Trustev, a Startup Battlefield company presenting today at TC Disrupt NY 2013, has developed a product to tackle online fraud using an algorithmic system of social signals, behavioural data and transaction history to create a “digital fingerprint” that lets companies verify that you are who you say you are when you are buying something online.

The problem that Trustev — based out of Cork, Ireland — is tackling is big, and growing bigger. E-commerce is booming, with sales topping $1 trillion globally in 2012 and still on the rise. But the market also has a dark undercurrent in the form of fraud — specifically around people using other people’s identities to purchase goods online. Currently ID fraud is a $20 billion problem and growing at twice the rate of the e-commerce market.

Beyond the very obvious issue of costing companies a lot of money, and consumers a lot of pain, there is another issue: traditional methods for trying to stem the problem are based mainly around human vetting.

Pat Phelan, founder of Trustev and its CEO, says that today 27% of all transactions online are referred to contact centers for review working out to 200 man-hours ever year. “At the moment, e-commerce is only 5% of all commerce, so as it grows you will run out of human beings to process all those transactions.”

And that’s not to mention the fact that current systems are inefficient. “Verification is a major operational cost,” he adds. “You have major cost centers created out of people Googling names, and trying to figure out if people are who they say they are.”

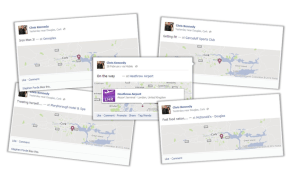

The social networks that Trustev tracks for identity signals include Facebook, Twitter and LinkedIn as defaults. In different regions, it plans to add others such as Orkut in Latin America, V-connect (from Vkontakte) in Russia, and Sina Weibo in China. Users check in to social networks when checking out to speed up the process.

Like other big data plays, the idea with Trustev is that it takes the mountain of data that is presented through these channels, and parses it and matches it up with other online activity associated with a person. This can also be used to help verify in a positive way, rather than simply to note when someone is not who they say they are.

A classic example is the case of a person travelling: some payment networks, when you go abroad, will automatically but bars on your payment cards, assuming that the use could be from someone who has taken your card number and is trying to use it elsewhere. A Trustev check could, however, note that you’ve recently travelled to New York because of some status updates in Twitter or Facebook, to confirm that this is really you (or not, as the case may be).

A classic example is the case of a person travelling: some payment networks, when you go abroad, will automatically but bars on your payment cards, assuming that the use could be from someone who has taken your card number and is trying to use it elsewhere. A Trustev check could, however, note that you’ve recently travelled to New York because of some status updates in Twitter or Facebook, to confirm that this is really you (or not, as the case may be).

But the company also notes that it’s not just social data that is used. “Social is an option that we can use to augment the traditional tools,” he said. “But if you don’t have the social profile it doesn’t mean that Trustev doesn’t work. It will still use all the information on you that it can find.”

The company has already raised some $300,000 in angel funding from strategic investors including Telefonica, and it is already trialling its service with e-commerce companies and mobile operators as it gears up to raise money for its Series A round.

One of its latest partners, being announced today, is Magento, the eBay-owned e-commerce platform, which will mean that businesses that are built on that platform can select the Trustev service as a plug-in to provide its verification on transactions on the platform.

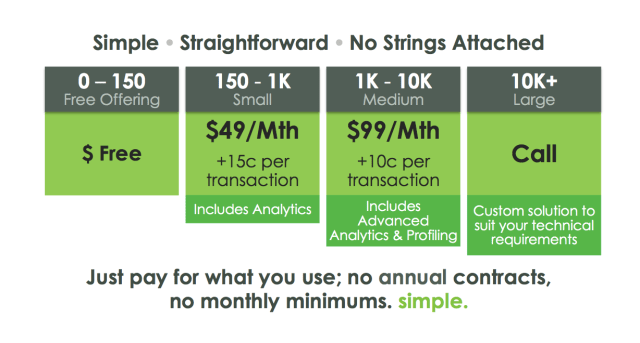

Pricing for how it works:

Perhaps unsurprisingly, because ID verification and fraud are very real issues online, we are already seeing a number of other companies emerging to tackle it as well.

Just today, PayPal launched a new effort to tackle verification of digital identities; and Airbnb’s launch of a new Verified ID service, to make sure that the people on its platform are not con artists, is an example of how sites themselves are also trying to move ahead to tackle this issue. Payment networks like Visa with V.me and MasterCard with PayPass are also interested in becoming the provider of secure digital identity online. And Max Levchin’s Affirm also appears to be, like Trustev, interested in using social signals to help build profiles of real people.

What other platforms besides Magento?

It’s a case of dropping in the code and can be used anywhere.

What is the process by which you do everything?

First we identify people, then we tag who needs to be reviewed (reduced by 75%), and then we will reject anyone suspicious with a message.

What besides Facebook Connect?

If someone doesn’t sign in with Facebook we have tools that we have built ourselves that work outside of that. You also see merchants that are not selling overseas because of this problem. This can help them sell abroad.

Why would the user want to do this?

We are not selling this to users, but we encourage site owners to get users to check in with Facebook to speed up the process. It’s projected that by 2015, 50% of people will be using social check-outs.