While smartphone growth may be slowing down in some developed markets, the services that people are using on the devices continue to grow fast, and that is having a direct impact on the growth of mobile advertising. Globally, the mobile ads market brought in revenues of $8.9 billion in 2012 — a rise of nearly 83% on 2011’s revenues of $5.3 billion, according to figures out today of the IAB and IHS.

To give these mobile ad figures some perspective, they are still small in comparison to the revenues coming in from Internet advertising. According to the IAB, Internet ad revenues for Q1 in the U.S. alone were $9.6 billion. The U.S. for all of 2012 is estimated to have brought in $3.5 billion in mobile ad revenues.

While we have seen a drive towards more interactive and media-rich, ad-tech fuelled innovations in the medium of mobile ads, search remains the biggest of all ad formats, accounting for over half of all revenues at 52.8%, or $4.7 billion, up slightly on last year’s percentage of 51.1%. And the analysts did not spell it out, but the supremacy of search ads means that Google, the worldwide leader both in search and in smartphones with its Android platform, remains on top.

We reached out to IHS’s Daniel Knapp, director of advertising research at IHS and author of the report, to ask for a little more detail on top networks. He says that after Google, the other two important networks for the year were Millennial and Amobee. IHS is not releasing actual proportions for market share, however.

Facebook only launched ads in Q2 but Knapp says that if we take aggregated mobile ad revenue for the quarters where Facebook was active, the social network accounted for a 21.2% share in display revenues (the only area among search, display and messaging where it is currently active).

Display ads accounted for 38.7% of all mobile ad revenues, or $3.4 billion, in 2012 while messaging continues its decline and now accounts for just 8.5%, or $756.5 million. Before the rise of the mobile Internet and apps usage, messaging-based ads were by far and away the most popular of formats; between 2011 and 2012 it grew the slowest in terms of actual revenues at 40.2%, compared to 87% and 89% respectively for display and search.

The rise of mobile ads revenue comes from a perfect storm of a couple of forces. In addition to growing smartphone penetration — with markets like the U.S., UK and others in Europe now tipped into smartphone majorities — there is also the fact that people are actually using them more than ever before, for an ever-wider range of uses. At the same time, those who produce content for mobile devices continue to see an increasing push from consumers for “free” content that they do not need to pay for, which in turn often gets supported instead by advertising.

At the same time, the IAB points out that there is a growing trend for more consolidated and savvy investing on the part of media buyers, who are following where users are going and making large ad buys across different networks and different platforms.

“Mobile is coming into its own as a powerhouse advertising medium,” says Anna Bager, Vice President and General Manager, Mobile Marketing Center of Excellence, U.S. IAB, in a statement. “Today’s advertising is happening in a world where ad campaigns can be planned and bought across global networks on multiple media, but the massive and continuing acceleration of mobile’s international impact provides new and exciting frontiers for content and communication.”

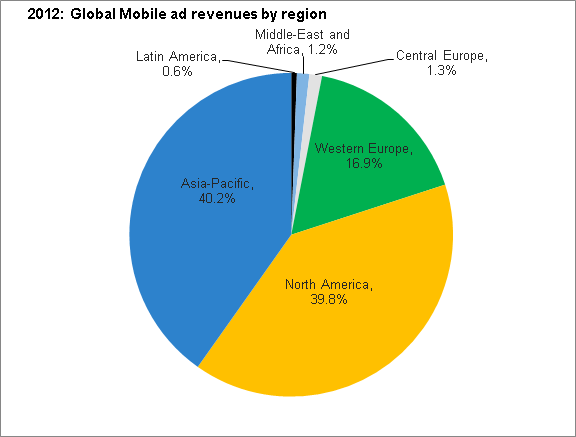

In terms of geographical breakdown, the biggest-growing markets continue to be those where mobile internet usage is the strongest: revenues in the U.S. rose 111% and Western Europe 91%. Interestingly, however, when it comes to the single-biggest region for mobile ads, it’s Asia Pacific — which includes the biggest smartphone market in the world, China:

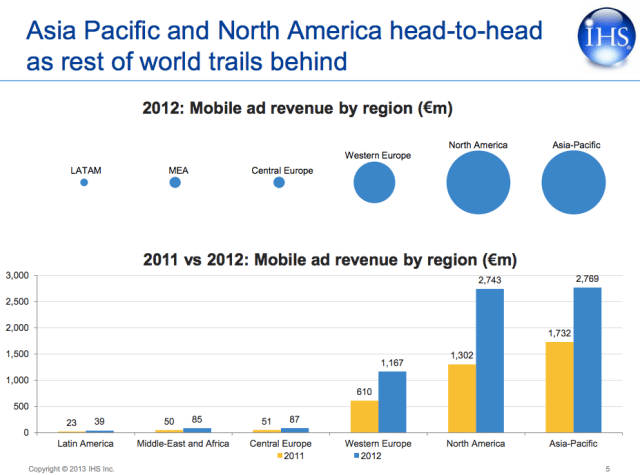

Looking at how that value plays out in terms of growth, you can also see that right now we’re still in a stage of the biggest continuing to grow the fastest; those countries with lower smartphone penetration and mobile data usage are seeing significantly smaller increases:

You can read the full report here.

Image: Flickr