Editor’s note: Joe Kraus is a partner at Google Ventures, focusing on mobile, gaming, and local services. In 1993, he co-founded Excite.com, an early Internet search engine. He also co-founded JotSpot in 2004, a wiki company acquired by Google in 2006. Follow him on his blog, JoeKraus.com, and on Twitter: @jkraus.

One of the things I wish I had done in both of my companies (Excite.com and JotSpot) was to take a piece of advice that I now give most entrepreneurs I meet. That advice is: “Right after you sign your term sheet for your Series A, write the fantasy deck for your Series B (complete with whatever metrics, graphs and customer lists you would love to have).”

I say this because of the way I’ve both done fundraising and seen it done. Whether we like to admit it or not, the way it’s usually done tends to be very haphazard and bottom’s up. It starts with…

“We have about 4 months of cash left, it’s time to raise money”.

With that statement, companies go about trying to weave together a narrative from the various facts that are true at the time. You look at your metrics, your sales, your customer lists and you try to create something cohesive. The problem is that it’s a bottoms up story; it’s composed of whatever facts are lying around. You didn’t set out twelve months before to create an intentional story. Your pitch deck ends up feeling a bit underpowered, a bit awkward. You try to emphasize the facts that look good and gloss over the ones that aren’t so hot.

At the heart of the problem is that startups often get trapped being busy and making general “progress” instead of driving, intentionally, down a path toward a fundable story.

A better approach is to use all the feedback you’re getting during your current fundraising process to create the ideal story for your next round. In the process of raising money (be it seed, series A or B), you hear from potential investors what they’re excited about and what they’re worried about. At the end of the process, you’re in a perfect position to create the fundraising pitch that would be absolute music to any investor’s ears.

So, do it. Write your Series B deck immediately after signing the term sheet for your Series A.

THEN, use this as your plan for how you spend that round of money. Use that presentation as the goal posts for the next 18 months. Begin with that end in mind and that presentation becomes your operating plan. Even if you don’t hit all of it, you will have a story and a company that holds together so much better than if you just run as fast as you can and try to create a story from the random assortment of facts that are lying around when you’re coming close to running out of money.

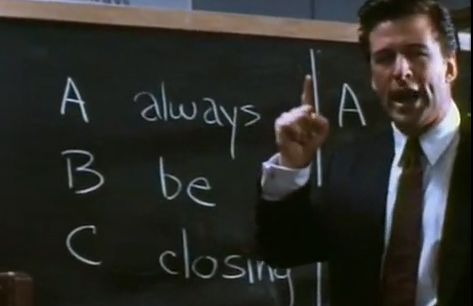

[image via the New Line Cinema film Glengarry Glen Ross]