Tiny sidebar and news feed ads aren’t going to cut it. If Facebook wants to live up to a $104 billion valuation it will need bold new revenue streams. An offsite ad network, big glossy news feed ads, and payments for physical goods are a few ways it could boost its average revenue per user far beyond the puny $4.34 a year it earns today.

Facebook has a tough decision to make now that’s going public. It will have to strike a new balance between the good of its users, advertisers, app developers, and investors. If it refuses to explore new business models, its share price could sink. But if it strays too far in favor of making money, Facebook could lose its addictiveness and the faith of its users. Here’s the four aces Mark Zuckerberg could have up his sleeve.

The AdSense Killer

Most ads suck because most advertisers don’t know much about who you are. But Facebook does. What if any website could use everything Facebook knows about you to show you ads you’d want to click? Well, those sites would pay Facebook a lot of money. They also might use Facebook to replace Google AdSense, the current leader amongst ad networks, which analyzes a site and automatically displays relevant ads.

Facebook’s ad network essentially turn ad real estate on any website into places to serve the campaigns that advertisers buy for display on Facebook.com. Anyone currently logged into Facebook who visits one of these sites would be shown ads targeted by their Facebook information, such as age, gender, location, work and education history, interests, app usage, and friends. Facebook and the site hosting an ad would then split the money made on clicks or impressions.

Facebook has denied this product is in the works whenever it’s been asked, but last week it revised its privacy policy to expand its ability to serve ads to its user while they’re outside of Facebook.com. There’d be little reason to do this if something wasn’t in the works. The march across the web of its other social plugins such as the Like button have also paved the way for an ad network plugin. It might need to develop or acquire a company with expertise in analyzing site content so it could serve somewhat relevant ads to site visitors who aren’t logged in to Facebook.

The biggest obstacle, and likely the reason Facebook hasn’t already launched an offsite ad network, is that the world might not be ready. People are already skittish about Facebook using all their personal data to target them with ads when they’re on its site. Even though Facebook wouldn’t technically be “tracking” user web browsing history to power ad targeting, seeing offsite ads targeted from their onsite data might cause some people to have an all-out privacy meltdown. But if it worked, the ad network could double or triple Facebook’s ad revenue.

PayBook

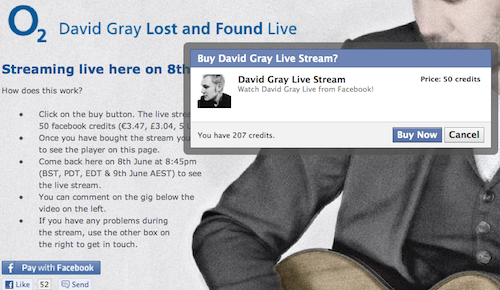

Facebook has its own virtual currency called Credits that’s typically used to let gamers make in-game purchases like powerups, clothing for their characters, and of course, cows for their farms. Users buy the Credits for $0.10 each, and when they spend them Facebook gives 70% to the game’s developer and keeps the other 30%. These in-game payments are a healthy business for Facebook, and they’ve made game developers like Zynga rich because creating and selling virtual goods is cheap.

The problem is that the 30% tax is too high to for people to sell physical goods for Credits. And while Apple also charges 30% to sell music, games, and in-app purchases through iTunes and its App Store, it has a tight grip on the digital media market. Facebook allows media sales with Credits, but only a few developers and content producers are experimenting with it as the tax is prohibitive.

But if Facebook wanted to get serious about making money on payments, it could reduce its 30% tax for digital media and physical goods. In fact, its S-1 filing to IPO noted that “In the future, if we extend Payments outside of games, the percentage fee we receive from developers may vary.” That could turn Facebook into a competitor to Amazon for the huge market of physical goods, and pit it against Apple, Google, and Amazon for selling music, films, and more.

The real power of Facebook Payments comes in its tie in with Facebook Connect. Together they could one day let you make a purchase and fill in your shipping info anywhere on the web with just a click or two. Before privacy fear-mongers in the media and congress made Facebook retreat, the social network briefly allowed apps to ask for your home address, aka your shipping address. Eventually Facebook will bring this back. Then this frictionless purchase system could increase conversion rates for ecommerce stores enough that they’d gladly implement Facebook Payments and Connet…

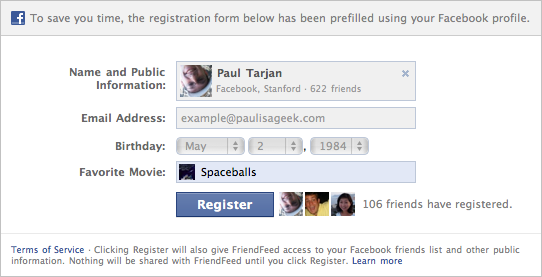

Charging For Apps For Your Identity

There were over 550,000 apps and integrated websites on the Facebook platform as of a few years ago. Many rely on Facebook’s identity system to replace or provide an easier alternative to signing up for an app-specific account complete with another password to remember and profile to fill out. This service saves app developers from having to build their own identity system, and primes users for social sharing that can drive crucial referral traffic to apps.

Could Facebook convince some of the developers to pay either a subscription or per-user fee? Yes, but the price would have to be steep to make it a serious revenue stream. If it got 300,000 apps paying $100 a month each it’d still only be make $360 million a year. $100 a month could be a bargain for popular apps, but it might discourage smaller developers from signing on. Meanwhile a per user fee would disincentivize growth, and force apps that suddenly get popular to abandon Facebook’s identity platform.

Charging for identity has potential, but it could also backfire and send developers fleeing to Twitter and Google’s free identity systems. That’s a huge problem because Facebook relies on third-party apps to contribute content to its news feed which Facebook monetizes with ads. So instead I think Facebook’s best bet to boost revenue in the short-term is…

Big, Glossy News Feed Ads

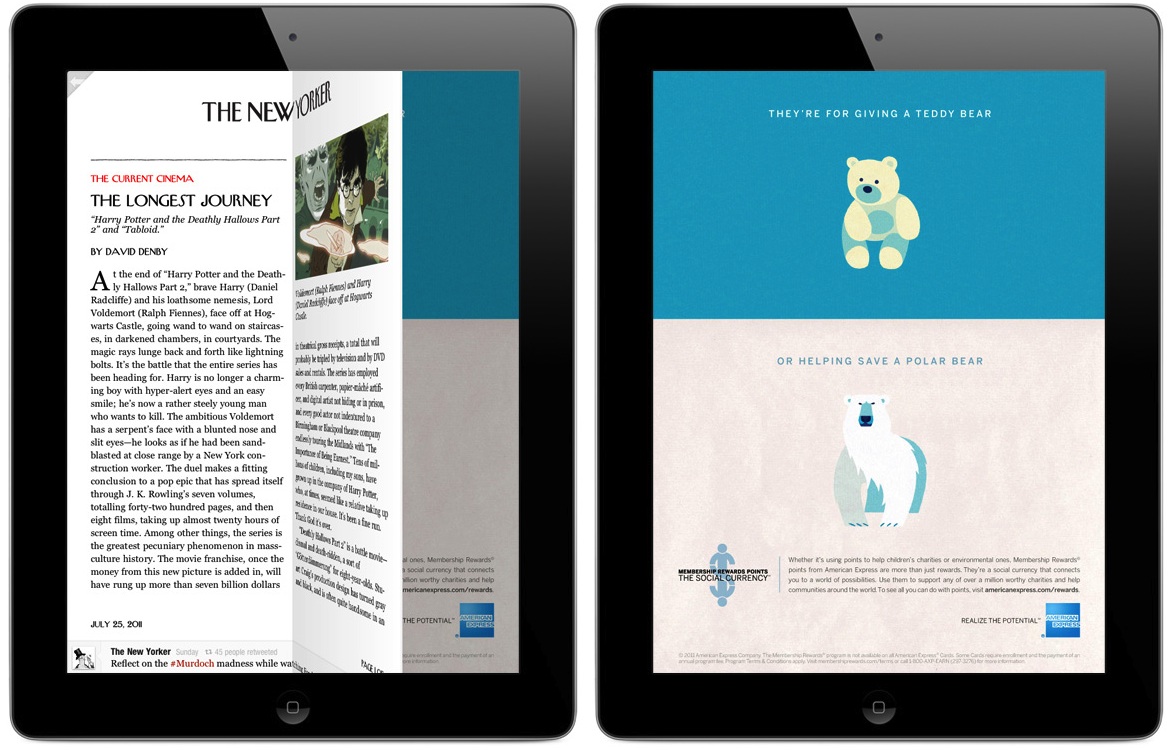

Advertisers don’t want to have their message crammed into the little sidebar ad boxes. And while they’re happy to have their ads made social as Sponsored Stories and injected into the news feed everyone reads, they also want less subtle marketing options. Facebook is trying to be flexible with the launch of Reach Generator and the big logout page ad unit, but advertisers want a louder marketing channel within the core Facebook experience. But beyond advertisers and investors looking to make a quick buck, nobody wants to see more ads on Facebook.

So the trick is for Facebook to make ads seem like content instead. Content we actually want to consume. Tiny boxes don’t do that, but large, high-impact full screen or near-full screen ads could. Flipboard and some other mobile apps have been experimenting with these big, glossy ad formats in their mobile apps.

Imagine scrolling down your news feed on the web or mobile and when you got to where there’d be a “More” button or fold (if Facebook didn’t have infinite scrolling), you’d see a large or full-screen ad. You could scroll right over it, or Facebook could make it snap into place for a second before you were free to move on.

These ads could be clicked to open an advertiser’s presence on Facebook such as their Page or App, or to open the buyer’s website. Facebook could even require the ads to be social, essentially creating a glossy Sponsored Story format that could only reach you if you Liked the advertiser’s Page or your friends had interacted with or Liked the brand.

As Facebook’s user base is quickly shifting to mobile where it only shows a few Sponsored Stories ads a day rather than multiple ads per page on the web, glossy ads could let Facebook make more money on mobile without having to show ads too frequently. Users might complain at first, and it could make people slightly less likely to visit the news feed. Still, Facebook could watch the data and manage rate limits to show these glossy ads only occasionally, and less often to users who immediately leave the site or app when they see them.

The fact is that Facebook is responsible to its outside shareholders, even if they don’t have enough voting rights to forcibly change the company’s course. If investors are smart, they won’t grumble if Facebook doesn’t immediately flood the site and the rest of the web with ads, payments, and subscription fees. Facebook got us all to connect. Now its biggest challenge is to remain cool while making more money. If Facebook expands its revenue streams slow and steady, it will have an ocean of users to draw from for years to come.

—

More Big Facebook News

Facebook Will Have The Biggest Tech IPO Ever, Raising $16 Billion With $38 Share Price

Here’s What Could Kill Facebook

Zuckerberg Will Ring In Facebook IPO From Menlo Park HQ On Friday