With the proliferation of smartphones, we’re now able to use these mobile, mini computers to do just about everything we would do on our desktop while on the go. Yet, in spite of this evolution, mobile payments seems to be lagging behind. We use our phones to capture pictures and video, and share them instantaneously, but the average smartphone carrier is less comfortable with the idea of paying for a meal by swiping their phone. People want a mobile wallet, and it seems only a matter of time before someone gets it right, even if a winner has yet to emerge.

Part of the reason for the slower rate of adoption is the perception that mobile payments are insecure, rife with hidden fees and are the very opposite of seamless — or cross-platform. Akimbo launched its eponymous card in March to take on the increasing number of players in the mobile payments space each taking a slightly different tack, from Green Dot and NetSpend to LevelUp and Dwolla. In contrast, the Akimbo Card is designed to be an alternative to your walled-in virtual bank account, with a social and mobile spin.

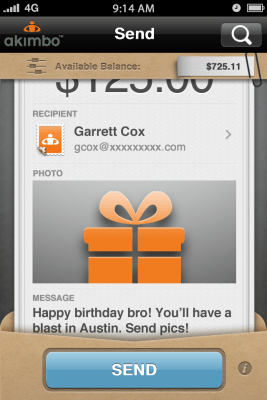

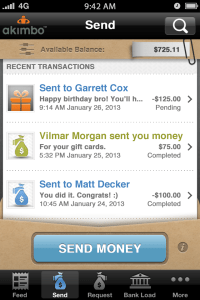

Like LevelUp, Akimbo wants to stand out from the pack by offering a fee-free platform through which users can send and request money to any email address, Facebook friend or mobile phone. Simply put, it’s PayPal meets a Visa pre-paid card. In other words, Akimbo allows users to access transferred funds from ATMs and any location that accepts Visa debit cards. In an effort to target the some 10 million young people who use prepaid credit cards, Akimbo enables users to link and load the card with their bank accounts with cash or via direct deposit.

This means that the startup’s proprietary platform not only allows cardholders to send money via email, Facebook post or SMS, but to reserve sent funds to be added to future card accounts, meaning all sent funds are guaranteed to the recipient. Once the funds are collected, the recipient receives the money, along with a depository account and payment tool to access the funds. The Akimbo founders believe that it is the first and only Visa payment product to offer this capacity.

By building a cardholder network, Akimbo believes that it can establish a more defensive position and benefit from some barriers to entry (and competition). Currently, almost 40 percent of cardholders use their Akimbo account to share money — a number Akimbo will look to increase as it moves forward to give it some protection from the growing number of competitors in this space.

Going forward, the founders want to turn Akimbo into the first prepaid card product with an account management portal based in HTML5, and the team is currently working to release a new website (and account management tools) that “auto-optimize” to all devices, be they mobile phones, tablets, TVs or desktops. With young people increasingly accessing the Web primarily from their smartphones, the founders see this mobile accessibility (and flexibility) as critical to the mobile payment user experience, overall, and to getting a step ahead of the competition.

Going forward, the founders want to turn Akimbo into the first prepaid card product with an account management portal based in HTML5, and the team is currently working to release a new website (and account management tools) that “auto-optimize” to all devices, be they mobile phones, tablets, TVs or desktops. With young people increasingly accessing the Web primarily from their smartphones, the founders see this mobile accessibility (and flexibility) as critical to the mobile payment user experience, overall, and to getting a step ahead of the competition.

Going forward, the startup also plans to integrate with PayPal and Amazon, along with adding credit and debit card-loading and card-linked discounts and deals. Akimbo sees the “prepaid industry” as one that’s been slow to innovate and has thus found it difficult to capture new audiences. So, by adding capabilities that enhance prepaid as not only a payment tool but as a budgeting tool as well, Akimbo sees the potential to create a prepaid card that’s actually valuable — something you’re not embarrassed to be carrying around with you.

To move forward with its planned integrations, discounts and HTML5 development, Akimbo is announcing today that it has secured another $850,000 in angel funding. The investment was led by Rackspace Chairman and co-founder Graham Weston, former CEO and Chairman Emeritus of Cullen/Frost Bankers Tom Frost and Akimbo co-founder Tom O. Turner.

The round adds to the $1.35 million in seed capital the startup raised early on, beginning in 2010, bringing its total to $2.2 million. Akimbo spent the next two years building out its technology, officially launching its social and mobile bank account alternative in March. Since then, Akimbo attracted 50K users, as the company has grown to over 15 employees, and, if growth continues at the current rate, the founders say they hope to hit profitability in early 2014.

For more, find Akimbo at home here.