BlackBerry has been hit hard by Apple and Android in the enterprise smartphone market, and now it’s making some moves to make sure that it doesn’t face the same fate in the automotive segment. QNX, BlackBerry’s operating system subsidiary that makes the new BB10 operating system, today announced that it would be adding music streaming service 7digital into its in-car entertainment and information system, QNX CAR.

The deal gives QNX more leverage against Google and its own car ambitions, as well as Apple, which has made some moves into the automotive segment, and is the world’s biggest seller of digital music today. The QNX deal will see access to 7digital’s catalog of 23 million tracks, and HTML5-based music store, via the QNX system; the music service will work across the 40 countries where 7digital already has licensing agreements. It follows on the heels of QNX deals with other music providers including Pandora, Tune In, and Slacker.

(As a point of comparison on footprint, yesterday music streaming service Spotify added several new markets in Asia, Latin America and Europe to its global coverage, and now works in 28 countries.)

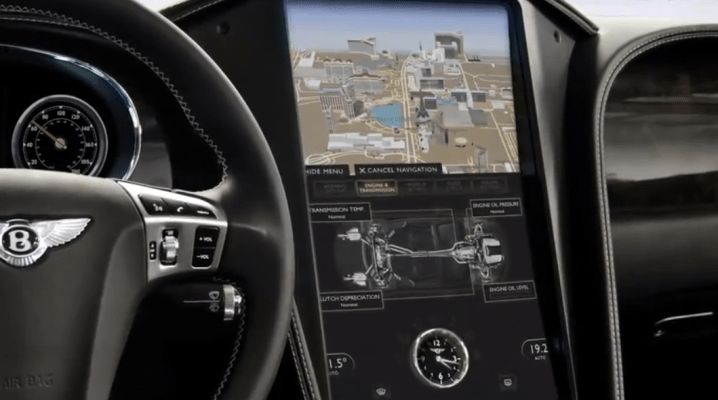

QNX says that this will in turn mean that automotive OEMs and others working on in-car systems can now build customized digital music stores into QNX-based “infotainment systems.” These will link up with 7digital’s wider service across mobile and web platforms so that subscribers can access their music on all of them.

The move is another sign of how everything, including cars, are fair hardware game today. “The lines between in-car systems, mobile devices, and the web are blurring,” said Derek Kuhn, vice president of sales and marketing at QNX Software Systems, in a statement. “Our partnership with 7digital is a testament to how well digital music services can be integrated into a seamless automotive user experience.”

At the same time, digital music specifically has a huge opportunity in the next generation of cars — something companies like Spotify and Apple are also considering as they also look to integrate with new platforms.

“Connected and mobile devices have changed the way music is consumed, but one thing that hasn’t is people’s desire to listen to music in the car,” said Ben Drury, CEO of 7digital. “We’re already working with partners in the automotive sector and now, for the first time, automotive companies using the QNX CAR platform can leverage our HTML5 music store, where their customers can access the largest collection of digital music from the convenience of their vehicles.”

For 7digital, this is another way of making sure its service remains relevant for its existing subscribers. It already has a strong relationship with BlackBerry; the service is preloaded on a range of the company’s smartphones, including the newest BB10 devices. The company, based in the UK, has raised $18.5 million to date, with its named investors including Sutton Place Managers and Balderton Capital. Its last round of funding, $10 million in October 2012, came from “two public technology companies.” I’ve reached out to 7digital to ask if BlackBerry happens to be one of them.

Samsung is another strong partner of 7digital; the streaming company powers the world’s biggest smartphone maker’s Music Hub music service. 7digital also works on Pioneer’s in-car system.

For its part, QNX, which was acquired by BlackBerry in 2010 as part of its bigger drive to update its mobile platform, has been an early and strong player in in-car systems for years already, and it works with companies like Audi, Toyota, BMW, Porsche, Honda and Land Rover.

Interestingly, it has something in common with BlackBerry in that both have reputations as workhorses. “The only way to make this software malfunction is to fire a bullet into the computer running it,” an automotive customer once said of QNX.

But as the mobile industry has shown us many times, it’s not always the early movers who are the long-term winners in this space.

While QNX has built a reputation with reliable in-car navigation and other legacy car-computer systems, in the new age of connected everything, the car could well become a hot battleground, like the smartphone is already, in the bigger war of ecosystems. QNX has been, like others, developing next-generation systems to meet that demand.

There are already companies working on ways of synchronizing the apps in one’s phone with those in the car, and companies like Apple and Google, as well as automotive companies themselves, all want a piece of the action. Cars and car news featured prominently at both the CES and MWC events earlier this year.

The bigger risk for BlackBerry is that QNX goes the way of its crown jewel, the BlackBerry smartphone, which was once the default smartphone — the only smartphone in many cases — used by enterprises. These days, it’s a different picture. IDC noted last November that iPhones are bing bought “in droves” instead of BlackBerry handsets. Some of this is down to individual users bringing in their own devices; and some is down to larger corporate contracts.