Mobile advertising firm Velti has released its monthly report on advertising impressions across its network. The iPad is far and away the leader when it comes to the tablet market, and is gradually chipping away share from the iPhone in terms of overall dominance among mobile ads. The iPad mini remains a much smaller factor, but is growing steadily, and on the Android side it’s pretty much all about the Kindle Fire.

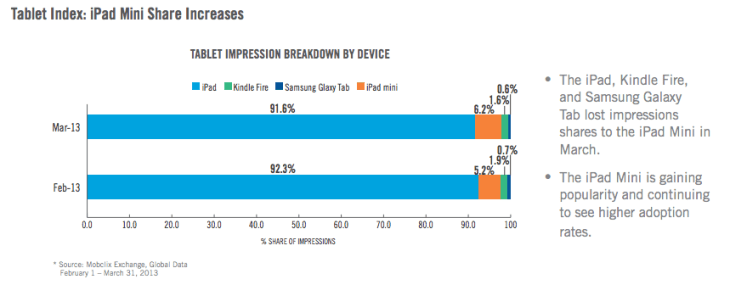

Velti’s data found that the iPad accounted for 91.6 percent of all tablet ad impression during the month of March, and only lost share to the iPad mini, which gained a full percentage point to come in at 6.2 percent during the month, firmly in second place. The Kindle Fire was the next strongest device, with a comparatively small piece of the pie at 1.6 percent. The Kindle Fire still dominates the Android tablet segment, however, with only the Galaxy Tab line of devices anywhere close. Amazon’s and Samsung’s tablets made up 73.4 percent and 26.2 percent of all Android tablet share, respectively.

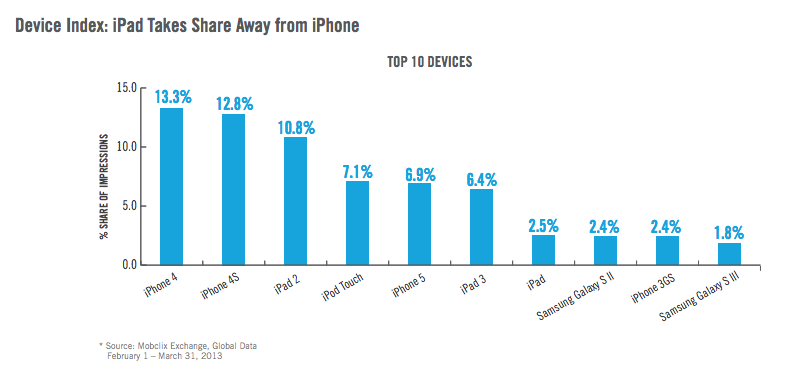

Among phones, the iPhone still leads the pack, with the iPhone 4 still leading all handsets with 13.3 percent of the impression share. iPhones accounted for eight of the top 10 devices, with the Samsung Galaxy S II and S III coming in at 8th and 10th place, respectively. Samsung is running away with the Android market in terms of ads served according to Velti’s figures, with 68.2 percent of all Android impressions. That’s no surprise given the company’s clear continued dominance in terms of hardware sales.

In March, most mobile app usage took place during weekends, with a much greater deviation between Friday/Saturday/Sunday and the rest of the week than Velti had seen previously, which perhaps indicates that more people were settling down to do serious work during the month. Finally, Velti also saw click-through-rates continue to grow on Android and shrink on iOS. This means that despite having a much smaller share of overall ad impressions, the ones that are viewed on Android are more likely to convert into some kind of customers action.

In March, most mobile app usage took place during weekends, with a much greater deviation between Friday/Saturday/Sunday and the rest of the week than Velti had seen previously, which perhaps indicates that more people were settling down to do serious work during the month. Finally, Velti also saw click-through-rates continue to grow on Android and shrink on iOS. This means that despite having a much smaller share of overall ad impressions, the ones that are viewed on Android are more likely to convert into some kind of customers action.

That may be due to the more relaxed rules about what types of advertising and campaigns can appear within Android apps vs. those on iOS. Still, iOS was better in terms of eCPM, but the gap narrowed between it and Android, meaning iOS users resulted in just a little less revenue on average than did Android users for advertisers.

The picture shows a fairly stable overall relationship between ads and the dominant mobile platforms, however; the needle hardly budged in terms of overall impressions. Will a flock of new devices coming to market affect this relationship in the coming months? Too soon to tell, though legacy handsets like the iPhone 4 and 4S, and the Galaxy S II still seem to be firmly entrenched.