Bloomspot, a local offers company launched back in 2010, is pulling back the proverbial kimono on its numbers in an effort to prove its business model works. Although sometimes lumped in with group deal providers like Groupon or Living Social, Bloomspot operates quite differently. Instead of group deals targeted at the masses, it offers exclusive deals targeted specifically at a merchant’s best customers.

Through Bloomspot’s rewards program, customers provide the company with permission to analyze their credit card data at places where the offer is being run, allowing the deal provider to track whether or not it was redeemed, and how much else the customer may have spent there. The traditional thinking is that deals and discounts are meant to be “loss leaders” for businesses – get customers in the door, then upsell them. However, the Groupon (et al.) backlash has merchants claiming that these types of deals are simply “losses,” not loss leaders. People come in for the bargain, but don’t buy more or become loyal customers after the transaction takes place. This forces the merchant to again advertise again with Groupon to get their next “hit” – another influx of customers a Groupon deal brings.

Bloomspot says that’s not the case with its customers, however, and wants to prove it.

The startup has been consistently forthcoming with its internal data, and has raised over $46 million in venture funding from investors who believe, too, including InterWest Partners, Columbia Capital, Menlo Ventures,True Ventures, QED Investors, Harrison Metal, Western Technology Investment and individuals such as Erik Blachford (former CEO of Expedia) and Gary Parsons (former Chairman of Sirius XM Radio).

72% Of Customers Repeat, $140 Average Overspend

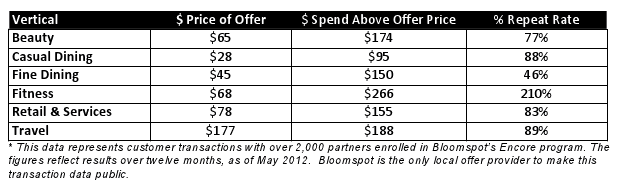

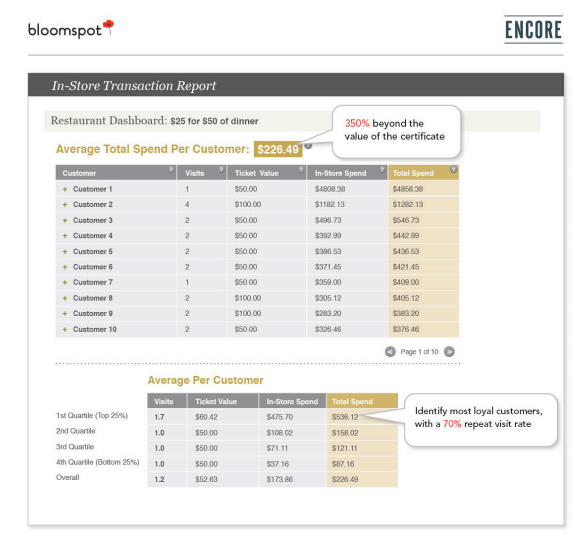

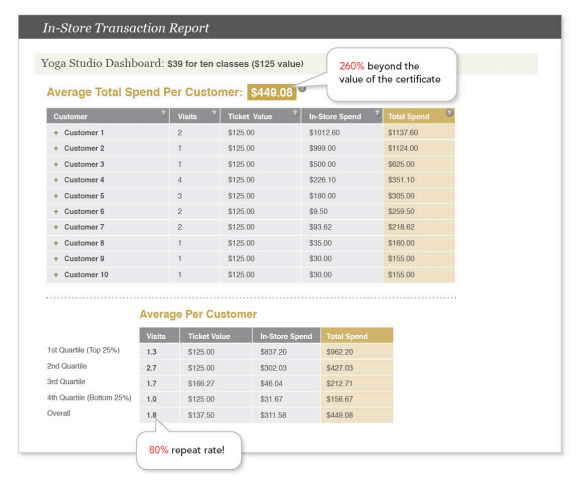

Using its anonymized data, the company now says that 72% of its customers who purchase offers from its partners become repeat customers of that business and spend an average of nearly $140 above the price of the offer they purchase. Across several verticals, this is the case (see charts below). For example, in fine dining, customers spend more than 3x the original price of the certificate. In beauty and spa, they spend on average $174 above the offer.

The data was sourced through Bloomspot Encore (Bloomspot’s opt-in rewards program which tracks credit card data), and it reflects actual consumer interactions from approximately 150,000 members and approximately 2,000 merchants in Bloomspot’s core markets. The company delved into average repeat rates, overspend, averages by vertical and anonymized data by merchant.

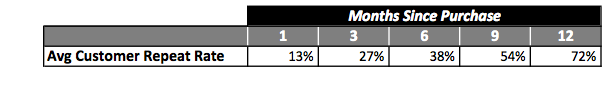

In its analysis of repeat customers, Bloomspot tracked visits over 1, 3, 6, 9 and 12 months. Over the 12-month period, it found that 72% of customers returned local merchants on average, as you can see below. But even after one month, 13% customers had returned.

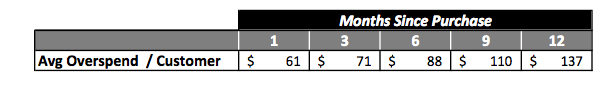

The company also found that the average overspend per customer is approximately $140 over the year, and that customers spend above the price of the certificate by on average $60 in the first month.

As noted above, in the Restaurant, Spa and Salon categories, overspend tracks even higher. Below, some specific examples highlighting a fine dining merchant, a yoga studio, and retail outlet. Granted these are likely cherry-picked top examples, but they’re worth a review nonetheless as proof that some merchants have managed to make the local offers model work for them.

The bigger takeaway from Bloomspot’s data is there’s room for a different approach in the customer loyalty space than the group-buying one employed by Groupon and others. Targeting a narrower niche of those likely to frequent a particular business then incentivizing them with an offer to do so is another angle loyalty programs can take. It’s the quality over quantity argument. And at the end of the day, Bloomspot and Groupon may both be operating in the “offers” space, but they’re approaching two very different market segments. That’s not to say that a merchant has to choose one or the other model exclusively, however.

Bloomspot CMO Lily Shen, points out that it’s the only company offering this level of insight. “We’re really offering and delivering loyal patrons,” she says. “Other companies sell merchants on large subscriber numbers and sell consumers on discount prices,” but that doesn’t really benefit the merchant in the long run.”

Repeat Merchants?

We asked, then, how many of Bloomspot’s merchants are repeat “customers” themselves per se, given that loyalty like this would likely be rewarded. Shen said that number wasn’t readily available, but noted a few companies that have worked with the company multiple times, including The Ritz-Carlton Destination Club, Jardiniere (S.F.), and Nobu (L.A.). She says this speaks to the types of businesses and clientele that Bloomspot is able to attract.

Why reveal these numbers now, though? Well, local deals is a tough market, and Bloomspot has not been immune to the crunch. Reports of layoffs trickled in last winter, with some serious cuts reported here (and through anon tipsters emailing us angry about the unforseen cuts).

Bloomspot is available in New York City, San Francisco, Los Angeles, Chicago, Washington DC, Boston, Houston, Seattle, Denver, and San Diego. While the company doesn’t have any immediate plans to extend beyond these markets right now, it does have a new program in the works called the Encore Network. Similar to edo or Cartera, the network would offer card-linked rewards, not specific deals you would have to buy. The program is being piloted in select markets now with a wider rollout planned for later this year.