and $0.19 on desktop in 2012.)

However, Twitter is really selling its ads as a way for companies to engage with consumers, so the filing also notes trends in cost per ad engagement — basically, it’s been falling steadily, with a sequential decrease of 46 percent in the last quarter, 12 percent the quarter before that, and 19 percent the quarter before that. (A decline in cost means Twitter is getting paid less for each engagement.) The filing attributes these declines to an increase in ad inventory, which has been partially offset by growing demand.

Advertising also gets its own section (page 18 if you want to read along) in the filing’s discussion of various risk factors, where Twitter notes that all kinds of things could go wrong with its ad programs — for example, if Twitter is unable to convince brands to invest in building a presence on the service, or if new programs like its video-based Amplify ads don’t take off, or if the decline in cost per engagement continues.

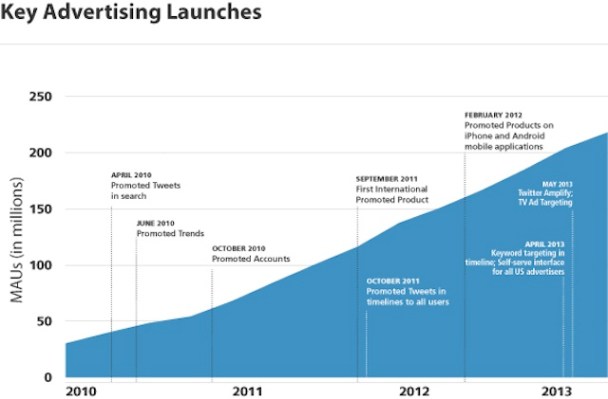

As we wrote earlier, Twitter brought in $253 million in revenue in the first six months of the year. Of that amount, $221 million (87 percent) came from ads, compared to $32 million (13 percent) from data licensing. In comparison, the company made $7 million from advertising in all of 2010 (that’s when it launched its first ad programs) and $21 million from data licensing. Oh, and Twitter says that mobile accounts for 65 percent of its ad revenue.