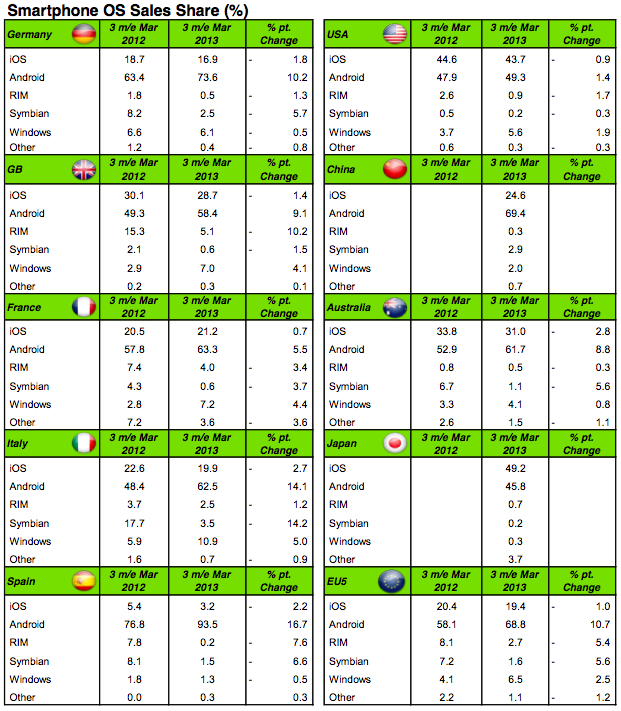

Google’s mobile OS Android continues to power ahead as the world’s most popular smartphone platform, according to figures out today from Kantar Worldpanel Comtech, the WPP-owned market research company that tracks sales of handsets across key markets on a 12-week rolling cycle. In the nine markets surveyed by Kantar — Australia, China, France, Germany, Italy, Japan, Spain, UK and the U.S., all detailed in the table below — Android on average accounted for 64.2% of all handset sales in the 12 weeks that ended March 31.

The only market where Android did not dominate was Japan, where Apple’s iOS just about eked out a lead against it (49.2% versus 45.8% of sales) for the three months ending March 31. Elsewhere, the figures indicate that regardless of whether the market is developed (U.S., UK, Germany) or emerging (China) or struggling financially (Spain), collectively, Android handset makers are winning them all, with sales figures for the platform reaching their high point in Spain, at 93.5% of all smartphone sales.

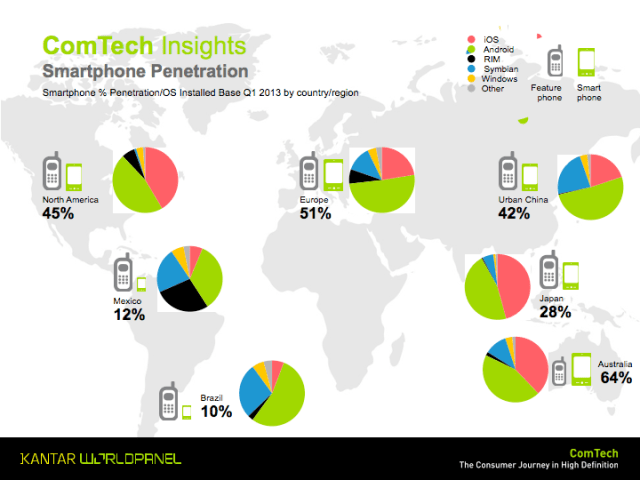

As you can see below, when it comes to smartphone penetration of actual devices in use, Android is leading everywhere.

Kantar — which bases its figures on (as samples) 240,000 interviews annually in the U.S. and some 1 million across Europe — believes that Android’s lead will only grow more in the months ahead, with the ongoing roll out of two new Android handsets, the Galaxy S4 from Samsung and the HTC One, driving sales of the platform.

“We expect to see a further spike in [Android’s] share in the coming months, as sales from the HTC One start coming through and the Samsung Galaxy S4 is launched,” writes Dominic Sunnebo, global consumer insight director at Kantar Worldpanel ComTech. “This will pile pressure on Apple, BlackBerry and Nokia to keep their products front of consumers’ minds in the midst of a Samsung and HTC marketing blitz.”

Indeed, in the U.S., without a strong handset launch in the last twelve weeks, and little sign of a new one on the horizon after the launch of the iPhone 5 last autumn, iOS declined by almost one percentage point to 43.7% of sales compared to Android’s 49.3%, which was up by 1.4 pp, a strong contrast to the period that included the iPhone 5 launch in the U.S. Symbian is now nearly totally out of the market, with only 0.2% of sales. BlackBerry’s BB10 launch has so far had very little impact on the company, which gained only 0.2 percentage points, to 0.9% of sales, compared to last month’s figures of 0.7%.

Kantar’s figures show that the only other platform besides Android in the U.S. market to see any gains was Windows Phone — a repeat of the trends that emerged last month. Microsoft’s platform was up by 1.9 percentage points to a still-modest 5.6% of sales, with Nokia accounting for the vast majority of those.

Elsewhere, the pattern of Android domination and modest Windows Phone gains was repeated. Across the 5 European countries covered, Windows Phone accounted for 6.5% of sales, up 2.5 percentage points; with Android at 68.8% of sales, up over 10 percentage points. Similarly, in Australia, Android was nearly 63% of sales, up 8.8 pp, while Windows Phone was up 0.8 pp to just over 4% of sales.

So why is Windows Phone gaining? Part of the reason, according to analyst Mary-Ann Parlato, is that WP handset makers (namely Nokia) have made a lot of effort to create and promote devices aimed at first-time smartphone buyers.

Although we have now just reached a global tipping point for smartphones shipped, and while smartphone sales are now exceeding those of feature phones, when it comes to active ownership there are still more feature phones than smartphones in the market. And Kantar’s theory is that the accessible, colourful, and cheap Lumias that Nokia is pumping out are appealing to those buyers, with feature phone owners representing 52% of Windows Phone buyers in the U.S..

In contrast, the majority of Android (51%) and iOS (55%) buyers previously owned other smartphones. If this purchase pattern continues, as smartphone penetration grows, Windows Phone could find itself with a growing advantage. And the UK is one case in point. There, smartphone penetration is now 63%, Kantar notes, and it’s also one of Windows Phone strongest (if modest in relative terms) markets: accounting for 7% of all smartphone sales in the 12 weeks.

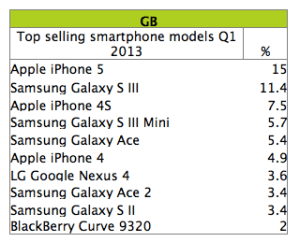

Kantar only breaks out specific handset model popularity for the UK market, where, although iOS is not the most popular platform, the iPhone 5 is the most popular phone, at 15% of all sales. When you break it down by handsets, it’s clear just how much iPhones and Samsung devices dominate the space, and how Samsung’s strategy to launch often and widely, across a spectrum of prices and models, has worked out for it (but perhaps with more sacrifice to margin than Apple).

“Kantar Worldpanel ComTech data clearly shows that different Samsung models are appealing to a very different type of consumer. The Galaxy Note II is popular with affluent 25-34 year old males, the Galaxy SIII Mini appeals to younger females, the Galaxy Ace to older females while the Galaxy SIII has broad appeal,” writes Sunnebo. “The fact that Samsung has so many models available in the market is not indicative of a scatter gun approach, simply a realisation that different consumers demand very different handsets, both in functionality, design and price.”

Kantar only breaks out how individual carriers perform in the U.S. market, but the figures provide a telling picture for what may be happening elsewhere, too. Kantar notes that Verizon has solidified its lead against AT&T with 37.2% of smartphones sold, with AT&T holding steady at 27.9% and Sprint in third with 12.3% of sales and T-Mobile drooping down more than 3 percentage points to 9.5%.

It looks like at least part of the story for Verizon’s gains is because it seems to have a healthier mix of Android and iPhone devices, which are roughly equal in terms of how well they sell at the carrier. AT&T’s mix is still heavily weighted to the iPhone, meaning if that device does less well, so does the carrier. All the same, the iPhone (and Metro PCS) could not come soon enough for the number-four carrier to boost figures.