Nielsen today released new data that examines trends in the “Zero TV household” – a definition which refers to those who no longer watch traditional television offered by cable or satellite providers, but who tend to stream video online, via computers, smartphones or tablets. According to the firm’s findings, there are now more than 5 million cord cutters in the U.S. this year, up from 3 million in 2007.

That’s still a very small slice of the market, Nielsen acknowledges. Today, 95 percent of U.S. viewers still watch so-called “traditional TV” in their living rooms. And even among the cord-cutting group, the TV itself isn’t obsolete. It’s a platform used for console gaming, watching DVDs and surfing the Internet. More than 75 percent of the cord-cutting group still has at least one TV set, Nielsen found.

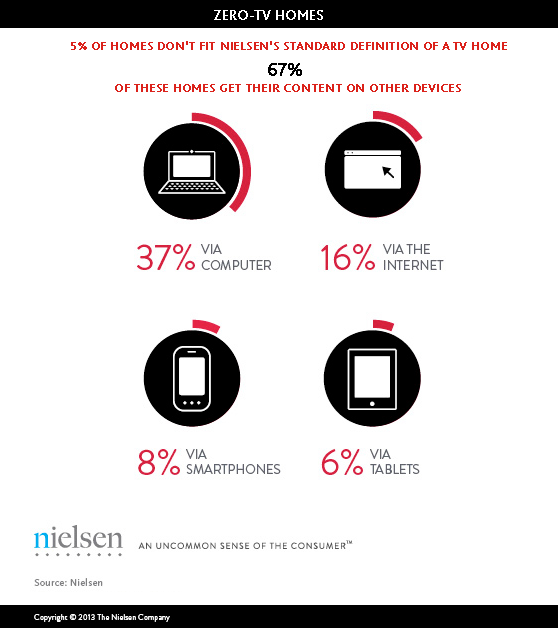

While the “Zero TV” household could also refer to those who simply don’t watch video content at all, most (67 percent) still do watch video content. Thirty-seven percent do so on a computer, 16 percent via the Internet, 8 percent on smartphones and 6 percent on tablets.

If those numbers seem odd, remember that we’re talking about “zero TV” households here – many people are streaming video on their devices, but haven’t given up their traditional TV viewing yet to do so.

The on-demand services we have available today like Netflix and Hulu can’t yet compete with the lineup of content from traditional TV, which is partly why it still has a foothold. But that’s also why companies are beginning to work around the problem by funding their own original programming. If one day, these alternatives to traditional TV can offer a lineup of content that’s worth watching, it may be easier to drop the cable subscription entirely. That day is still off in some hazy potential future, however. Regular TV is still king for now.

But the trends among the cord-cutting group are interesting in that they could perhaps indicate the direction the market is at least slowly headed. Though most are not dropping traditional TV, the way we’re interacting with television content is changing. We’ve not only introduced more devices into the mix, we’re consuming content in new ways, as well.

These changes are no longer just limited to earlier adopters, either. On CBS News’ mainstream-friendly “Sunday Morning” TV program this weekend, contributor Luke Burbank confessed to his addiction to binge-watching episodic television, thanks to services like Netflix, Hulu and HBO Go. It’s not news to TechCrunch readers perhaps, (as many can probably relate), but seeing this sentiment shared with the older, TV-watching audience it becomes clear: Things are changing, and boy is it crazy.

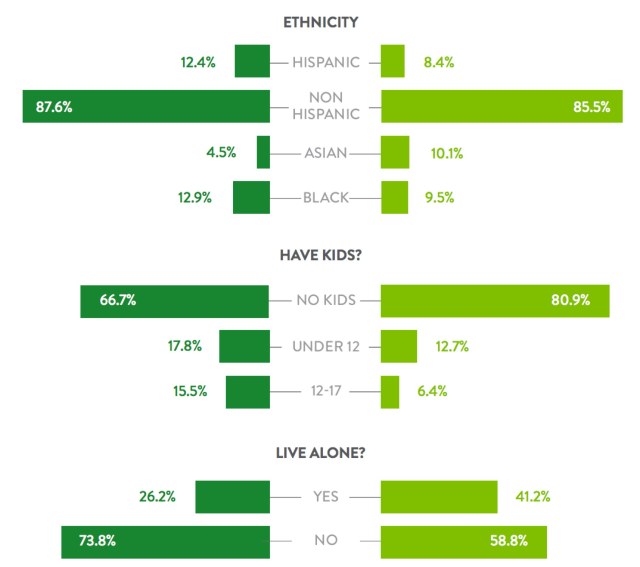

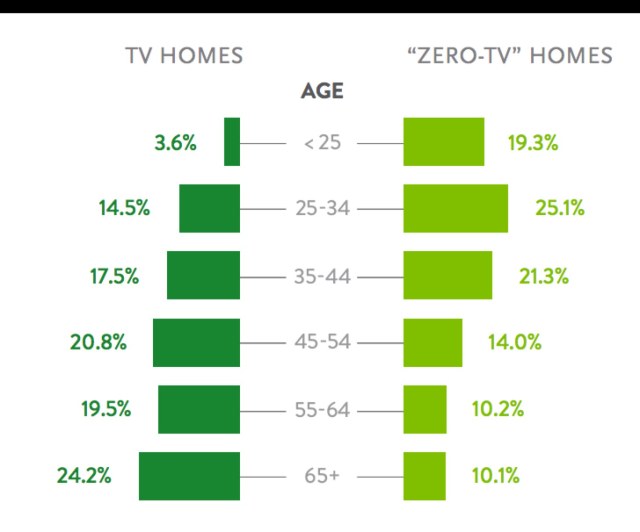

In the new report, Nielsen also found that the Zero TV homes tend to be younger, with almost half under the age of 35.

The majority are non-Hispanic (85.5 percent) with 10.1 percent Asian, 9.5 percent black and 8.4 percent Hispanic filling out the mix. And, Zero TV homes are more likely to be those where the viewers live alone and have no children (80.9 percent, vs 66.7 percent for traditional TV).

Just wait till these kids grow up, though.

To some extent, this group is responding to the downturn in the economy which has coincided with the ubiquity of alternative viewing options. For 36 percent, cost was the primary reason for cutting the cord, but interestingly, “lack of interest” was a close second at 31 percent. That latter reasoning also speaks to the Internet’s and mobile’s power to disrupt TV not by offering the same service, only via streaming, but how it provides a variety of other things to do instead. There’s YouTube, social networking, video chatting, Tumblr posting, mobile gaming, and a world of news and entertainment content to consume. But doing so can mean little time left for vegging out to watch living-room TV.

Only 18 percent of the Zero TV group said they’d consider subscribing to TV services, said Nielsen.

Earlier this month, Nielsen announced that it would begin including data on these Zero TV Households in its cross-platform reports for the 2013-2014 season going forward. The news followed a leak from The Hollywood Reporter in February, which included details of Nielsen’s plans to begin analyzing viewing behaviors beyond traditional TV watching, which today also includes DVR content and on-demand programming.

The company will have hardware and software in place to measure streaming services like Netflix and Amazon, as well as over-the-top services from game consoles like the Xbox and PlayStation, the report stated. In the initial rollout, Nielsen will look at behavior taking place primarily on iPads and other tablets, but in phase two, the plan would be to track video viewing behavior from any source.

We’re not at the point where Nielsen will be reporting daily or weekly “Netflix ratings,” so to speak, but in the long run, it may not have to. That’s a metric that may no longer make sense in a day when viewers sit down and “binge watch” TV instead of making an appointment to watch a show the day or day after it airs. In fact, a recent report found that Netflix’s “House of Cards” was the service’s most-watched show of all time – and that most had watched six episodes in the first few weeks of availability. (Netflix released the entire season at once.)

But the more concerning data point – at least for those in the traditional TV industry – was tucked away in that study. Approximately 23 percent of Netflix subscribers had cancelled their cable TV or satellite subscription, the report found.