In May of this year, to raise its game against the likes of Square and PayPal, Groupon relaunched its Breadcrumb point-of-sale app — originally conceived as a payments app for restaurants — as a free payments app for all local merchants.

Today, the daily deals company is embarking on stage two of that strategy by adding a number of new features in an update to make the app, part of the company’s wider suite of payment services and apps, significantly more usable (but still free). They include the ability to take payments when you’re offline, redeem Groupon deals, and customize the app to fit specific business categories, like beauty salons or cafes. The moves, Groupon hopes, will not only drive more transactions through Breadcrumb, but give Groupon one more way of upselling those merchants to other services — like Groupons themselves.

Jyri Engestrom, the head of product overseeing Breadcrumb, says that part of the reason Groupon has updated the app is to speak to some of the most vocal feedback it has had so far.

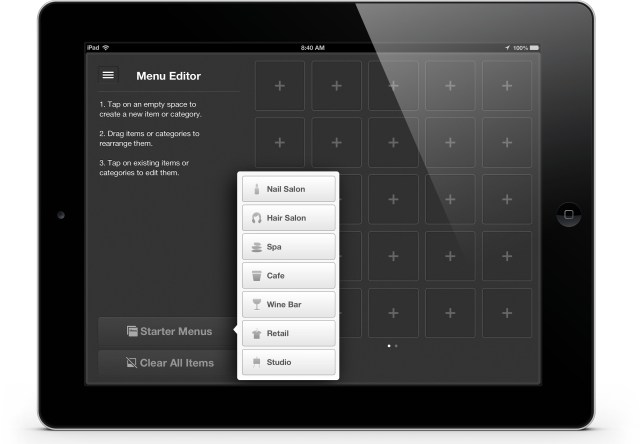

It sounds like it’s been a steep learning curve for Groupon, having collected feedback post the app launch in May from hundreds of thousands of users. “We noticed that it was taking a long time to get started if you’ve never used a point-of-sale app before,” he said. “When you landed in the app, you were dropped into an empty canvas, and it was really hard for merchants to know what to do next.”

To that end, users are now asked to identify what kind of business they are, and that in turn offers them a select of pre-set menus tailored to that vertical. Users then have the option to customize those settings more — say with different coffee options and prices if you are a cafe, or treatments if you are a spa. (The full list of pre-set verticals: hair and nail salons, spas, studios, wine bars, cafes and retail establishments.) For now, Engestrom says the app will remain “horizontal” and that time will tell if each vertical will eventually get its own, more powerful app. The company is not revealing any specific download or usage numbers, but I suspect launching further apps will depend on how popular this one ends up being.

While all that sounds practical, Engestrom describes the addition of an offline mode — which means merchants can make payments even when they do not have an Internet connection — as “mission critical”. He describes a sea change underway among merchants. “Just like Nokia was wiped out by the smartphone revolution, I think something similar is happening in local businesses with iPads and Android tablets,” he says. But the promise of technology becomes a bit hollow — and at least less reliable — if the merchant has to stop taking payments when the broadband goes on the fritz.

Those charges for payments work like this: Groupon charges merchants 1.8 percent on Visa, MasterCard and Discover swiped transactions, 2.3 percent when keyed in, plus $0.15 for each transaction. American Express pricing is more complicated, as it is “determined by American Express based on your industry category.” The rates range from 2.3 percent-3.5 percent (swiped) and $0.00 to $0.15 per transaction, says Groupon. For non-Groupon Merchants, the fees are higher: 2.2 percent when MasterCard, Visa and Discover are swiped, plus $0.15 per transaction. As a point of comparison, Square has two options: a flat 2.75 percent fee per swipe, or $275 per month with no fees per swipe — with the latter aimed at higher-volume users, or those who like to gamble that they might be.

Engestrom’s background, prior to Groupon, was as the founder of Ditto, a mobile recommendation app that Groupon acquired last year. Prior to his Ditto days, Engestrom worked at Google, where he ended up after his Twitter-style microblogging service Jaiku was acquired but eventually shut down by the search giant.

He told me today that the Ditto acquisition was “a technology acquisition and an acqui-hire” in that some of the work he created at Ditto is making its way to Groupon’s mobile products — specifically around the consumer-facing Groupon app. But he also adds that what he’s doing here with Breadcrumb is equally, if not more, important, because of how it closes the loop on his previous work. “If you want to build an innovative business, as I was doing with Ditto, you have to have a terminal on the merchant side, because that’s the only way you can really see what people are buying.” A company like Foursquare can let you check into a merchant, but you don’t really know what is getting bought in connection with that.”

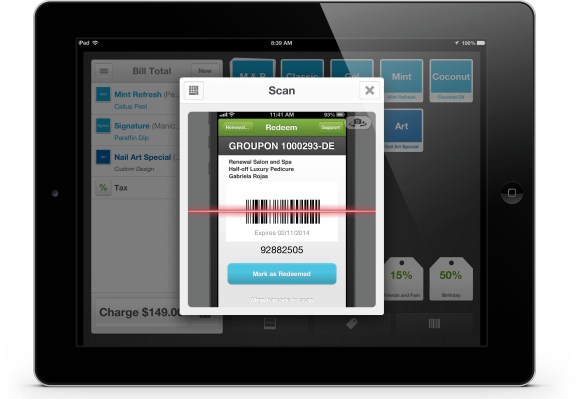

This links back also to the third big feature getting added today: integrating Groupon deals with the payment app. Now, Groupon can offer its users deals nearby or recommended, and when a user goes into the business to use their Groupon, the merchant, if he uses the app, can link that up directly to complete the sale. That saves time, but also then leaves an analytics trail that the merchant can use.

“We charge a processing fee and that is a real business for us, but ultimately I frankly think Ditto was acquired because of this area. Where companies like Groupon and Square compete is basically ultimately a game of who can drive consumer demand for these merchants,” he says. “We are building all these robust features, but this is a game ultimately of who can leverage this data and who can elevate that interaction between the consumer and merchant at the point of sale,” he adds.

With the tens of millions of customers that Groupon already has with its app downloaded, and the many thousands of merchants who push deals through the platform, the trick will be whether Engestrom and his team can sell merchants on the promise of closing the loop, as well as getting more users engaging in the deals, simply because now it will be quicker to act on them.

For now, Groupon has yet to roll out this solution to its 500,000 merchants internationally who sell goods and services through its platform — although strategic investments like this one, in Square-like mobile payments provider SumUp in Germany, certainly does point to the company figuring out ways that it could do this soon.