AOL fended off activist shareholder Starboard Value today, as all of the company’s existing directors were re-elected to the board. All eight of them — Tim Armstrong, Richard Dalzell, Karen Dykstra, Alberto Ibargüen, Susan Lyne, Patricia Mitchell, Fredric Reynolds and James Stengel — are staying according to a preliminary vote count, while the three candidates Starboard suggested were not elected.

It’s a short-term victory for Armstrong, although he still faces the very formidable task of making AOL a sustainable business that can withstand the decline of subscription dial-up revenue. Shares fell 5.7 percent today to $25.55, giving the company a market capitalization of $2.4 billion.

We caught up with Armstrong after the call. “We have one of the most public company strategies in the world,” he said. “Investors knew what they were investing in. They saw us buying back a lot of shares, the patent transaction and the operational results.” AOL sold 800 patents to Microsoft for $1.1 billion in April.

How much time does this buy him? “You know better than I do that in the Internet space, every second is a day,” he said. “We’re on a fast mission to be a growth company again.”

AOL’s dial-up revenue declined at a rate of 15 percent year-over-year to $182 million in the first quarter. Meanwhile, display advertising revenue — which is what the company is betting on — grew just 5 percent year-over-year to $330.1 million.

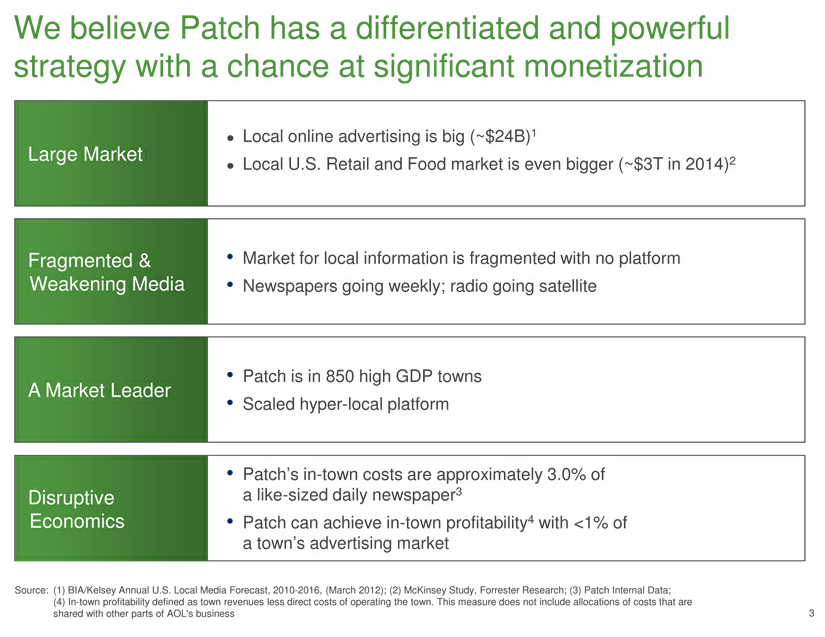

The timeframe for AOL’s controversial local media effort, Patch.com, remains the same. They’re looking at profitability by the end of 2013. AOL filed a fairly long slide deck defending the unit last week (excerpted below). Groupon, Google, Yelp and others are all gunning for the same local business advertising market with varying success.

As for the premium brands like The Huffington Post, Armstrong says he’s going to continue investing in them. He’s not planning any bigger acquisitions in the near-term. “We don’t have any plans for any major acquisitions. As for the acquisitions that we’ve done over the last two years, we’re very interested in growing those and putting resources into them.”

“We went from the worst merger in history to where we are today,” he said. “We have a lot of long-term thinkers behind us and we’re going to maniacally execute for those shareholders.”