Pittsburgh-based startup AutoRef.com, which is something like a CarWoo for used vehicles, has raised $850,000 in seed funding. The round was led by an interesting, strategic investor: Deutsche Telekom, which owns the large European online car marketplace, AutoScout24.

T-Venture, the venture arm of Deutsche Telekom, led the funding alongside Innovation Works, plus local angels and other investors.

AutoRef.com was founded in December 2010, but didn’t really have a product until its participation in Pittsburgh’s AlphaLab accelerator, home to companies like Mark Cuban and Floodgate-backed Insurance Zebra, college search startup CollegeZen, hiring platform The Resumator, and many others.

Launched in July 2012, AutoRef has now expanded to 5,200 dealerships across the U.S., largely in the northeast, and in New Jersey in particular.

CEO Michael Pena, whose background is in equity trading, says he came up with the idea while working at the trading desk. “I always thought that an option platform – similar to trading or bond trading – would make a lot of sense in the car space,” he explains. Pena also grew up in the car industry, as his family owns a dealership Vegas where he had spent summers working when younger.

Pena thought it would be great to use the “reverse auction” format with cars – meaning, putting customers at the center, then allowing dealerships to bid for them. That’s the same idea that the car-buying service CarWoo uses today, but Pena was especially interested in employing the model for used vehicles.

“New cars are easy. You get three new cars, zero mileage, and you control all the variables – color, mileage, and year. It’s really easy to just get the lowest price,” Pena explains. “With used cars it’s difficult there are so many variables – maybe the mileage is off, the color is off, or it’s even a different model…how do you commoditize that? How do you equalize that so the consumer gets the best deal?”

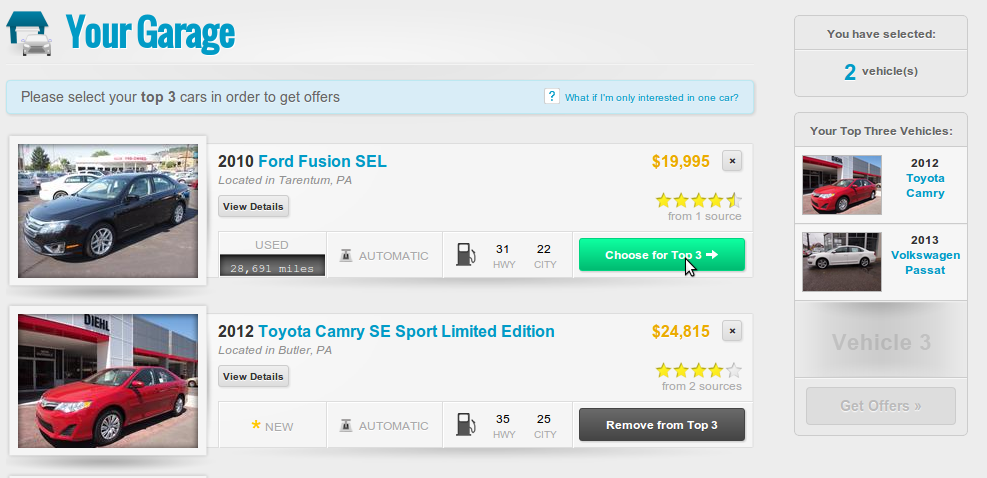

AutoRef came up with a model where the consumer chooses a car they’re interested in, and the site then provides them with similar vehicles based on their research history. The customer then picks three cars from that list, and that information is sent off to dealers who compete for that customer.

Despite how it sounds, the service is not just a lead gen operation. Traditional sites bombard consumers with phone calls or emails after they provide their contact information. “It annoys the heck out of customers and it makes it so that most customers don’t even want to go through the process,” Pena says.

AutoRef works differently. It uses technology to provide customers with a “proxy” email and phone number, so dealers don’t have access to this personal information. And the buyer gets to say when the dealer is allowed to call or email. These virtual means of contact only work for up to 72 hours, and the customer can shut off access at any time.

For those unfamiliar with what a proxy number is, you can think of it as something like Google Voice, for example – a virtual line that can be configured to ring your phone. And a proxy email is essentially a temporary, disposable email address which forwards to your inbox. Again, both of these work only for 72 hours, providing the customer with a bit of protection.

An interesting data point about AutoRef.com, is that while the idea is to negotiate the car buying online, when customers actually show up for their test drive, over half of them end up buying a different vehicle than the one they were researching. Pena is careful to explain that it’s not a bait-and-switch situation – that is, it’s not that the dealer is saying their car is unavailable – it’s the customer who’s looking around and sees something else they like better once they’re on site. But what got the customer in the door was the relationship and rapport they developed initially, having used the service to make that initial contact with the salesperson.

It’s still early days for AutoRef, which claims to see around 20,000 uniques per month, 2 percent of which convert. Of those conversions, around 38 percent end up buying a car, which averages the startup around $250 per car sold. Revenue-wise, AutoRef is making around $19,000-$20,000 per month – but revenue isn’t why AutoScout24 made this deal.

The European company has been looking for a entry point in the U.S. market, Pena tells us [Update: Deutsche Telekom tells us it is not.] “They loved the business model, and how we’re doing things differently – how we’re charging for things on a transactional basis, how we’re scaling, and how we’re growing,” he explains. (AutoRef is growing uniques at 20 percent per week). “You don’t see these large convertible debt rounds happen quite often…and we’re actually already in talks about putting an A round together,” he says.

There’s also the potential for a revenue model based on the analytics AutoRef is now collecting, though it will need to grow larger for those figures to be reliable.

In the meantime, AutoRef is focusing on growing its U.S. footprint, and scaling the business. With the funding, it will hire a few more sales people and engineers. However, because of AutoScout24’s involvement, the startup now has access to AutoScout’s developers in Germany for assistance on projects going forward.

Interested used car buyers can try out the site here for free.