As two of the first VCs in Silicon Valley, Don Valentine and Tom Perkins have ridden through the highs and lows of the tech industry over the decades. The co-founders of Sequoia Capital and Kleiner Perkins Caulfield & Byers, respectively, they have invested in and helped build icons like Apple, Genentech, Compaq, Oracle, Cisco and Google. We’re thrilled to have both Valentine and Perkins on stage together at Disrupt SF in September.

Valentine and Perkins were also the subject of Something Ventured, a documentary that follows the stories of the country’s original venture capitalists and the companies they helped form.

For background, Perkins founded KPCB with co-founder Eugene Kleiner in 1972. Prior to Kleiner Perkins, he started a company in the mid-1960s (University Laboratories) to manufacture lasers based upon his original inventions in optic and was the first general manager of the Hewlett-Packard Company’s computer divisions.

Perkins is now, or has been, a director of the following public corporations: Acuson (Chairman), Applied Materials, Compaq Computer, Corning Glass Works, Genentech (Chairman), Hewlett-Packard Company, Hybritech, LSI Logic, The News Corporation, Philips Electronics NV, Spectra-Physics, Symantec and Tandem Computers (Chairman).

Valentine founded National Semiconductor and was also senior sales and marketing executive for Fairchild Semiconductor. In 1972, he founded Sequoia, and has served a number of tech company boards including Apple, Atari, C-Cube, Cisco Systems, Electronic Arts, Linear Technology, LSI Logic, Microchip Technology, NetApp, Oracle, PMC-Sierra.

We’re excited for both Perkins and Valentine to take the stage with other notable speakers, including Marc Benioff, Michael Moritz, John Doerr, Doug Leone, Dick Costolo, Marissa Mayer, and Jeff Weiner.

Disrupt SF takes over The San Francisco Design Concourse from September 7 to 11. Tickets are currently on sale here. If you are interested in becoming a sponsor, opportunities can be found here.

Don Valentine

Don Valentine

Venture Capitalist, Sequoia Capital

Co-founder, Sequoia Capital and Kleiner Perkins Caulfield & Byers

Don Valentine is a venture capitalist at Sequoia Capital focusing on semiconductor, systems and software investments. Don founded Sequoia Capital in 1972 and was one of the original investors in Apple Computer (AAPL), Atari, Cisco Systems (CSCO), LSI Logic (LSI), Oracle (ORCL) and Electronic Arts (ERTS).

Prior to starting Sequoia Capital, Don was a Founder of National Semiconductor and a senior sales and marketing executive with Fairchild Semiconductor.

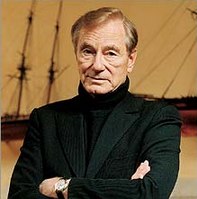

Tom Perkins

Tom Perkins

Co-founder, Sequoia Capital and Kleiner Perkins Caulfield & Byers

Tom Perkins is one of Silicon Valley’s pioneers, with a career spanning entrepreneurship, the management of major corporate activities and most importantly, venture capital. In 1972 he formed America’s premiere venture capital business with co-founder Eugene Kleiner. The partnership and the follow-on Kleiner Perkins Caufield & Byers series of partnerships have created some of the most interesting and innovative businesses in the world.

Prior to Kleiner Perkins, he started a company in the mid-1960s (University Laboratories) to manufacture lasers based upon his original inventions in optics. The company was successful and merged into Spectra-Physics becoming a major part of that firm’s growth. Later he was the first General Manager of the Hewlett Packard Company’s computer divisions and is credited with establishing the foundation for the enormous growth which that business has enjoyed.