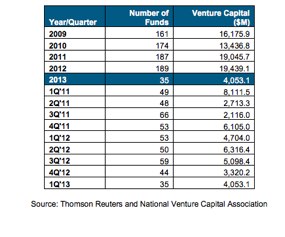

According to an NVCA and Thomson Reuters report issued this morning, U.S. venture capital firms raised $4.1 billion from 35 funds in the first quarter of 2013, an increase of 22 percent. But compared to Q4 2012, there is a 14 percent decrease by number of funds.

The actual number of funds raised during the first quarter of 2013 is a 34 percent decline from the number of funds raised last year and marks the slowest quarter for venture capital fundraising, by number of funds, since the third quarter of 2003. The top five venture capital funds (three from Massachusetts) accounted for 57 percent of total fundraising during the first quarter of 2013.

“The first quarter venture fundraising activity represents more than just a “slow start” to the year and really demonstrates the contracting and consolidating nature of our asset class,” said John Taylor, head of research for NVCA in a release. He says the “the lack of a strong exit market is keeping many funds that would like to be raising money away from investors until they can demonstrate a track record. This dynamic is keeping the number of funds raised low. Many of the larger funds closed last year and won’t be back in the market until 2014 and beyond, keeping total dollar levels lower this year.”

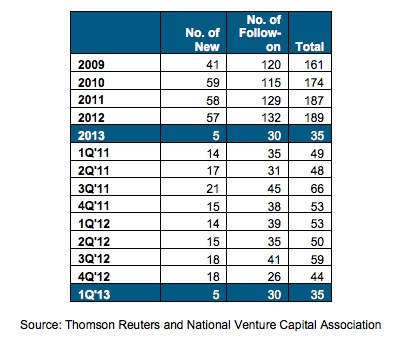

There were 30 follow-on funds and five new funds raised during the first quarter of 2013, a 6-to-1 ratio of follow-on to new funds. The number of new funds raised during the first quarter marks the lowest level of first-time funds raised during a quarter since the fourth quarter of 2006 (A “new” fund is defined as the first fund at a newly established firm, although the general partners of that firm may have previous experience as a VC).

By dollars raised, follow-on funds account for 98 percent of total dollar commitments during the first quarter of 2013. By comparison, over the past five years, follow-on fund dollars have accounted for 92 percent of total venture capital fundraising.

The largest first fund to have raised during Q1 was Washington, D.C.-based NaviMed Partners, L.P. which raised $44.8 million. Other large raises in the quarter included Battery Ventures X, which raised $650 million, Third Rock Ventures III, which raised $516 million and Spark Capital IV, which raised $450 million.

The NVCA is predicting lower fundraising levels this year, so it should be interesting to see if this actually is reflective in the numbers. There were a number of large raises last year, so perhaps we’ll see a bigger 2014 for VC fundraising.