Intel has quietly made another international acquisition in its push into artificial intelligence technology: it has bought Indisys, a Spanish startup focused on natural language recognition. The terms of the deal have not been disclosed, but it is reportedly “north” of €20 million ($26 million). It comes just two months after news broke that Intel acquired Omek, an Israeli maker of gesture-based interfaces, reportedly for about $40 million.

Intel has given us direct confirmation of the deal and noted that the majority of employees joined the company. “Intel has acquired Indisys, a privately held company based in Seville, Spain. The majority of Indisys employees joined Intel. We signed the agreement to acquire the company on May 31 and the deal has been completed,” a spokesperson noted in an email to me. She also added that the financial terms of the agreement are confidential and it is not disclosing the price. “However, I can confirm that the value of the transaction is not material to Intel.” Among those who have now moved over to Intel, Pilar Manchon, CEO of Indisys, is now in Santa Clara working in Intel’s R&D department.

No further details, either, on how the technology or existing products may get used. “Indisys has a deep background in computational linguistics, artificial intelligence, cognitive science, and machine learning. We are not disclosing any details about how Intel might use the Indisys technologies at this time,” the spokesperson said. (If you read further down I give some obvious areas where the tech may get used.)

Prior to Intel’s statement to us, there were press reports (in Spanish, example) of a deal; a news release from Inveready, one of the Indisys’ early investors, noted it was selling its stake to Intel.

(Inveready, who declined to comment for this story, has a track record with Spanish startup exits: it was also a backer of PasswordBank, acquired by Symantec for $25 million.)

Based in Seville, Indisys’ dialogue-based systems have been used by Spanish companies like the retailing giant El Corte Ingles, insurance group Mapfre and the banking giant BBVA, across multiple platforms like web and mobile.

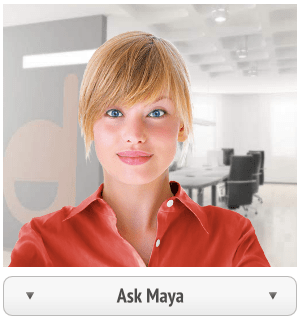

Indisys is a developer of natural language recognition technology, but also Siri-like intelligent assistant (IA) interfaces so that people can interact with it. Pictured here is “Maya,” one of its creations. Other clients like Boeing have been using Indisys’ technology for a project called Atlantis, to create interfaces to control unmanned vehicles.

While many of its reference customers are Spanish, the company says has developed multilingual technology. Indisys writes that its IA “is a human image, which converses fluently and with common sense in multiple languages and also works in different platforms.”

As with Intel’s Omek acquisition, there are likely a couple of reasons behind the purchase of Indisys.

The first is that it is part of Intel larger moves into 3D visualization and “perceptual computing”, Intel’s term for gesture, touch, voice, and other artificial intelligence-style sensory technologies. This is also the focus of a $100 million investment fund Intel launched in April 2013.

The second is that voice recognition technology is being worked directly into Intel’s processor business.

Indeed, just earlier this week, Intel presented devices that showed off the company’s advances in gesture and natural language recognition business. While there has been speculation that Intel would license technology from companies like Nuance to build it into its own systems, the Indisys deal is an indication that Intel is getting more serious and wants to build and ultimately control this technology itself instead.

Intel was not a stranger to Indisys: its venture arm, Intel Capital, led a $5 million Series A investment into the company in November 2012, raising just over $6 million in total. Indisys has been in operation since 2003, and that last funding injection was specifically to help build out its business into international markets.

Given that Omek was also a portfolio company, it’s another sign of the tight integration between what Intel is doing on a strategic level as a business, and what it does on a VC level, something you can’t say for all corporate VC arms.