BillGuard, the TechCrunch Disrupt NY 2011 runner-up offering credit and debit card users protection against fraudulent charges, is today formally announcing its integration with Lemon’s digital wallet application. The integration was actually soft-launched a couple of weeks ago, where it appears to users as a toggle switch beneath any supported credit or debit card stored in Lemon’s wallet.

For those unfamiliar with Lemon, the company offers a mobile application that serves as a place to hold all the cards you would normally carry around in your physical wallet, including credit and debit cards, ID cards, gift cards, store loyalty cards, and more. The wallet is designed to store digital backups of cards, and, in the case of a lost wallet out in the real world, Lemon also provides a service which will help users automatically cancel their cards. In addition, it offers other wallet-related features like a barcode-scanning option for some store cards and loyalty cards, receipt tracking, card balance updates, and more.

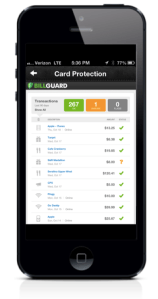

The new BillGuard integration, which can be switched on within the wallet app with just a tap, will authenticate with the user’s bank account, if supported, and then monitor that account for any odd charges going forward. Around 5,000 U.S. banks and credit unions are available at present.

The new BillGuard integration, which can be switched on within the wallet app with just a tap, will authenticate with the user’s bank account, if supported, and then monitor that account for any odd charges going forward. Around 5,000 U.S. banks and credit unions are available at present.

BillGuard’s service is based on techniques which are similar to those which are used to combat spam in email systems – that is, crowdsourcing. When email users mark a particular message as spam, they’re providing a signal which is used to make the spam-fighting system smarter. The more users who signal that a message is spam, the more likely that message is caught in the spam filter the next time. The same goes for BillGuard – the company harnesses human opinion related to odd and possibly fraudulent charges in order to determine if a particular line item on a bill is of a questionable nature. When it is, indeed, a bad charge, BillGuard can also assist users in getting their money back – a service which CEO Yaron Samid says has over an 80% success rate.

The integration with Lemon will reach a potential 2.5 million users, but it’s just one of many future integrations, Samid says. The plan is to integrate with other mobile wallet players, as well as banks and other payment services. More announcements related to these will be available soon.

Making the cards stored in Lemon’s wallet “smarter,” as they are now thanks to the new alerts from BillGuard, is something which Lemon has focused heavily on in recent weeks. In October, the company launched a platform called “Lemonade,” which provides developer tools for making interactive cards that can communicate with users, display card balances, spending alerts, power loyalty programs, and more.