Plastiq, an online payments startup aimed at bringing credit card payments to industries which tend to shy away from supporting them, has raised a $6 million Series A. The round was jointly led by Atlas Venture and Flybridge Capital Partners, and included previous investors NextView Ventures and Greenoaks Capital, along with notable angel investor Harvey Golub, former Chairman and CEO of American Express.

The company had previously raised $2.3 million from Atlas and Flybridge in April, bringing its total raise to date to $8.35 million in outside funding.

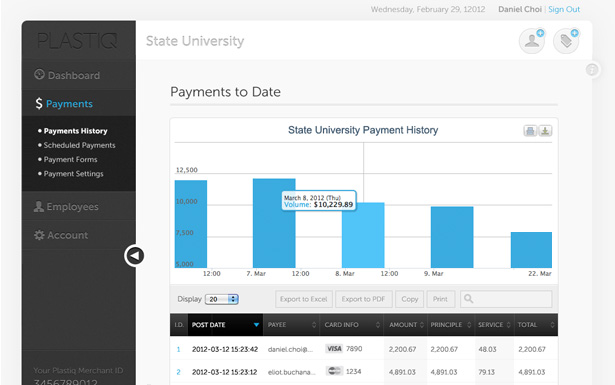

Headquartered in Boston, with a team of over 20, Plastiq was co-founded by Harvard graduates Eliot Buchanan (CEO) and Daniel Choi (COO). Buchanan says the idea originally came to him after experiencing one of the problems Plastiq wants to solve while he himself was in school. That is, he wasn’t able to use his credit card to make tuition payments, and realized that was a pain point other consumers may be experiencing too.

Plastiq now targets a handful industries where consumers often want to use credit cards, but can’t. In particular, it aims to bring credit card payments to things like paying tuition, tax and rent online, says Buchanan. “Primarily, the reason is that the landlords, the schools, and the government don’t want to eat the cost [associated with credit card payments],” he explains, when asked why these verticals have been slow to support credit cards. “They don’t want to set up the infrastructure to accept the payments,” he adds. The company’s website lists other potential verticals where Plastiq could work, including payments for boats, art, and donations.

The service will be marketed to consumers via emails from partners, and through payment buttons offered on the merchants’ websites, generally speaking. Meanwhile, merchant partners gain access to the benefits of being able to support credit cards – offering their customers choice, and getting faster cashflows (no waiting for checks to clear, e.g.) in return. Through an online portal, merchants can download data and run reports, and. Plastiq provides an API for deeper integrations into backend systems, when needed.

Plastiq works with the major credit card companies and a variety of payment networks to provide the necessary infrastructure, and charges the consumer a small fee for each transaction processed of somewhere between 1.5 and 2.5 percent for the convenience and flexibility of being able to use a credit card. There’s no upfront cost to merchants, however. Buchanan declined to provide specific details about how many merchants have signed up (“hundreds”), how many consumers have used the service, or how many transactions have been processed since the company’s launch around a year ago (“millions of dollars” to date, he says.)

He did, though, offer a few specific examples of larger partners, including the University of Alberta (40,000 students) and Mount Royal University (20,000 students), for instance. The startup has also signed deals with a couple of large property management companies, also in Canada, one of which is MetCap. Another recent partner is ClubSoft, which operates around 300 country and membership clubs across North America. Currently, Plastiq is talking to banks in order to expand its reach the U.S. market.

The company is headquartered in Boston, but also has smaller offices in Toronto and New York. Over the next few quarters, Plastiq’s new funding will help the team focus on further product development, marketing, and partnership efforts.

Correction: The fees assessed are charged to consumers, not merchants. The article has been updated to clarify this.