Editor’s note: Bill Ready is CEO of Braintree, an online and mobile payments provider.

Every day there is a new headline about mobile payments focused on using a mobile phone to pay at retail locations. Paypal, Google and other industry giants are racing to provide new in-store mobile payment solutions. Large merchants, such as Wal-mart and Target have contemplated their own mobile payment solutions. The debate about whether NFC will be the preferred technology to enable mobile payments rages. However, despite all this press and efforts by industry giants, there is stunningly little traction to use a mobile device to pay at retail locations. This is largely because the solutions offered by industry giants thus far don’t solve a meaningful problem in the daily lives of consumers or merchants. Few things in life are easier for consumers than swiping a credit card at checkout and in-store payment systems are as easy and ubiquitous as dial-tone for merchants.

However, There is a massive mobile commerce opportunity that is a severe pain point for both consumers and merchants, but large industry players are failing to meaningfully address it. That opportunity is e-commerce on the mobile device or m-commerce. M-commerce is ramping up, proving that consumers not only like to shop via their mobile device, but also will purchase. However, the numbers also show that there’s significant room for improvement in the mobile device purchasing experience – mainly through optimizing the shopping and payment processes for consumers.

Online holiday shopping in 2011 showed substantial growth in mobile shopping activity, with both traffic and sales on mobile devices more than doubling their volume over the same period a year earlier, according to research from IBM. During the holiday shopping season, 14.6 percent of all online sessions on a retailer’s site were initiated from a mobile device (up from 5.6 percent the year before), and sales from mobile devices reached 11 percent versus 5.5 percent in December 2010. Clearly, more consumers are becoming comfortable shopping and buying from retailer web sites using their smartphones.

But this volume of mobile shopping is far below the potential. Total time online via mobile device already exceeds the amount of time spent online via traditional desktops and laptops according to data from Flurry. That’s largely because the web browsing capabilities of mobile devices and mobile apps have improved dramatically over the last few years. If consumers spend more time browsing the web on their mobile devices than traditional devices, they’ll ultimately end up shopping and purchasing more on those mobile devices as well. The mobile buying experience just needs to catch-up to where users are already. The opportunity now exists in making the mobile shopping experience as easy as possible for the consumer. This would increase sales and decrease the number of times a consumer gets frustrated with purchasing experiences that haven’t been optimized for mobile and likely abandons the purchase.

Here are four immediately actionable items that e-commerce companies and payment providers can take today to improve mobile purchasing and capture the m-commerce opportunity:

1. One-click checkout: As exemplified by Amazon, nothing beats the one-click checkout experience for online shoppers. The more steps we put between the consumer and the final transaction, the more we risk them dropping off (which, many times means the consumer never returns). This opportunity is amplified on the mobile device where it is significantly more cumbersome to enter your credit card data. E-commerce providers should be using a card vault solution that enables one-click checkout for both online and mobile transactions.

2. Mobile security: Security is an issue whether you’re shopping online using a laptop computer or a mobile phone. However, consumers are more likely to lose a mobile phone than a laptop or desktop and they are less likely to have password protected the phone than the laptop or desktop. Consumers need to know that if they lose their phone or it gets stolen, their credit card information is secure. Taking steps like encrypting credit card data directly on the device as soon as the user enters it or implementing a one-click checkout so that the user never has to enter credit card data on the device help to ensure that if a mobile device is lost or stolen, a fraudster can’t gain access to their credit card data.

3. Speed of transaction: Speed really does matter, particularly in the limited bandwidth environment of the mobile device. If a retailer’s process is not optimized for mobile, they are likely losing sales to a slow and painful experience consumers just don’t have patience for today. Through benchmarking, we have found that just the payment process alone with many payment providers requires multiple round-trips between the mobile device and the payment provider’s servers, some as many as sixteen, just to complete the payment transaction. Look for a payment process that makes a single, efficient round-trip to the server to complete the purchase. Otherwise, the consumer will likely be waiting a very long time for the transaction to complete or may even abandon after clicking purchase.

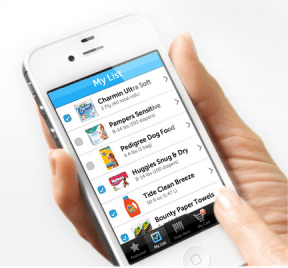

4. Websites that are fully optimized for the mobile shopping experience: If a consumer has to pan around, pinch and expand things in order to make a purchase, they’re likely not going to do it. Without a site and shopping experience that’s fully optimized for mobile, retailers risk losing the consumers who are shopping on their phones. When a user encounters a site that isn’t mobile optimized, they are increasingly likely to go to other sites that have optimized for mobile since there are a rapidly growing number of sites that are catering to the mobile experience. A good mobile shopping experience is one that is fully optimized for the smaller screen, takes advantage of touch screen technology and also offers a fast checkout in as few steps as possible.

But won’t mobile shopping cannibalize online shopping?

I’ve heard merchants say that optimizing mobile hasn’t been a priority for them in the past because they assume the consumer would just switch devices and fire up the laptop or desktop computer to complete their purchase. While this seems like a perfectly logical assumption, the evidence out there now doesn’t back it up. Mobile browsing didn’t surpass online browsing by cannibalizing online browsing. Traditional online browsing is still growing, but mobile browsing eclipsed traditional browsing through the addition of significant additional browsing time by the user in spare moments away from their computers (we’ve all seen people walking down the street or in the store looking at their mobile device). Therefore, mobile presents added opportunity to make purchases. If you compared this to offline shopping, the mobile device presents an opportunity equivalent to having your storefront on every street corner that a user walks by, given the always-on, always-available nature of mobile browsing.

Chasing the real opportunity

So far, the mobile payments debate has revolved around solving a problem that doesn’t really exist. There are few things in the life of a consumer easier than swiping a card at checkout. There are a number of reasons we’re not seeing major pickup in “use your phone as a credit card” technology, but one of the most significant is that we’re forcing change where it’s not yet needed.

Mobile shopping or m-commerce on the other hand is real and growing rapidly. In a 2011 survey by Pew Research, 25 percent of smartphone users in the U.S. said they do most of their online browsing on their phone. The real opportunity is in converting those browsers – who are growing by the day – into purchasers.