Chirpify, a startup aiming to simplify online commerce by bringing it to the platforms where people congregate, like Twitter, and more recently, Facebook, and Instagram, has raised $6 million in Series A funding. Previous investor Voyager Capital contributed $2 million to the round, while the remaining came from new investors Saturn Venture Partners, Provenance Ventures, as well as angels Idan Ravin (who has connections with NBA stars), Chris Paul, Dwight Howard, Kevin Durant, David Cohen (former Interscope Geffen A&M Vice Chairman), and others.

The company had closed on the $2 million in Series A from Voyager this April, so this is an extension of that earlier raise. To date, Chirpify has raised $7.3 million.

As you may have guessed by the line-up of angels, the company went after strategic investors it believes can help it reach the markets it wants to target, including sports, music and media. Specifically, the plan is to introduce a means to use Chirpify’s technology for live events and TV-based conversions over the next few months.

It’s still the early stages for this business, which, though it has investor interest, still has a competitive landscape to overcome and needs to prove user adoption. There are several other “in stream” payment solutions on the market today, including Soldsie, which is currently focused on Facebook, as well as more direct competitors like Ribbon and Gumroad. In other words, it no longer matters who invented this concept of replying “buy” to make a purchase on social media channels – it only matters now who can execute it best, and can expand its footprint the most quickly.

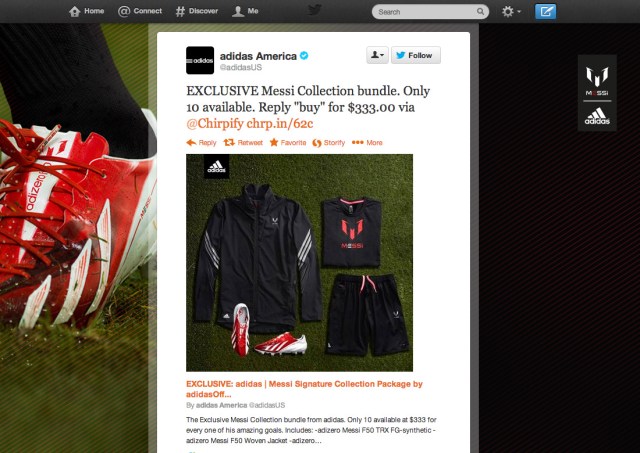

In Chirpify’s case, the company touts that it’s adding over 300 new users per day, and has a 4 percent conversion rate. It has worked with clients including Adidas, MasterCard, the Portland Trailblazers, Taco Bell, Green Day and Snoop Dogg.

Like the others in its space, the startup generates revenue through a percentage of the transaction (5 percent) plus a pre-transaction fee ($0.30). For comparison, Ribbon is 2.9 percent plus 30 cents, and Gumroad is 5 percent plus 25 cents. Chirpify lowers its rate to 2.9 percent for enterprise customers, however, who can also set up branded web stores, utilize promo codes, run giveaways, integrate the service with their e-commerce site, receive upgraded support, and more.

In addition to enabling mobile commerce, Chirpify’s technology also works for fundraising efforts and collecting donations through social media.

To use the service, a company or organization tweets or posts their call to action (e.g. to purchase this item, reply “buy” or “gimmie”) and provides a link. The first time a customer signs up with Chirpify, they have to enter in their payment information including their PayPal info, credit card or debit card details. But afterwards, they can begin to transact just by responding to a social media post with the keyword trigger specified.

The larger goal here – and with the forthcoming live event and TV efforts – is to expand e-commerce to new areas where, typically, people did not regularly transact or shop using their computers or phones. Of course, in terms of targeting mobile users, Chirpify will also go up against the ubiquitous short code (you know, text “keyword” to “####”) – a process that is easier for first-time customers, but fails to establish an account which can later be used elsewhere across the web.

At the end of the day, Chirpify and others in market, have an interesting idea in that shopping is no longer something that takes place only on destination websites or seller marketplaces – and that merchants need to figure out how to move into social media since that’s where today’s users spend a majority of their time, especially on mobile.

But sometimes these startups also feel like they would work better for end users if they were a part of something bigger – like a PayPal or Google Wallet, for example. Then, not only would the larger companies be onboarding new users who are just starting to shop via their first computers (their phones) for the first time, they could then also establish accounts for those users which would work on the wider web including outside of social media, as well as within native apps, and even at point-of-sale in the real world.