Editor’s note: Steve Patterson’s observations and writing are based on his 20 years working in the primordial ooze of start-ups in Boston and the San Francisco Bay Area. Follow him on Twitter @stevep2007.

At the start of CES 2013, Qualcomm has an enviable dominant market position, owning half the mobile processor shipments and virtually all of the LTE/4G baseband chipset shipments. But it has limited brand recognition compared to the Android smartphones it powers. To cement its dominance in the growing mobile market, Qualcomm needs to emerge as a consumer brand from the obscurity of being a component in smartphones sold under other companies’ brands. Otherwise, it will lose its price premium and precious lead to competing mobile processor manufacturers.

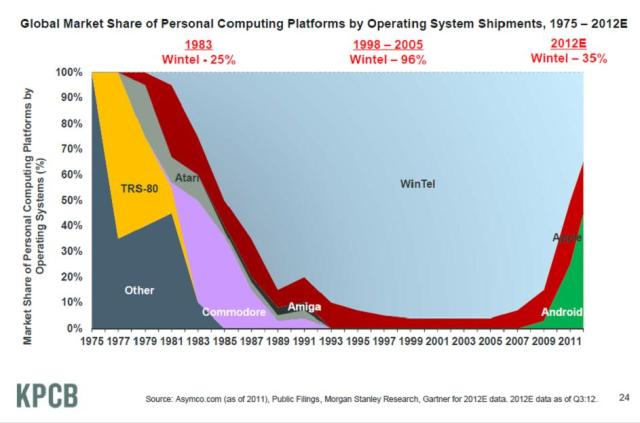

Intel, by contrast, has been rewarded with brand preference in the PC and server market after many years of investment in innovative marketing that influenced consumers’ purchase decisions based on computer manufacturer’s choice of Intel’s processor rather than the manufacturer’s logo. Intel, late to the mobile processor market, now must transform its technologies into mobile product shipments to counter stalled Wintel revenues. As the chart below from Kleiner Perkins Partner Mary Meeker illustrates, Intel must aggressively pursue the mobile market and compete with Qualcomm.

Qualcomm CEO Paul Jacobs has begun 2013 with a clear intention of strengthening Qualcomm’s brand. After appearing on the Charlie Rose Show last week, Jacobs will return to keynote CES 2013. Jacob’s theme, “Born Mobile,” is intended to build brand recognition for Qualcomm’s silicon chips. He is presumably hoping for the same consumer branding results in consumer smartphone purchase decisions that the Intel Inside campaign delivered for Intel in consumer PC purchase decisions.

Intel, meanwhile, will use CES to begin writing its mobile story. Today, after a year of preparation, Intel announced the Bay Trail-T microprocessor and the Bay Trail-T tablets that manufacturers are developing for both Windows 8 and Android. The Bay Trail-T is a shrink to 22 nm and enhancement of the Atom Medfield chip currently in production that will deliver as much as twice the performance with extended battery life. The Bay Trail-T is a compatible Wintel microprocessor which will run Windows 8 and any Windows app as well and Android and Android apps. This is an advantage over the ARM powered Microsoft Surface that runs a Microsoft variant called Windows RT that only runs Windows applications that have been re-coded and recompiled.

In February at the Mobile World Congress in Barcelona, Intel is expected to update its investors and partners on its Merrifield processor due to be launched later in 2013. Merrifield, first announced in May 2012 at Intel’s investor conference, is targeted at smartphones, a shrink to 22 nm with performance improvements similar to the Bay Trail-T. Intel has begun production of its LTE/4G baseband chip, according to Intel’s spokesman Jon Carville.

Also anticipated in the first quarter in preparation of Intel’s mobile rally is the announcement of a successor to retiring CEO Paul Otellini who will be responsible for leading Intel into the mobile era.

A Two-Front War: Building Consumer Brand Recognition and the Fastest, Lowest-Power SoCs

Most observers define the mobile device battle in terms of the Apple, Android, and Samsung brands, but it is really a two-front war – the second front being the competition to build the most efficient and integrated Systems-on-a-Chip. SoCs are such a major factor in determining the capability of a mobile device that leading the mobile device industry is synonymous with leading SoC design. Although there are many mobile processor SoC competitors, there are only a few, including Intel, NVidia, Qualcomm, Samsung, and upstart MediaTek, that can have an impact on this market, because they have microprocessor technology and either own or have licensed LTE/4G baseband technology.

LTE/4G is delivered as a silicon component called a baseband modem that pushes SoC designers to the limits of innovation to design and fabricate for low-power consumption applications, such as mobile devices. It is a necessary upgrade to 3G that mobile users need to become permanently untethered.

Intel has moved quickly to backfill its LTE/4G intellectual property and engineering design capability. Last year Intel acquired Infineon Wireless, a fabless semiconductor baseband modem company with LTE/4G patents and a long history of delivering baseband modems to handset and base-station manufacturers. With the acquisition, Intel gained a product portfolio, design capability, and patents that Hermann Eul, vice president and general manager of the Intel Mobile and Communications Group, describes as a “profound portfolio of patent protection.” Through acquisition, Intel has joined Qualcomm and Samsung as the only baseband modem suppliers that have the patent portfolio and scale to coordinate LTE/4G development through separate certifications and approvals required by each mobile carrier.

In mid-2012 Intel doubled down on LTE/4G when it opened a new office in San Diego, Qualcomm’s home territory, with the express intent of recruiting from the area’s deep pool of baseband talent to build a new modem design team for LTE/4G technologies. There are rumors that Intel will be making at least one more LTE/4G investment in 2013. A second source for LTE/4G baseband modems from Intel will be welcomed by smartphone manufacturers as an alternative to Qualcomm’s near monopoly of LTE/4G modems and will relieve supply constraints.

Intel has demonstrated that it can build a competitive smartphone SoC. The Intel Atom Medfield processor powers the Motorola Droid Razr i. It was tested by The Verge against the Qualcomm Snapdragon S4 powered Droid Razr M that is built with almost an identical design except for the mobile processor SoCs. The Intel-powered Razor i demonstrated equal or better software compatibility and power efficiency. The Razr i’s performance and Intel’s seven design wins, including Lenovo, are notable.

But while Intel’s ability to deliver high-quality processor SoC designs is indisputable, Qualcomm’s dominant position indicates that smartphone manufacturers favor suppliers that offer both processor SoCs and baseband modems. Delivering LTE/4G to smartphone manufacturers in the first half of 2013 is a critical milestone for Intel.

Qualcomm poses significant challenges because it has already delivered its Snapdragon processor with an LTE/4G baseband modem integrated on a single chip. According to Qualcomm VP of Marketing Tim McDonough, “Qualcomm is on its second release of LTE/4G and sampling its third release while competitors have yet to announce or deliver a first release.”

Intel’s Response to Qualcomm’s Integrations of Processor and LTE/4G

Intel separates its production of LTE/4G and Atom processors. Eul believes it is too early in the evolution of Intel’s LTE/4G to combine it on a single chip with an Atom processor because the two technologies will iterate at different rates precipitated by different market events. We may see Intel’s LTE/4 modems integrated with a future Atom SoC when another shrink to 14 nm takes place sometime after 2014.

To close the gap, Intel will apply to smartphones and tablets the significant systems-level design capability that it honed when nearly monopolizing the X86 PC and server business. Intel will deliver smartphone reference designs that will allow manufacturers to produce complete optimized smartphones using Intel’s components.

Intel also acquired carrier certification and approval know-how and relationships with its acquisition of Infineon. Eul’s strategy is to take both the components and reference designs through the lengthy and complex mobile carrier certification and acceptance process and share the certifications with smartphone manufacturers to shorten the time to market for a new smartphone by at least six months. Based on the context of Eul’s comments, Intel might even use its vast supply-chain relationships to deliver an Intel-branded smartphone that cuts approval times.

The New CEO Must Lead Intel Into The Post-PC Era

How much of Intel’s growth in the mobile SoC market will be at Qualcomm’s expense is uncertain because of Qualcomm’s powerful market position and significant design capability. Consolidation can be expected as mobile processor SoC suppliers without strong LTE/4G patent portfolios leave the mobile business as exemplified by Texas Instruments’ recent retargeting of its OMAP mobile chipset to automotive infotainment applications. Qualcomm may feel little pressure from Intel while the industry segment consolidates. Longer term this is an epic championship fight between two great competitors, each with more than $10 billion in cash that spend 15 to 20 percent of revenues on serious scientific R&D.

Intel’s failure to exploit the mobile SoC market has often drawn criticism. But Intel has produced few early subscale successes. Willy Shih, a Professor of Management at the Harvard Business School, has studied Intel and told us that most of Intel’s “New Business Initiative” ventures failed when the new ventures could not scale to match the profitability or volumes of the core x86 microprocessor business. The mobile processor and communications business has the attributes that meet Intel’s expectations for growth and scale. But since Intel has all the design, intellectual property, and manufacturing capability to succeed in the mobile market, the new CEO will need to carve out Intel’s top talent and state-of-the-art fabrication capacity and dedicate it to winning mobile market share, perhaps at some cost to the core PC microprocessor business.

Since another growth market of the magnitude that Intel needs to reignite growth is not apparent, the next CEO will be selected based on his ability to lead Intel into the Post-PC Era. And he will be able to tell this story – perhaps at CES 2014.