Tablets and smartphones may be gradually ushering us into a post-PC world, but for now the bigger machines continue to dominate the market. Figures out today from Gartner, focusing on PCs in Europe, note that shipments in the economically-troubled region declined by 2.4% to 13.6 million units in Q2, in a wider global market where growth was flat. Within that, HP kept its lead as the biggest PC maker, while Apple has managed to crack into the top-five PC makers in one market, the UK.

The wider trend seems to be that even in PCs, people are gravitating towards smaller machines. Gartner notes that desk-based units were down by 12.8 percent, but mobile PC shipments (laptops, netbooks) went up by 4%. Similarly, you can see the effects of consumerization at play here: the “professional” PC market is down by 5.3%, while consumer PCs saw a sliver of growth: 0.4%.

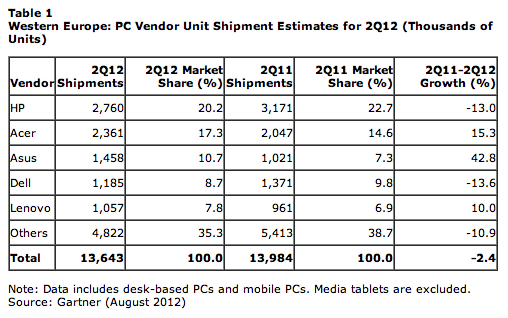

Europe accounts for about 16% of the global market for PCs (globally there were 87.5 million PCs shipped in the quarter). In the region, HP currently controls 20% of the market, down from 23 percent in Q2 a year ago. It shipped 2.8 million units, 13% less than last year, while Acer, Asus and Lenovo all grew their shares, with Asus posting the most impressive increase at 42%. HP retained the lead in all individual markets except for Germany, where it dropped to third and Acer now leads. (HP will be reporting quarterly earnings later in the month and that will give us a more accurate picture of what is going on.)

Gartner notes that Dell declined the most among the top-five vendors. It dropped down for third-largest to fourth-largest PC maker, with a share of 8.7 percent (1.2 million units, a decline of 13.6%).

Asus’s rise, Gartner notes, was down to the company offering a wide range of devices between mobile and desktop PCs, as well as Ultrabooks and tablets, “all of which are marketed at attractive prices,” according to Meike Escherich, principal analyst at Gartner. Dell’s decline is partly attributed to how it has largely started to pull away from PC maker to professional services supremo — although it seems to be doing that bang off trend, given the decline in the professional market. (In the UK market, its shift saw Dell lose some 40 percent share in consumer PCs, Gartner pointed out.)

Given that there will be a wave of new machines coming on the market with Windows 8 in the lead-up to the holiday season, if sales don’t pick up now, you may start to see some real bargains on the market. The knock-on effect will be tricky for Microsoft and Windows 8. As a result of the price cut on older machines, “challenges may arise in selling new products into the channel in the third quarter of 2012,” she noted.

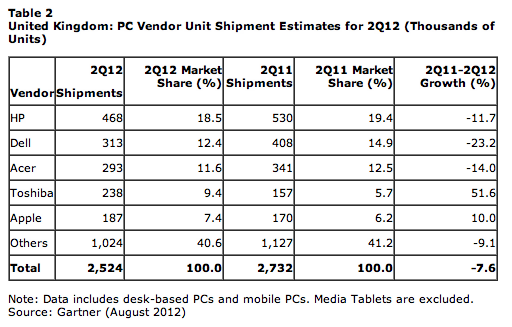

As for how individual markets are performing, the rankings are largely a reshuffling of the European top-five, with one notable exception. In the UK, Apple and Toshiba are part of the mix, and Lenovo and Asus are not.

HP retained the top position in the UK, but Apple squeezed in at fifth position with 187 million units sold, for a 7.4% share of the market. Toshiba, meanwhile, saw a very healthy growth of 51.6% for a 0.4 share of the market (238 million units).

Still, the UK was “very weak” in Q2 with an overall decline of 7.6 percent, beating the European average and well below the state of the global market.

And with the move to smartphones and tablets particularly strong in the country — it was one of the first developed markets to have a majority-smartphone penetration among mobile users — PCs might continue to fare poorly even when economic conditions get better:

“The real worry for the UK PC market is whether it will ever return to solid growth,” writes Ranjit Atwal, a Gartner research director. “Windows 8 and Ultrabooks now look even more important. However, messages emerging from the PC supply chain remain inconsistent and largely uninspiring.” He notes that in the UK, the PC channel will be “holding back on new shipment orders” until Q4 2012 to try to shore up demand.