The retail world of consumer electronics is a tough game, with a lot of the traditional bricks-and-mortar trade continually pushing online to compete against the likes of Amazon and eBay for consumers that prefer to get a wider selection for cheaper prices to seeing the products in action before purchasing. A startup called YBUY is trying to turn that ecommerce model on its head, by offering a kind of extended lease service to online buyers, giving them the chance to try out gadgets at home before closing the deal. With daily new sign-ups registering around 2,000 at the moment, today YBUY is announcing it’s picked up $1 million in Series A funding from Google Chairman Eric Schmidt’s investment firm Tomorrow Ventures.

YBUY says that the money will be used mainly to help it continue growing its business, which has had a strong response since launching at the end of 2011. Currently it has a waiting list of nearly 50,000 people to use the service — so most immediately it is gradually opening up the service to them.

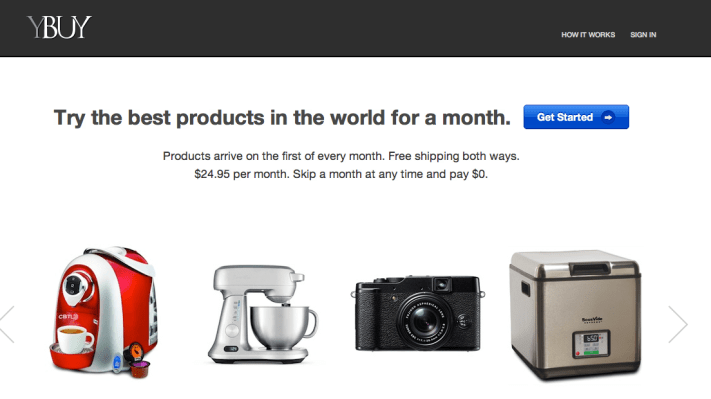

The concept behind YBUY is fairly straightforward: for a flat fee of $24.95 per month, it offers a selection of consumer electronics and kitchen gadgets — both new and refurbished — giving users the option of getting them for 30-day testing periods before actually agreeing to buy them. YBUY pays for all the postage and packaging to send you the product and get it back if you don’t want to keep it.

Stephen Svajian, the founder and CEO, tells me that the product selection is pretty varied: it ranges from iPad tablets to Jawbone and Breville kitchen products. But it also features products from Kickstarter campaigns. The idea is curating and aggregating the best and becoming an alternative to, say, a Google product search. “We only represent what we think is the best product in a particular category,” he tells me. “We do a lot of the work [looking for them] the online shopper would typically do.”

YBUY is not yet disclosing its total number of customers or tunrover but says that it’s been growing 25 percent month-on-month, and as an example created 2,000 accounts yesterday. Svajian says that in customer interviews, the main reasons for going for YBUY over something like Amazon are multiple. For one, there is the issue of financial commitment. Even if sites today have good return policies, “They don’t like to see the $600 leave their bank account on something they’re not sure about.” Then there is the issue of returns: these can be a hassle, but YBUY encloses return packaging with each product. The third reason is a bit of a surprise: “They feel bad,” he says. Apparently there is a kind of stigma or guilt around returning products that keeps people from doing it, whereas here it’s built into the business model, almost being encouraged. There is also the issue of trust: online there is a bit of a worry that people will never get all their money back in return situation.

Although YBUY bills monthly, Svajian says he doesn’t put itself into the category of “subscription e-commerce.” That’s because they are getting ready to introduce another model as well:

“We felt it would be useful to have a subscription early on to drive engagement and to be able to run experiments to track against different months,” he says. But in the next few months, the company will be rolling out a different option for customers. “They’ll be able to choose whether to bill monthly or just get billed when they receive a product. We’re big believers in one, single experience for customers and our customer interviews have told us they want this model, but we’d like to see the data before we commit to just one option.”

If there is a comparison between YBUY and another business, it might be Costco, where YBUY appeals to the discover/demand driver, and Costco to discounts. “We’re both a membership club with a disruptive distribution channel that delivers long-term value to customers,” he notes, but adds: “It’s strange thinking about us like Costco, because we just give you cool stuff and Costco gives you cheap stuff, but I think our manner of disruption will be similar and we’re focused on the long-term.”

What’s perhaps most compelling is that as the service continues to grow, it’s actually making better and better margins on the service. In December, he says, they were losing $50 per customer. Now they are making around $35 per customer, with the value per customer at $450, with the profitability per customer ranging between 25% and 50%.

In terms of partnerships, YBUY currently has no plans to do any white-label agreements with brands to offer this kind of leasing service on their behalf, or for any other e-commerce sites that want to introduce this kind of service into the purchasing mix. And Svajian says that he is reluctant to make direct deals with manufacturers full stop, even for promoting on their own site: “We’ve done a deal with a manufacturer and we’re reluctant to do that again. We think its more important to have integrity around the process. If we are paid by the manufacturers to slot their products, then that detracts from our value prop to customers – to get them the best stuff. We need to be rabid about the value we deliver to customers and we don’t want anything to get in the way of that.”

The whole try-before-you-buy space is pretty nascent at this stage but we are seeing others moving here, too. Warby Parker is doing it with eyewear; and Trunk Club’s applying it to fashion, among others. On that trend, Svajian is adamant that it’s not just a fad but something that speaks to what customers are actually needing today: “This isn’t disruption for disruption’s sake. Rather, it’s important to note that this disruption is being driven by the customer. Customers want to try before they buy. The consumer will drive the push into this model.” For now that will keep YBUY in the U.S. with international growth somewhere down the line.

Svajian is a lawyer by training but has been a serial entrepreneur, with YBUY being his fourth company. Jim Patterson, the Yammer chief product officer, has been a partner in two of them — in addition to being an angel investor in YBUY. One of them, AudioCaseFiles, targeting the legal market, sold for a 10x return for its investors when it was sold to Courtroom Connect.

Other angel investors, in addition to Patterson, in this Series A round include David Hanna, Chairman and CEO of CompuCredit Corporation.