Nielsen-owned Vizu is releasing its 2013 Online Advertising Performance Outlook today, and the results suggest that, despite concerns about measurement and return on investment, marketers plan to increase their online spending on brand advertising, and to spend more in emerging areas like mobile and social.

The blog post outlining the findings describes 2013 as the “year of brand advertising.” And the report itself says that until recently, if you looked at online ad spending, “it would be reasonable to assume that the lion’s share” went to direct response efforts. Now, however, most marketers plan to mix direct marketing with brand advertising that’s less focused on driving a sale or other response immediately.

In the survey, 63 percent of marketers said they plan to increase spending on brand advertising (one in five said the increase would be more than 20 percent), while 51 percent said they plan to increase spending on direct response. And here’s something more suggestive of a shift: 61 percent said they would be moving money away from direct response toward brand ad campaigns.

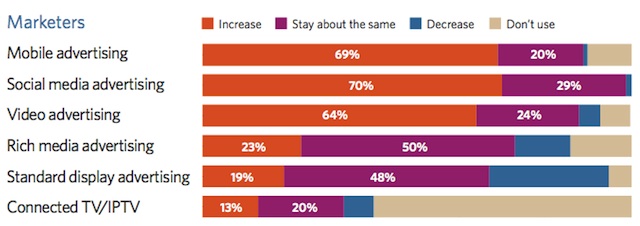

The predictions are also very different when you look at various platforms. When it comes to mobile advertising, 69 percent of marketers expect their spend to increase. That number is 70 percent for social media and 74 percent for video. (In fact 48 percent said they would shift spending from TV to online video.)

However, 50 percent expect their spending on rich media advertising to stay the same, and 48 percent said the same about standard display ads. The vast majority of respondents said they don’t run connected TV ads at all.

Vizu was acquired by Nielsen last year with the aim of improving Nielsen’s ability to measure online ad effectiveness. And effectiveness is a big theme of the new report. The survey included a question about what would increase marketers’ online brand spending — 69 percent said more clarity on the ROI, 68 percent said they wanted to be able to verify the impact of the advertising on things like consumer awareness, and 42 percent wanted to verify that the ad was delivered to the right audience.

As for the specific metrics that marketers want to see, 78 percent of respondents pointed to sales lift, while 55 percent pointed to brand lift.

The other issue here seems to be trust. Among the respondents from brands, 10 percent said they don’t “strongly believe” media sellers’ claims, and that number drops to 8 percent at agencies.

The report concludes:

Closing these gaps will not be easy or happen overnight, but there are clear opportunities that agencies and publishers can seize to collaborate directly around improving performance and reporting relevant metrics. Marketers will also have to more clearly communicate their definition of performance, perhaps spearheading the collaboration that they understand is critical to success.

As online brand advertising continues to grow in importance, brand marketers, agencies and publishers must start to work around a common currency of communication.

The report is based on a survey conducted for Vizu by the CMO Council, which took place in January and February and included 287 “senior brand leaders,” 176 agency executives, and 152 publishing representatives. You can read more about the report and request a copy here.