Joking aside, this is remarkable. Apple’s market cap now stands at $623 billion. That’s a new all-time high for a publicly-traded stock in the U.S. The previous record was $618.9 billion, which Microsoft hit on December 30, 1999.

Yes, adjusted for inflation, Microsoft’s tally is far higher (about $850 billion), but you should also consider another inflation: that was the height of the tech bubble. The real one, not the fake one that people keep saying we’re in now.

At the time, Microsoft’s market cap was more than double Exxon’s. Cisco was the third most valuable company in the world at that point, with a market cap of over $350 billion. Today, their market cap is about $100 billion. Nokia was the ninth most valuable company in the world at $200 billion. Today, they’re closer to $8 billion — and quickly approaching $0.

AOL (which owns this site) was 12th, also right around $200 billion. They were just weeks away from buying Time Warner for $162 billion. Today, AOL’s market cap is closer to $3 billion, having long since been spun off from the company they acquired.

Back then, Oracle and Sun Microsystems were roughly equal — Oracle at $137 billion, Sun at $116 billion. Less than ten years later, Oracle bought Sun for $7.4 billion.

Yahoo was also at the peak of their fiscal power, with a market cap of $100 billion at the end of 1999. They were the 39th most valuable company in the world. Today, that market cap is right around $18 billion. I wouldn’t rule out Apple making that much in profit in the upcoming holiday quarter.

And then there’s Dell. They were the 30th most valuable company in 1999, with a market cap of $122 billion. In 1997, when asked what he would do if he were in charge of Apple, Michael Dell famously said, “What would I do? I’d shut it down and give the money back to the shareholders.”

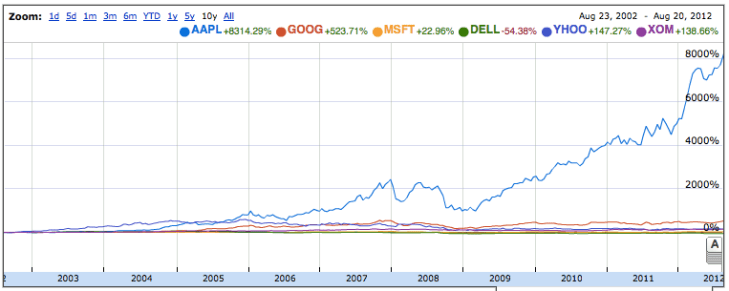

At that time, Apple’s market cap had fallen to about $2.3 billion. By 1999, it had risen to $9 billion — still just a 10th the size of Dell. And a 60th the size of Microsoft. Today, Dell’s market cap stands at just under $22 billion. They’ve lost $100 billion in market value while Apple has gained about $610 billion.

While Apple’s long-term surge is obviously massive, short-term is just as impressive. Consider that it was only a little over two years ago that Apple passed Microsoft in market cap for the first time since the early days of both companies. On May 26, 2010, both had a market cap of $227 billion. Apple’s market cap has grown $400 billion since then. Microsoft’s has grown “just” $30 billion in the same timeframe.

A year ago, I wrote a post wondering if Apple may be able to overtake Exxon in the fall to become the most valuable company in terms of market cap? Some people thought I was insane. Then it happened. Three weeks later.

Since then, Exxon has added about $70 billion to their market cap — a hugely impressive run. But in the same amount of time, Apple has added almost $300 billion to their market cap. No, that’s not a typo. Apple has added nearly $300 billion to their market cap in the past year. As a result, today Apple is worth nearly $220 billion more than Exxon — in other words, the market cap of Google — which is still the second-most valuable company in the world, by the way.

So what’s next for Apple? Well, they hit this peak just weeks after a “disappointing” third quarter. They could miss (from Wall Street’s perspective) in the fourth quarter as well, as everyone will be waiting for the new iPhone. But there’s little question that Q1 (the holiday quarter) is going to be insane. At that point, the race may be on to the $1 trillion market cap.

It sounds crazy to think they could hit that mark. But again, they added $300 billion to their market cap in the past year. If there is in fact an “iPad mini” this fall and some sort of Apple television product next year… And a $1 trillion value isn’t completely unprecedented. PetroChina actually hit that mark back in 2007, on its first day of trading. That made it worth more than Exxon and General Electric combined. Amazingly, it had a greater market value than the entire Russian stock market, as Bloomberg pointed out.

Right now, Apple has to settle for being worth what Exxon and Google are combined. Or worth more than Microsoft, Google, and Intel combined. Or maybe they’re just content to be worth 28x what Dell is worth. Someone alert the shareholders.