With Austin, Texas, expected to be named as the next city for the Google Fiber project, possibly as soon as tomorrow, the analysts at Bernstein Research have published some estimates on how the economics are shaping up for the only place where Google has built out services so far — Kansas City. The firm also sounds a note of caution about whether the search giant will ever embark on a nationwide effort: it could cost up to $11 billion to build out gigabit Internet and TV service to another 20 million homes to achieve a medium-to-large rollout to compete with other providers.

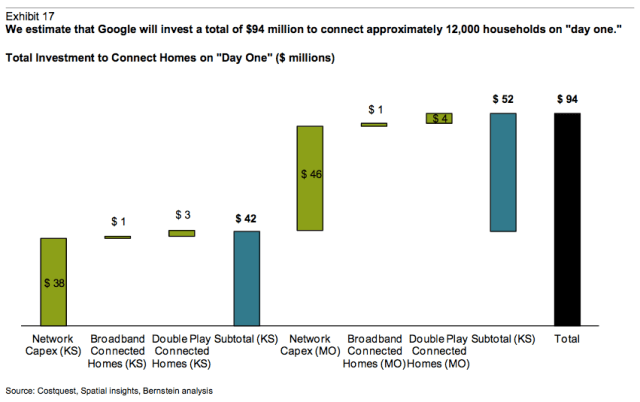

As Ryan pointed out last year when Google first unveiled the details of the Kansas City project, there are a couple of big hurdles to getting a new broadband service off the ground, starting first with building out infrastructure, and then connecting it. Bernstein’s Carlos Kirjner and Ram Parameswaran now put a price tag on that: They say it will cost $84 million to pass (but not actually connect) 149,000 homes — Google’s first phase of buildout for Kanasas City. Some $38 million will go into Kansas City, Kan., and $46 million into Kansas City, Mo., with the cost per home respectively at $674 and $500.

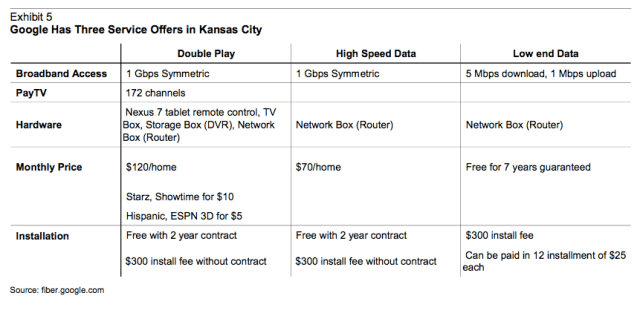

Connecting those homes is another matter. Google has detailed three service tiers, offering a variety of speeds and payment plans, including one with seven years of free service (after you play a $300 installation fee):

Bernstein estimates that to connect up a broadband-only service, it will cost Google $464; those taking double-play of broadband and pay-TV services will cost $794 to connect. “To reduce labor costs, Google will connect homes in waves within each neighborhood, taking advantage of the pre-subscription process it ran asking customers to express interest in its services as it deployed the network,” Bernstein writes. That first wave, of 12,000 homes on “day one” of the service equates to an 8 percent penetration and will cost an additional $10 million for Google, making for a total cost of $94 million for the Kansas City project — $42 million in Kansas and $52 million in Missouri.

As the project gains some momentum, the revenues incoming from new customers will offset the costs of more growth. Based on 8 percent penetration of homes passed on day one, Bernstein writes, “the incremental cash investment to grow to 18% penetration in the first year will be of approximately $2 million, with $15 million in incremental cash costs offset by $13 million of contribution from users.” Bernstein estimates that double-play customers will bring in $64/month and broadband-only customers will bring in $47/month.

Kirjner and Parameswaran write that a wider rollout around Kansas City for 300,000 homes would more than double build-out costs to $170 million (before acquiring customers and connecting those homes). Austin, meanwhile — expected to be announced tomorrow — could end up costing either the same amount or less to build out, since “preliminary analysis suggests that Austin’s population density is materially higher than Kansas City’s and hence could yield a cost per home passed (and hence total cost to pass) that is lower or similar to KC’s even if the network build-out requires a larger portion of (usually more expensive to deploy) buried or underground infrastructure.”

Yet played out on a wider scale, Bernstein is more skeptical:

“We remain skeptical that Google will find a scalable and economically feasible model to extend its build out to a large portion of the US, as costs would be substantial, regulatory and competitive barriers material, and in the end the effort would have limited impact on the global trajectory of the business.”

Using existing providers as a point of comparison (Comcast passes 53 million homes, Time Warner Cable 30 million, and Charter 12 million), Bernstein works out the cost for a 20 million-home coverage for Google, which would give it a 15 percent coverage and rank it as a “medium-to-large domestic access and pay-TV provider.”

Kirjner and Parameswaran estimate that if Google built out a fiber network to serve 20 million homes over a period of five years, “the annual capex investment is required to be in the order of $11 billion to pass the homes, before acquiring or connecting a single customer.” There is a big question mark over why, in fact, Google would ever embark on such a project. “It would have limited impact on the global broadband access industry beyond these 20 million homes,” Bernstein writes. As a point of comparison, it was estimated that it cost Verizon, before it halted FiOS buildout, about $4,000 per home to connect it to its fiber network.

Then again, the Kansas City project, covering neighborhoods in both Kansas and Missouri, has always appeared to have a two-fold purpose. It is a test for Google to see whether it could be a viable infrastructure-based service provider; and it is a way for Google to test out new applications and services, and to amass more data about consumer behavior.

Bernstein has weighed in with a pretty definitive opinion on the first of these (and not for the first time, we should add), but that still leaves questions about the second motivation for Google Fiber.

There is a very clear opportunity for Google to cherry pick a handful of cities for fiber rollouts for in-the-wild tests. These could then subsequently get launched on other service providers’ networks, and provide more opportunities for Google to package its advertising and content in more ways.

Remember, Google’s longer-term vision of how content gets consumed extends across multiple screens. While it’s setting out a winning stake on the mobile screen, by virtue of Android, and dominates a lot of activity on the PC screen, by way of its search engine, its Chrome browser and its many cloud services, it’s relatively far behind the game on what’s still a main screen in the home, the television.

In that regard, it may be that Google never planned for something as costly and extensive as a 20-city, $11 billion investment. A far smaller one in the hundreds of millions, however, could end up being money well spent.