As one of Facebook’s very earliest backers (with a $37,500 investment at a $5 million valuation), LinkedIn co-founder Reid Hoffman sounds neutral on the company for the next six months, but bullish over the very long-haul.

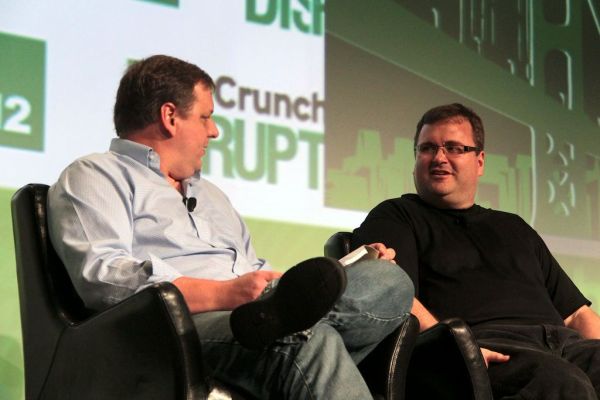

At TechCrunch’s Disrupt conference in San Francisco today, he said that he’s waiting to see how the broader market responds to employee lock-up dates over the next few months. After waiting for as long as four years, employees will finally be able to cash out on their shares or restricted stock units, which could dampen Facebook’s shares further in the short-term. Facebook is trading at $18.75, down from the initial $38 price it debuted at in May.

“I’m a big believer in Facebook’s long-term position. The real question is how it plays out over the next year or two. I suspect that if it continues at this price, it will be a good buy either at now or some point,” Hoffman said.

He added that Facebook’s issue with generating revenue from its mobile apps is just a short-term issue. Facebook only recently started showing advertising in the mobile news feed, but a dramatic shift in usage from desktop to mobile devices has dampened the company’s profit margins in the short-term. Facebook shows seven ad units on the side bar on the desktop version, but can only show occasional news feed ads in its mobile apps and mobile web site.

“The issue with monetizing mobile is a hand-wringing problem that’s not hard to solve,” he said. “The executive team there is very strong. They have 1 billion users. Given all of that, I’m very bullish on their future prospects. Whether I would give investing advice depends on the timing.”

Interviewer and TechCrunch founder Michael Arrington prodded him on his thoughts for the next six to 12 months. “I’m waiting on all of the lock-ups and then after that, that’s when I’d take an evaluation.”