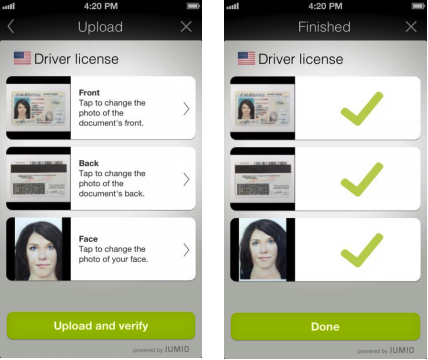

Jumio, a mobile payments and ID-scanning startup backed by $35.3 million in outside funding, is expanding its suite of identity verification tools with the launch of “Face Match,” a feature which will allow its business customers to match provided photo IDs with an end user’s actual face. To be clear, this isn’t exactly the same thing as “facial recognition” technology, as it’s not about scanning a face then identifying the user – instead, it’s about matching a photo with the person’s face, in near real-time.

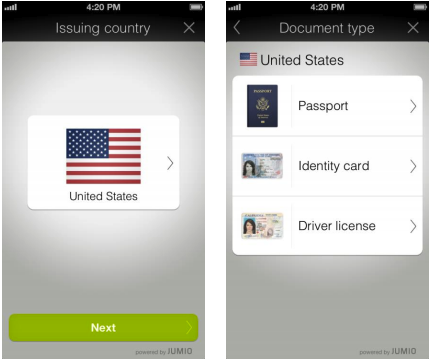

Face Match will become a part of Jumio’s Netverify line, which is one of two key products the company produces, the other being Netswipe, a computer vision-aided way to quickly scan and validate payment cards. Netverify, meanwhile, offers developers the ability to scan passports, driver’s licenses, identity cards, and even utility bills, bank statements, and insurance cards – the sort of thing businesses in the past would require copies of, often by fax, as means of establishing a consumer’s identity and fighting fraud.

The additional ability to scan and match faces offers another layer on top of the previously available Netverify capabilities. This allows the business to not only confirm that the end user is physically holding the ID card or driver’s license, for example, but also that they are the same person as is in the picture, effectively transforming “person-not-present” transactions in to more secure “person present” ones.

Netverify’s Face Match technology could also be used in authentication scenarios where it combines something you know (a username and password) with something you have (an ID) with Face Match (something you are) for a layered security approach, explains the company.

According to CMO Marc Barach, Face Match is being offered as a part of the overall Netverify package, which is priced on a recurring monthly fee basis, determined by number of transactions. Customers can choose to activate the option, but won’t need to install a separate SDK to enable the technology in their applications.

He notes that already Jumio has over a dozen clients testing Face Match, but he can’t discuss who those are due to NDAs. Barach also declined to discuss the specifics of how the technology works for security reasons. But more broadly, for those unfamiliar with Jumio, the company uses the cameras on smartphone and computers to “see” and read what the document in front of them says, but without storing and saving the data – like credit card numbers, for example – to company servers.

Jumio had hinted earlier this year that it was working on another product that would leverage its core scanning capabilities with a launch planned for this fall, and Face Match appears to be what the company had earlier referred to. Longer-term, Jumio sees what it’s doing with both Netswipe and Netverify as complementary, as opposed to separate, products. Both extract and collect information, then validate it, and enable more secure transactions, Barach had previously explained.

Today, Netverify works in 90 countries, but the company declined to share information related to traction, including customer numbers, footprint, growth figures or revenue at this time.