The smartphone boom is continuing apace, but with growth comes mutation: new figures out from Deloitte estimate that 2013 will be the first year that the industry collectively ships 1 billion smartphones worldwide, taking the total installed base of smartphones to nearly 2 billion. However, at the same time, the definition of “smartphone” is changing, perhaps in some surprising ways.

Deloitte, which has provided us with a preview of some of the findings from its Global Mobile Consumer Survey that is officially coming out next week, notes that while some smartphones can sell for $700, about half a billion handsets this year will sell for less than $100, with many models under $50. This — combined with the prevalence of feature phones with smartphone-like features and the fact that many smartphones are being used as “dumbphones” — means that the definition of “smartphone” is blurring.

“The definition of a smartphone for this prediction is based on consumer perceptions of what a smartphone is, rather than the standard industry definition, which pivots on the type of operating system (OS) used,” Deloitte writes. “Many consumers, particularly middle majority adopters, are likely to consider phones as smart if they have touch screens or full keyboards and they can use apps and not based on what intangible OS is under the hood.”

The idea that dumbphones are getting smarter sounds about right — witness Samsung’s bada feature phone line that is already counted by some in smartphone estimates, or Nokia’s move to acquire companies to help it soup up its lower-end handsets.

But the other part of Deloitte’s assumption, that people don’t recognise what “intangible OS is under the hood,” runs counter to figures out earlier today from rival consultancy Accenture. It found, in a survey of 11,000 consumers, that a full 100 percent of them could name the operating systems on their phones. That could imply that, although some believe that consumers don’t care or know about their operating systems, in fact the reverse may be true.

While many countries are starting to pass a tipping point where there are more smartphones being bought than feature devices, Deloitte has produced some evidence that shows that not all smartphones are being used to their full potential: Deloitte estimates that about one in every five smartphone owners, or 400 million users, may never or rarely (less than once a week) connect to the Web through cellular or Wi-Fi in 2013.

“Throughout the year, there are likely to be hundreds of millions of smartphone owners who are not on a data package,” it writes. “The 400 million smartphones that never or rarely connect to the Web in 2013 will not be idle, but their usage will resemble that of a feature phone.”

In other words, the trend works both ways: some feature phones are smartphones, but in reality, some smartphones have been relegated to dumbphone use.

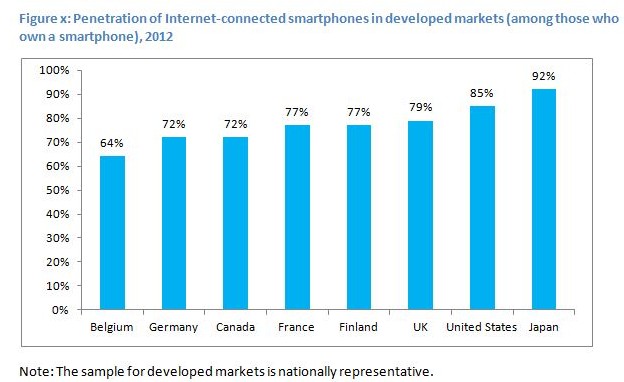

In developed markets, Japan is currently topping the list of mobile Internet usage at 92 percent, with the U.S. and UK in second and third with 85 percent and 79 percent, respectively. That seems to indicate that mobile Internet usage correlates with overall smartphone ownership, since these three rank among the highest for overall penetration.

In emerging markets, the smartphone often becomes a replacement for a PC altogether because of cost and lack of fixed broadband networks (and lack of commercial appetite to invest in these instead of more quickly installable wireless networks).

But at the same time, it points out that there are a lot of gating factors: a lingering lack of interest among users to get connected, or data tariffs that remain unaffordable or difficult to understand, or a remaining basic lack of infrastructure. In some cases, consumers simply aren’t able to buy feature phones anymore, so when they purchase smartphones they just use them like their past devices. In Vietnam as of Q1 2012, smartphone penetration was around 30 percent, Deloitte notes, but only 11 percent of subscribers had a 3G subscription.

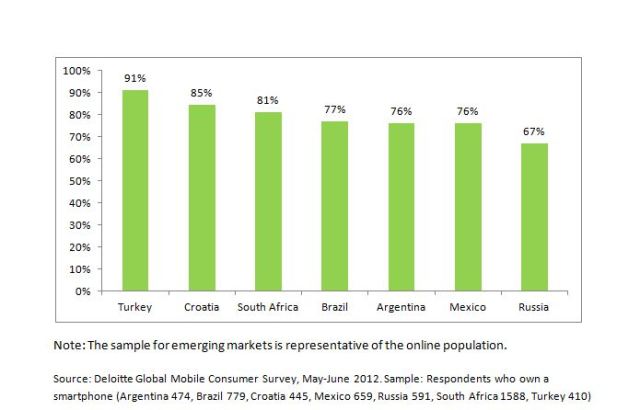

Still, all that together has translated to an equally similar number of smartphone owners using their devices for Internet connectivity, as well. Turkey ranks the highest at 91 percent, followed by Croatia and South Africa at 85 percent and 81 percent, respectively.

Interestingly, although China is now considered to be the world’s biggest smartphone market in terms of shipments, it’s not ranking in either list as the most connected of smartphone user bases. That shows just how much potential is left in that market.

Another area where Deloitte points out smartphone owners are not necessarily globally active is apps. It found that a full 16 percent of smartphone owners have never downloaded a single app. That number, interestingly, is even higher in developed markets, at 21 percent, and lower among urban professional smartphone owners in emerging markets, of which 13 percent have never downloaded an app. “It may be that the only apps this category of owners will ever use are those that come pre-loaded onto the device,” Deloitte writes.

Some of the issue is lack of interest — something that might come as a surprise to some in the occasionally-insular tech world — but, again, with feature phones being difficult to buy these days in some markets, a lot of users are simply buying fancier devices but continuing to use them for only their most basic functions.

Photo: Flickr