Facebook yesterday saw a decline in share price on a report of falling user numbers in key markets like the U.S. and Europe, but in a sign of how it is firming up its business, Facebook is also making significantly more money and getting more sticky with its advertising, on the back of newer, more targeted ad formats like Sponsored Stores and mobile ads. The latest quarterly report from ad agency TBG Digital, out today, indicates that cost per thousand impressions (CPMs) on ads on the social network rose by 58 percent compared to the same period last year, with overall engagement also up by 11 percent, a reversal of the decline seen last quarter. And among Facebook’s newer units that target people more directly, Sponsored Stories saw 53 percent more engagement than standard ads, and mobile ads had four times the engagement of Twitter ads, says TBG.

Pointedly, TBG says that there is growing acceptance from brands and other advertisers of Facebook’s wider business model, blending more traditional digital advertising metrics with new metrics like social engagement to determine the value of paying to be on a platform like Facebook’s. “Our clients, upon our advice, are now willing to pay more for quality clicks and fans. Focus is shifting toward measurable engagement and the difference Social Media connections are making to their bottom line,” the analysts write.

The report (embedded in full below) takes into account 406 billion impressions, covering 190 countries and 276 clients, and as with past reports has been vetted by the Cambridge University Psychometrics Centre.

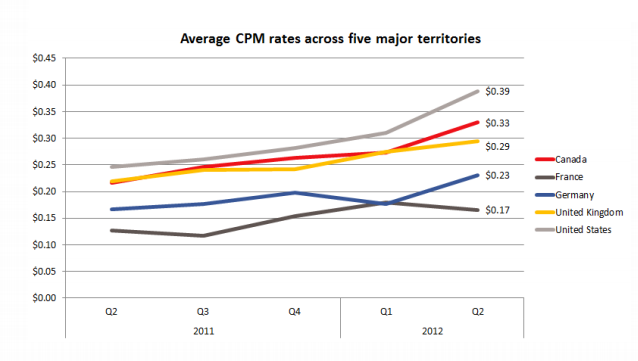

The 58 percent rise in CPMs looks to be part of a growing trend: Last quarter, the CPM was 41 percent compared to a year ago; the January report indicated that it was 23 percent up. Germany, it says, had the largest increase in CPMs, up by 31 percent, while the U.S. was second-highest at 25 percent. The UK saw only a 7 percent rise.

What’s behind the rise? TBG puts it down to increasing use of Sponsored Stories and mobile ads, both of which have higher CPMs than basic display ads.

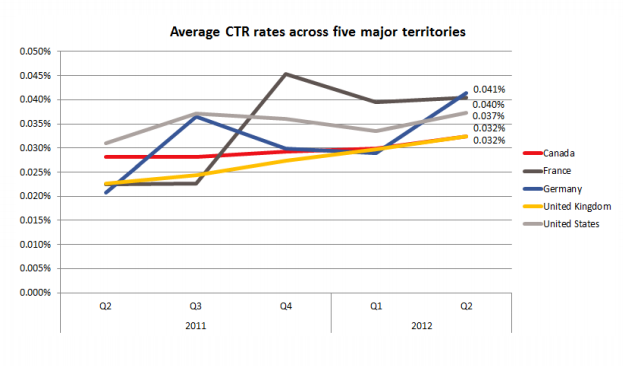

Meanwhile, it looks like the introduction of those newer formats is also having a knock-on effect in ad engagement. This was up by 11 percent compared to a decline of six percent last quarter. The more important thing to watch here, perhaps, is how this continues to evolve: will users be as interested in these formats as they get more and more accustomed to them, or will they learn to skim over them as much as they have with regular display ads?

For now, having more sophisticated targeting techniques (and probably better designed ads), seems to be working some magic.

In addition to having higher CPMs, mobile ads, which were only introduced in June 2012, for now seem to also be impacting overall click-through rates, too. These were up by 31 percent compared to a year ago. Additionally, social impressions — where ads include some context about who else likes it, are also up by seven percent. “It would appear that Facebook is doing something right here,” TBG writes. “Social context continues to make a different to ad engagement and mobile targeting is positively affecting CTRs.” As you can see below, CTRs were up in all major territories.

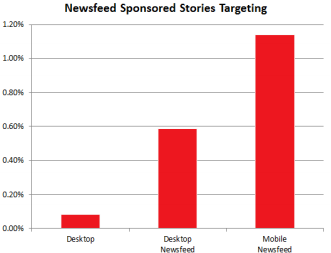

Breaking out the different categories of ad formats further, TBG notes that “desktop” ads — those that appear in the right column of the Facebook page, and news feed ads are performing significantly worse than mobile ads. Desktop had CTRs of 0.083 percent; with desktop news feed ads with CTRs of 0.588 percent. In contrast, mobile ads, which appear in a users’ news feed, were at 1.140 percent. TBG also took the step of comparing this to Twitter ad engagement, which it charted in a separate, recent study. In 24 million Twitter impressions the average CTR on its ads (across mobile and desktop) was 0.266 percent — four times lower than mobile ads on Facebook.

It should be noted, though, that so far Twitter doesn’t appear to have made much use of targeting those ads to specific users: I am just as likely to see an ad about a cruise as I am a new tablet right now, regardless of what I’m doing or who I follow on the site.

The fact that the targeted ad formats are doing so well is a sign that we will probably continue to see more developments on that front on Facebook, as it continues parallel tracks in areas like e-commerce to continue to grow its revenues.

Facebook is due to report its earnings on July 26 so it will be worth watching how these increases play out in that context. But if Facebook can continue commanding higher ad prices, it could generate huge profits even if it runs out of users to sign up.