Don’t call it Kickstarter, because on FundersClub you get real equity for your investments in hot startups. In just three weeks since launch, FundersClub’s platform has pulled in $1 million for Y Combinator companies, closed an oversubscribed $500,000 round for itself, and proven there’s a new way for entrepreneurs to keep the lights on. Here’s a closer look at why FundersClub is so damn disruptive.  For the full rundown of how FundersClub works, check out my scoop on its launch, but here are the basics. Any accredited investor (over $1 million in net worth or earnings of over $200,000 a year) can check out the open rounds on FundersClub, learn about the startups, and invest as little a $1,000 in exchange for equity. If the startup exits, the investors can earn money, and FoundersClub plans to charge for liquidity so users can transfer their stakes before then.

For the full rundown of how FundersClub works, check out my scoop on its launch, but here are the basics. Any accredited investor (over $1 million in net worth or earnings of over $200,000 a year) can check out the open rounds on FundersClub, learn about the startups, and invest as little a $1,000 in exchange for equity. If the startup exits, the investors can earn money, and FoundersClub plans to charge for liquidity so users can transfer their stakes before then.

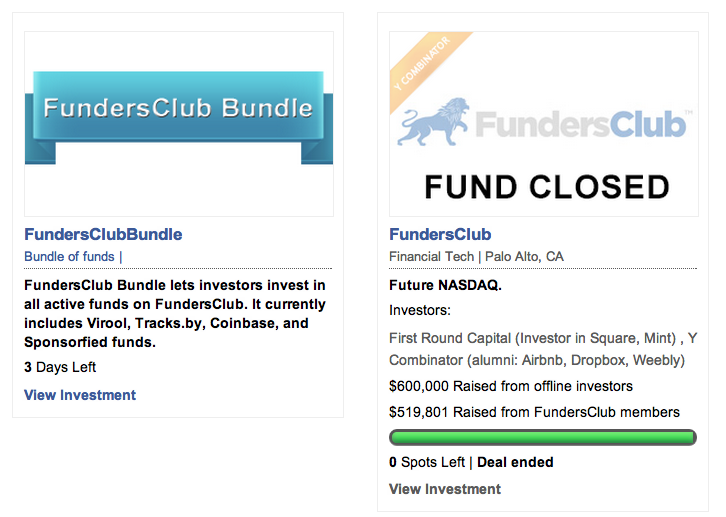

FundersClub doesn’t rely on the JOBS Act that would let non-accredited investors crowdfund startups. But if the bill is finalized without being sterilized, the JOBS Act could make FundersClub even more of a game-changer by letting literally anyone invest. FundersClub is backed by Y Combinator, First Round Capital, Start Fund, and now 95 mini-angels that together poured in half a million dollars. FundersClub doesn’t necessarily replace the traditional venture capital sources, but it’s a powerful alternative.

Startups can amass an army of evangelists and advisors with a vested interest in their success. It could help founders fill out rounds from angels wanting to lead, and avoid bringing in money from meddling capitalists they don’t see as good additions to their cap table. There will always be a place for high value-add investors that can offer advice, connections, and endorsement, but now there’s an easy way to money on its own.

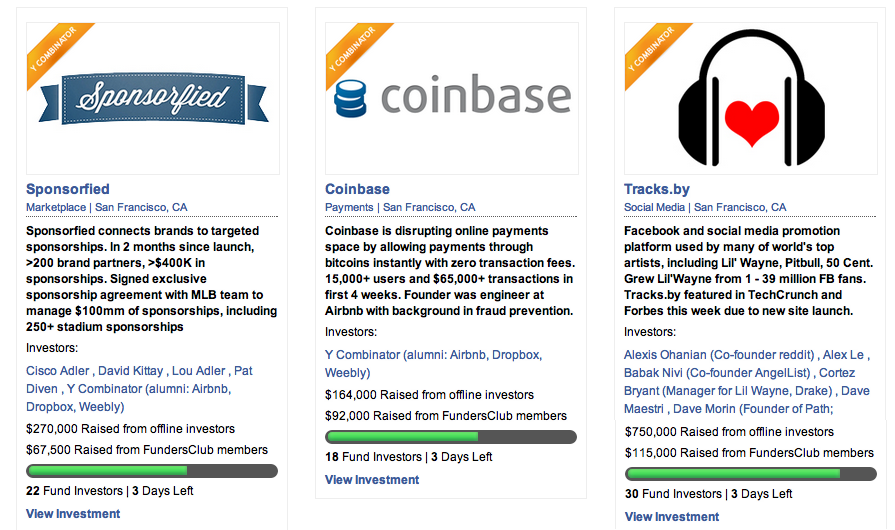

Before offering its next batch, FundersClub is accepting investments to finish closing rounds for four YC companies:

- Sponsorfied – A software platform that connects brands with events and influencers they want to sponsor, and facilitates the deal. Sponsorfied has signed on over 400 brands since its launch a few weeks ago.

- Tracks.by – A marketing service that reps top recording artists like Lil Wayne, and just launched a “Pinterest for music” site called Hipset.

- Coinbase – A PayPal for Bitcoin that allows for transaction fee-less money transfers. In just a month since launch it’s collected 2,000 users, $30,000 in deposits, $15,000 in transactions, and praise from Kevin Rose.

- Virool – A promotional tool for video creators that’s seen revenue double each month, up to $245,000 in July from just $33,000 in April.

According to info I cobbled together from its website, investor lists, and member emails, FundersClub has brought in money from early Facebook and Google employees, serial entrepreneurs, top-tier VCs using their own money, first-time angels, and international investors from over 25 countries. FundersClub gives these investors dealflow they might not have had access to.

According to info I cobbled together from its website, investor lists, and member emails, FundersClub has brought in money from early Facebook and Google employees, serial entrepreneurs, top-tier VCs using their own money, first-time angels, and international investors from over 25 countries. FundersClub gives these investors dealflow they might not have had access to.

Now its launching FundersClub Bundles so angels an easily spread their money across all of the site’s open rounds and invest in startups as an asset class. Several of the companies it hosts are now offering perks to investors, such as meeting founders in person, invites to company parties, and private chat forums with the founders and fellow investors.

FundersClub also manages a moderated Q&A where potential investors can ask founders questions, and it even mans the phones so angels can learn more about how the equity crowdfunding platform works. By democratizing venture capital, FundersClub could shift the axis of power towards entrepreneurs and away from professional investors. It will force VCs to prove why they offer value to startups beyond their money. And if they don’t give founders reasonable terms, a team could potentially raise funds straight from The People at whatever valuation the market will withstand.

If FundersClub can work out the kinks in equity crowdfunding and establish a respected brand as a smart curator of what startups have high potential, I wouldn’t be surprised if big financial institutions or firms tried to buy it. And it promotes innovation, since it lets anyone with a brilliant vision and an all-star team join the club of funded startups, even if they aren’t a Silicon Valley insider.