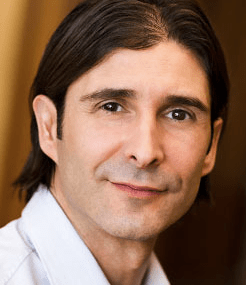

After promoting former Facebook and Twitter product lead Josh Elman to partner, Greylock is adding another consumer investing partner to its ranks from its existing team–executive in residence Simon Rothman. And as part of this move, Greylock is announcing a $100 million commitment to invest in marketplace entrepreneurs and companies, which Rothman will be managing.

Rothman, who will be on Greylock’s consumer investment team, is uniquely positioned to be leading this new initiative as he worked for a number of years at one of the original marketplaces, eBay. Rothamn joined eBay in 1999 when it was still a small, US collectibles auction business. He helped scale eBay to nearly 200 million users generating over $40 billion in merchandise sales. While at eBay, Rothman led US operations and also founded eBay Motors, which he built into a $14 billion a year global business. Following eBay he also founded Glyde, and ecommerce marketplace for for electronics and more. He also served as a board member of and advisor to Tesla Motors.

In 2011, Rothman joined Greylock as an Executive-in-Residence and ws helping advise a number of the firm’s network effects businesses, transaction-based startups, and mobile apps with a specialty around marketplaces, including Lyft, Wanelo, Poshmark, Tango, and others. He said he joined with the intention of finding a startup that he wanted to join, and help scale the company. But he began to enjoy actually helping individual startups and entrepreneurs. “I used to think that VC was more about money, but from an operators standpoint, being a VC is really about adding value to a startup,” he told us in an interview.

There are huge opportunities to build marketplaces with the current technologies available to entrepreneurs, including mobile platforms, hardware, and social identity, and more. But building lasting marketplaces is a challenge of itself, Rothman explains. These include creating content worthy of drawing a community and transactions, and long build cycles that often take many years.

As part of the new initiative, Greylock is forming an advisory network of executives and leaders in the space and will be organizing a marketplace conference to take place later this year in Silicon Valley. Speakers include: Airbnb CEO & co-founder, Brian Chesky; eBay CEO, John Donohoe & Linkedin co-founder and Greylock Partner, Reid Hoffman.

“We’re pleased Simon will continue on the Greylock team as a Partner,” said Hoffman. “His unique experience of helping to scale one of the most definitive marketplaces in the world has already proved to be invaluable to our entrepreneurs. Personally, I’m excited to support a new wave of innovative marketplaces. With Simon’s leadership and with guidance from committed speakers and friends like Brian and John, we believe we can build out a fantastic network in this space.”

As for the new initiative, Rothman says the $100 million is more of a focus than an actual fund. And the investments made will be stage agnostic, and across Seed, Series A & B and more.

“I believe marketplaces have the perfect business model,” says Rothman. “As they get bigger, marketplace grow stronger and more durable.” He thinks that in the next five years there will be more $1 billion dollar marketplaces than there were in the past 20 years, in areas like transportation, fashion, hotels, and more, with Airbnb kicking of this new generation of successful companies (at last count Airbnb was valued at $2.5 billion).

As for new areas where Rothman believes there could be growth, health care and education provide interesting opportunities for marketplaces. He acknowledges some of the complex regulatory environments and laws in these areas (especially health care), but says that eventually this frameworks will succumb to innovation.

Clearly, many marketplaces such as Airbnb, Uber, and others are flourishing, with multi-billion dollar valuations. It’s no surprise that Greylock is seeing the future potential of this business model, and wants to make a big bet on this. It’s similar in some ways to Kleiner Perkins’ iFund, which was created to spur and fund development around the iPhone.