With the mobile gaming industry growing up on Android and iOS, developers focused on different genres are following diverging trajectories. Many casual developers are chugging along profitably even if their valuations have been readjusted by Zynga’s performance on public markets. Midcore developers are enjoying a Renaissance of sorts, and casino gaming is attracting new interest on the possibility that U.S. domestic laws around online gambling may relax a bit.

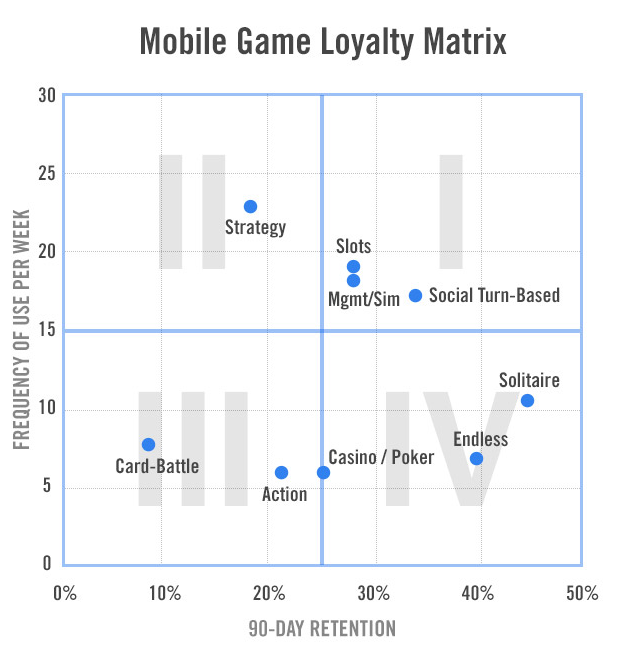

San Francisco-based Flurry took a look at different genres of games to see how they retain and engage users over 90 days. With rising marketing costs, it’s becoming ever more important to be thoughtful about the types of audiences you attract and how you retain them. Ideally, a mobile app that monetizes well maximizes engagement (or the number of times a user interacts with a game on a weekly basis). The more they interact with an app, the more opportunities there are for in-app purchases or other transactions.

In the graph above, Flurry divides games into four types. Quadrant 1 is the “sweet spot,” where games not only retain users well, but keep them actively engaged on a weekly basis. Social turn-based games, slots and casual simulation titles (like the familiar farming or zoo games) do well in this category. Game mechanics that set “appointments” like the need to water plants every nine hours, get users back into games. That said, these are more casual titles that don’t necessarily attract higher-paying players. The quality bar has also become a lot higher for these types of games over the last 18 to 24 months, so barriers to entry are higher for new competitors.

The second quadrant just has room for strategy games, which have a shorter lifecycle because users churn through content very quickly. With these types of games, developers have to drive monetization through player vs. player mechanics. While the 90-day retention is not as strong as in Quadrant 1, these types of games are part of the trend toward midcore gaming, which happens to attract a more select, but more lucrative audience.

The third quadrant includes card-gaming titles, which started out being popular in Japanese markets but have since crossed over into the West with titles like Mobage’s Rage of Bahamut. Publishers behind these titles have to be strategic about how they acquire users, since many of them drop off. The mechanics in these games are sometimes too complicated for newer users to follow.

The fourth quadrant has older types of familiar games like casino titles, solitaire and poker. Aside from poker games, solitaire and casino games might not offer that many opportunities for in-app purchases, but they do have inventory for advertising impressions. Flurry says even though these games might be harder to monetize, they can be good for cross-promoting more lucrative titles.

Flurry also took a look at gender balances in these titles. These stats aren’t really all that surprising. Casual sim games, social turn-based games, slots and solitaire tend to attract female players while strategy and card-battle games attract male players.