SmartAsset, a Y Combinator-incubated startup that built tools to help you answer tough financial questions, is expanding its offerings today with features for choosing the right neighborhood and the right mortgage.

Founder and CEO Michael Carrvin said that there are four broad stages to the home-buying process. The company’s initial product focused on the first part — whether it makes sense to buy a home, how much you can afford to put down, things like that. With today’s launch, SmartAsset now covers three out of four.

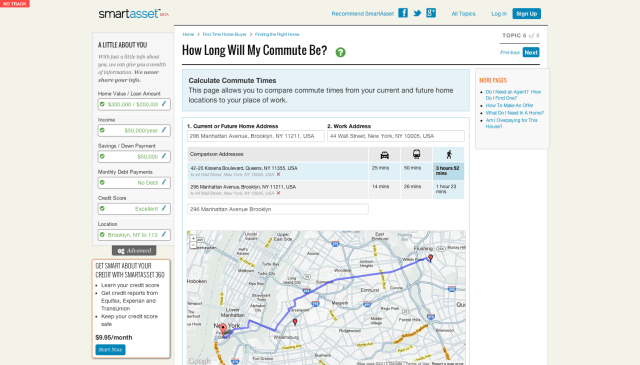

Carvin took me on a quick tour of the new features. As with SmartAsset’s previous products, the new features are structured around a question-and-answer format, with SmartAsset surfacing data that makes it easy for visitors to understand the implications of their decisions. On the neighborhood front, SmartAsset tells you things like the quality of nearby schools and the length of the commute. Some of this data is available on other sites, but now you get to see it in the context of the larger home-buying decision. Plus, Carvin said SmartAsset is the first site to incorporate data from Moody’s with investor predictions about the annualized change in home prices in a neighborhood over the next five years.

As for choosing mortgages, SmartAsset doesn’t just include a mortgage calculator, but also helps visitors wrestle with issues like whether they should buy mortgage points. (Carvin suggested that in many cases buying points is a bad decision.) And similar to other topics that SmartAsset addresses, Carvin said that most of the existing online mortgage aids are limited to “content and financial calculators.”

“Would you rather read about someone’s sister’s experience buying a house, or read real analysis about whether you should buy points and what mortgages you qualify for?” he said.

Carvin has plans to continue expanding the home-buying product, specifically by adding features to help close deals. At the same time, he said SmartAsset has formed a separate team that’s focused on building completely new products, revolving initially around car buying and going back to school.

Here’s the full list of new questions that SmartAsset answers as of today:

Section 2 – Finding the right home

1. What Neighborhood Is The Best Fit For Me?

2. Am I Overpaying for This House?

3. Will This Home Appreciate?

4. What Will My Commute Be?

5. What Do I Need In A Home?

6. What Type of Home Should I Buy?

7. Do I Need an Agent? How Do I Find One?

8. How To Make An Offer

Section 3 – Getting the right mortgage

1. SmartAsset Introduction to Mortgages

2. Mortgage Calculator

3. Should I get a Fixed or Adjustable Rate Mortgage?

4. Should I Buy Points?

5. Do I Need Mortgage Insurance?

6. How Will My Mortgage Amortize?

7. How Do I Get A Mortgage?

8. Do I Qualify For An FHA Mortgage?

9. FHA Loan Limits

10. VA Loans

11. VA Loan Limits

12. VA Loan Requirements