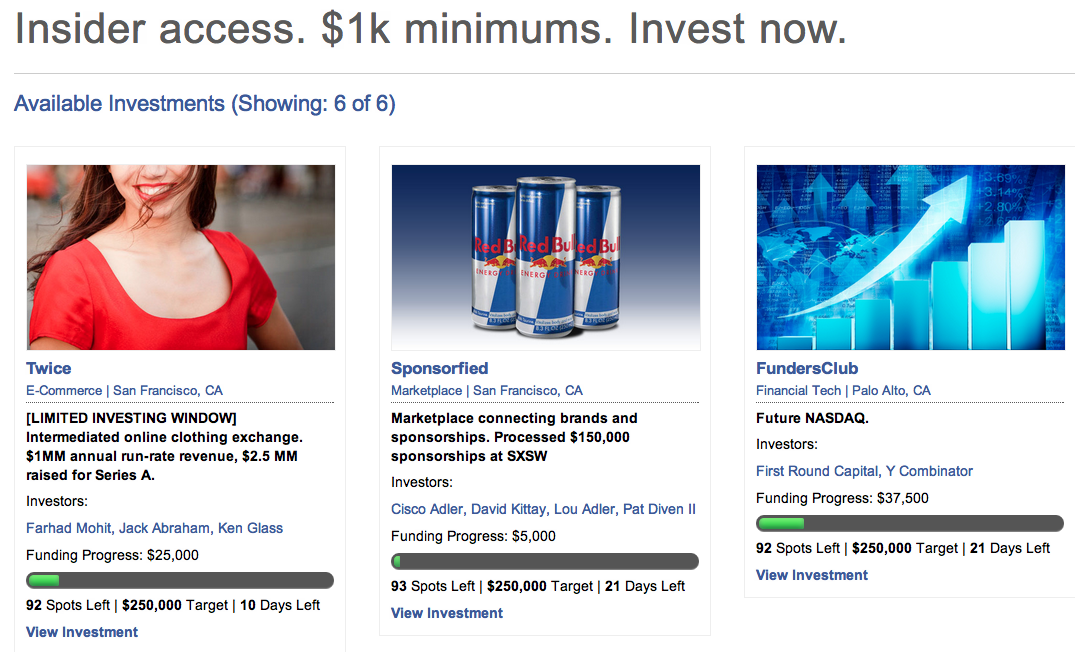

FundersClub is going to change how companies get funded.The website is designed to let anyone with as little as $1000 make equity investments in startups and earn money if they succeed.

For now you have to be an accredited investor with a net worth over $1 million or yearly earnings over $200,000 to use FundersClub. But an industry source familiar with the Y Combinator startup gave me an exclusive rundown of its whole roadmap. For example, if the JOBS Act goes into effect or FundersClub pays to set up a mutual fund, literally anyone will be allowed to use it to invest and profit if a startup successfully exits.

Put simply, FundersClub could utterly disrupt venture capital, democratize investment in private companies, and ensure any founder has easy access to enough funding to pursue a great idea.

Bringing Equity Investment Online

Here’s how FundersClub works and what my source tells me is its big plan:

FundersClub lets potential investors browse a gallery of startups.

They include a set of data about their business and also list the amount of money they’re trying to raise through FundersClub. The platform lets potential investors process payments and execute the necessary legal documents online, and if the startup’s funding goal is met, the funds are transferred.

If the startup gets bought or goes public, the investors get paid just like an angel would. Several sites like Fundable allow “crowdfunding” of startups, but investors don’t get equity. Instead they’re told they’re giving donations or gifts. And this isn’t Kickstarter. You don’t get paid in products or rewards. You get real equity worth real money.

How FundersClub Gets Paid

Investors are only charged the small accounting, state entity, and filing fees FundersClub has to pay and nothing more. It doesn’t even take a commission on the payback if a startup exits. Still there are ways for the startup to make money, but they’re nontraditional. It’s also currently backed by Y Combinator, First Round Capital, and Start Fund.

Investors are only charged the small accounting, state entity, and filing fees FundersClub has to pay and nothing more. It doesn’t even take a commission on the payback if a startup exits. Still there are ways for the startup to make money, but they’re nontraditional. It’s also currently backed by Y Combinator, First Round Capital, and Start Fund.

Typically VCs have a “2-20” arrangement where they collect a 2% per year management fee and 20% of the profits. That means a ten-year $1 billion fund would charge its investors $200 million dollars even if it broke even. Considering most VC firms are currently underperforming the S&P 500 that seems like a rip off that’s worthy of disruption.

To contrast, I’m told FundersClub plans to charge investors for liquidity. If someone invests early, the company increases in value, and someone else wants to buy their share, FundersClub will charge them to transfer their stake.

It also has an even bolder scheme. It wants to work with giant private companies looking to give their long-time employees liquidity. FundersClub would buy stock off of employees and let outside investors buy rights to those shares. This could help companies delay their IPO by staying under the 500-shareholder limit, remove the need for auctions on SecondMarket or SharesPost, but get cash to veteran employees. FundersClub could charge these big private startups for the program.

Sidestepping But Not Excluding VC

FundersClub startups don’t have to pull in all their funding there, and probably won’t want to. They’re welcome to bring in traditional firms and angels who bring advice, expertise, and connections along with them. But the fact is there are still VCs and angels whose money is their only value-add, and FundersClub will give startups an alternative to letting them join the cap table.

Meanwhile, there’s a lot of value to having 100 or 1000 investors instead of 10. With a real stake in the company, an army of investors might serve as beta testers and evangelists, or bring in recruitment referrals. If FundersClub works right, startups will get these benefits but stay insulated from the noise of the crowd.

The biggest danger to FundersClub might be that those with vested interested in the status quo could lobby to have their whole model made illegal. For starters, they might try make sure the ban on general solicitation doesn’t get lifted when it’s examined by the SEC on August 22nd. If that restriction was removed, startups could advertise and freely encourage people to visit FundersClub and invest in them.

Those who might be disrupted by FundersClub could also try to get the SEC to place heavy rules on the JOBS Act that recently passed but is not yet in effect. If the JOBS Act goes through without a hitch, FundersClub could allow anyone with a grand to spare to invest, accredited or not. Otherwise, it may have to raise more money so it can establish itself as a mutual fund, which could allow it to drop the accreditation requirement.

If this all sounds like it could usher in a new era of investment, that indicates only that you are still sane. Yesterday it may have taken $20,000 or $250,000 to invest in a startup. Now it takes just $1,000 and a solid nest egg. What’s more, hedge funds, real estate investing, or lending could be the next financial systems upended by a startup like FundersClub.