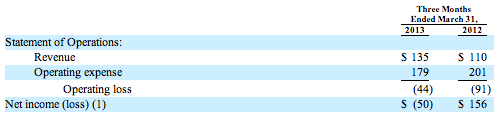

Daily deals company LivingSocial continues to face challenges in the market. In the last quarter it posted sales of $135 million, up 23% on a year ago, but it also swung to a net loss of $50 million, from net income of $156 million in Q1 2012. The numbers were revealed in a 10-Q filing from one of its key investors, Amazon, in line with its Q1 earnings reported on Thursday.

The filing also shows that Amazon was the majority investor in the $110 million round earlier this year. Amazon put in $56 million of that sum.

“Additionally, in Q1 2013 we made a $56 million investment in LivingSocial that we have recorded as a cost method investment,” it notes.

LivingSocial’s operating loss, meanwhile, was down to about half the size of last year, at $44 million. The Washington Business Journal cites a source that notes that LivingSocial has reduced its operating cash burn to single-digit millions to continue that trend. The company has been making an effort to cut expenses; in November it laid of 10% of its staff, equivalent to about 400 people.

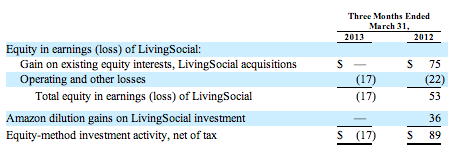

E-commerce giant Amazon has a 29% equity stake in the company, it noted in the SEC filing. It also writes in the 10-Q that the book value of its equity-method investment was $36 million at the end of March. The losses at LivingSocial had a $17 million negative impact on Amazon.

Overall, Amazon saw revenues of $16 billion, falling just short of analyst expectations of $16.2 billion, with a bleak outlook for the quarter ahead, with its aggressive, thin-margin strategy leading it to an operating loss of up to $340 million. Right now, its stock is trading nearly 7% down.

The market for daily deals sites is less than healthy right now. Rival Groupon in February also reported a worse-than-expected loss and then lost its founder and CEO Andrew Mason in the wake of the news, and now it’s working on a pivot to become more of a multi-purpose local commerce player.

LivingSocial, which has been around since 2007, has raised an eye-watering $918 million in the last six years — and what that much sunk into the company, you can see why existing investors are key to keep it from falling over. CEO Tim O’Shaughnessy noted in February that its most recent $110 million round of fundraising was indeed a “down round”, valuing the company at around $1.5 billion, lower than in its last fundraise. But it was not an emergency debt infusion, he maintained: at least some of the investors took equity in the company as part of the deal.