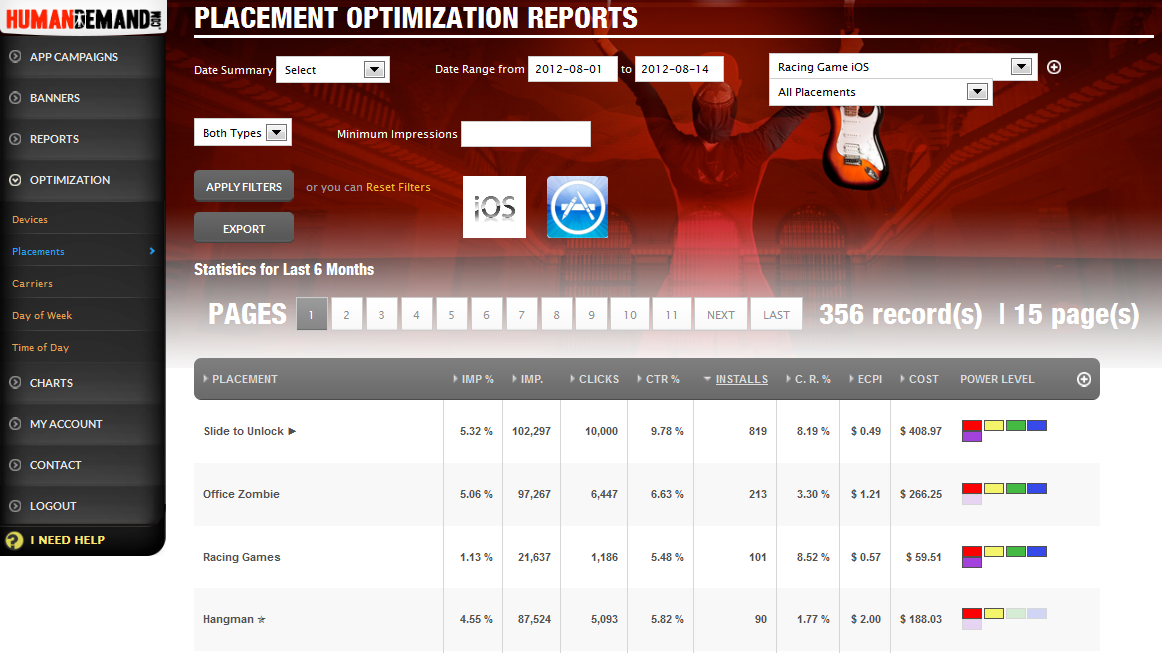

A startup called Human Demand is coming out of stealth today to enter the ever-growing mobile advertising industry with a new platform to help developers acquire more users. Its radical ideas: transparency and control. On Human Demand’s exchange, developers can see where their mobile ads are running down to the very app in which they appear. And they can then opt off of the apps where they don’t want to be, based on the results that particular app provides.

The company is the brainchild of Howie Schwartz, the co-founder of OfferMobi, and an active investor in multiple funds (BHV, ff Venture Capital, Metamorphic) through which he has made other investments in startups like UpNext, Klout, 500px, GameSalad, and a lot of East Coat tech startups. Another fund he’s a partner in, Arc Angel, also made a small investment in this new company, but Human Demand is mostly self-funded at this point.

Currently a team of eight developers and two account managers, Human Demand is focused on what Schwartz believes is a under-served market: the long tail of app developers.

“If you’re an app developer today, and you’re trying to run a user acquisition campaign and trying to generate installs for your apps, and if you’re working with any of the self-serve ad networks out there today, it’s very difficult – if not impossible – to optimize your campaign because the other ad networks are what we call ‘blind’,” explains Schwartz. “What I mean by that is that they don’t show you or tell you where your ads are running in other apps, and they don’t provide tools to make it easy to optimize and to show you what’s working and what’s not. So that’s what Human Demand has done.”

Schwartz says the goal here is to be transparent about the metrics provided, while also allowing developers control over their ad placements, on the Human Demand RTB platform (real-time bidding). But the way it goes about those configurations is different too. For starters, there’s an emphasis on the so-called “long tail.”

“There’s tens of thousands of developers who are launching apps, and some of them may have a little bit of a marketing budget and some of them might just want to test something,” says Schwartz. None of the agencies and larger networks will give them any attention today, he adds. “That’s really our target market.”

Human Demand shows exactly what the acquisition price is per user on each app, which is unique. The company has been in stealth mode since February, running a closed beta, and has managed 200 campaigns on iOS and Android across 9 countries during that time. Through its partnerships with exchanges (MoPub, MobClix, Smaato, Nexage, OpenX, etc.) there are about 5,000 publishers in the Human Demand network. The average estimated cost per install is currently $1.50, and ranges from $0.50 to $2.00.

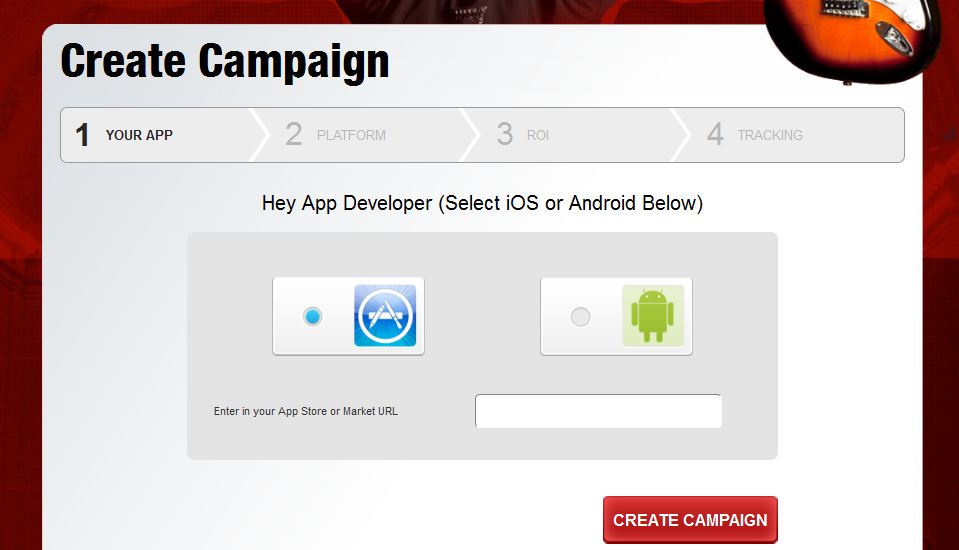

The platform also has a different toolset for targeting campaigns, which it calls a “power level.” This color-coded system (red, yellow, green, blue, purple) allows developers to target or block (red) apps on an easier to understand scale than having to figure out the actual dollars and cents per each. Campaign set up is different too. Instead of loading a URL, a banner creative, and setting up targets, developers just enter in the iTunes or Google Play URL and Human Demand pulls in all the information available from the marketplace and builds the campaign for you. It even builds banners for you. The total process is four steps, Schwartz says.

Although a lot of this setup speaks to Human Demand’s long tail target demographic, Schwartz said that four or five of the top 25 grossing apps in iTunes also participated in the beta. Today, the platform is available for any developer to try, and the company is now considering raising a round.