Here in these parts, we may write a tad too much about our Silicon Valley gaming brethren like San Francisco’s Zynga and Redwood Shores’ Electronic Arts.

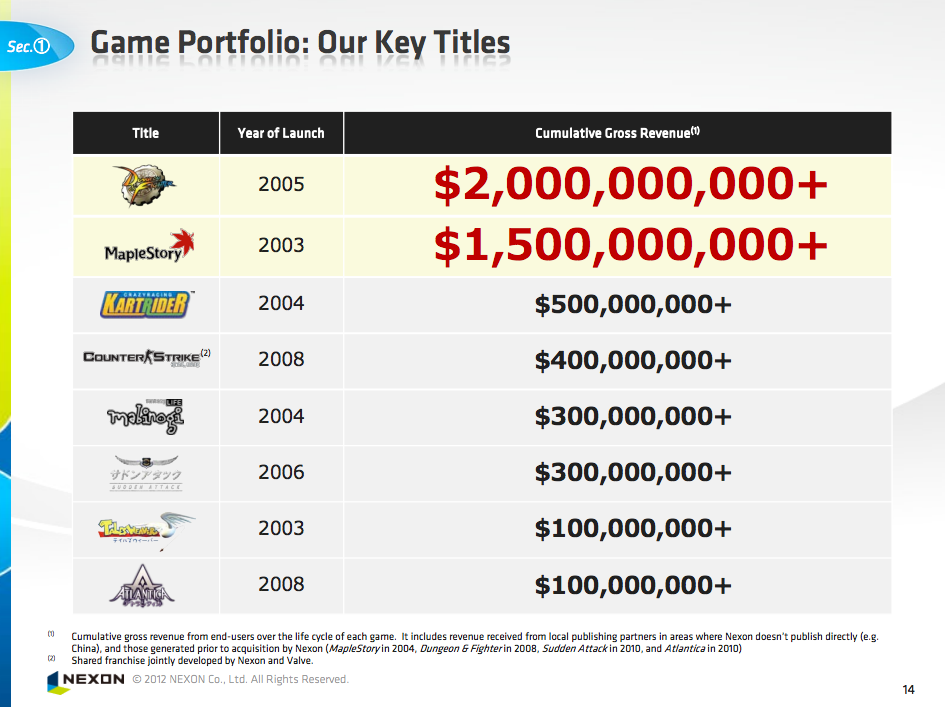

But there’s actually a company that’s worth quite a bit more and has outperformed both since its IPO last December. It’s Nexon, a free-to-play gaming company that started out in South Korea and quietly grew a handful of titles into multi-billion dollar franchises over the last decade (see the chart below). The Tokyo-based company went public the same week Zynga did in December. Its shares have climbed 15 percent while Zynga’s have fallen more than 20 percent since their debuts. Now Nexon’s worth $7.9 billion while Zynga has a $5.5 billion market cap.

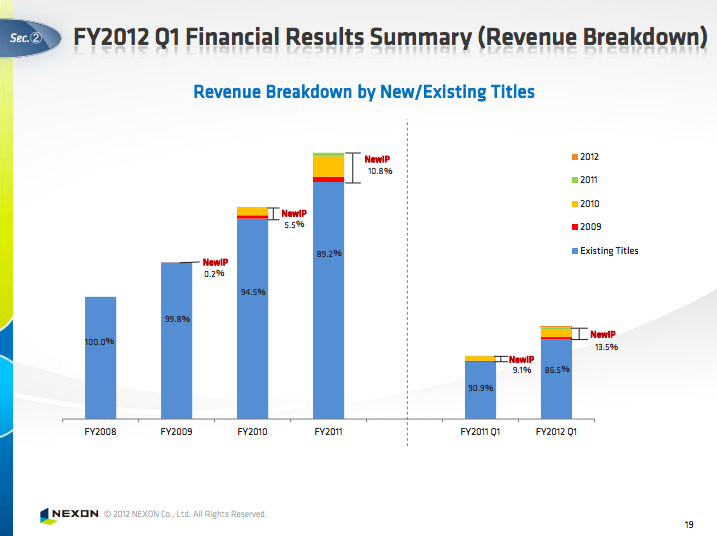

We caught up with Nexon’s chief financial officer Owen Mahoney just as the company came off its first earnings call yesterday. The company grew revenue by 46 percent year-over-year to $379.9 million (or 30.4 billion yen) with $154.8 million in net income. (Yeah, freemium gaming companies in Asia have ridiculous profit margins.)

Nexon takes a long and slow approach to building games. Many of its most lucrative hits are five to 10 years old and just keep chugging along, thanks to continuing servicing and content updates. Dungeon Fighter, for example, has done more than $2 billion in revenue since it launched in 2005. Nexon also has a direct relationship with most of its customers and doesn’t have to go through any platform (like, cough, Facebook) where it has to give up a 30 percent revenue share.

As for this last quarter, the real standout was China, Nexon’s biggest market by revenue. Revenues there almost doubled from last year to $190 million in the quarter (or 15.2 billion yen). It helps that there was Chinese New Year, which gives the same seasonal bump that you’d see during the holidays in the U.S. and Europe.

“I’d like to say it was because of a major strategic move or because we did something radically different, but it was just really solid execution by the teams responsible for building the games,” Mahoney said. “It was doing content updates that the market took really well.”

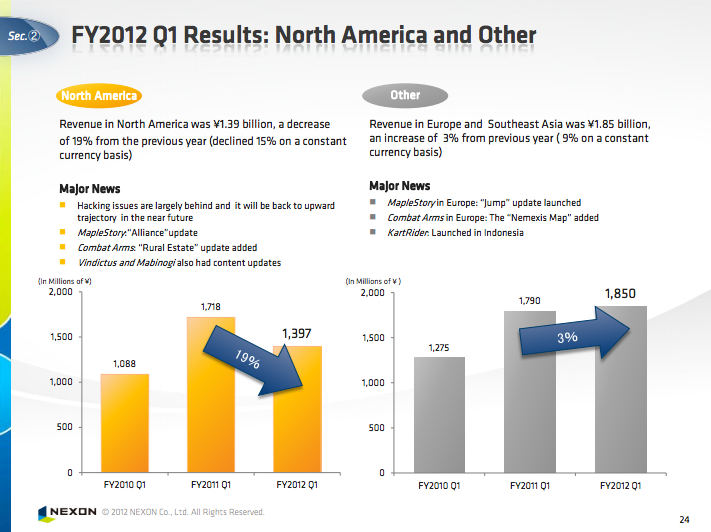

North America was down a little bit to $17.4 million (or 1.4 billion yen) because of a hacking attack during Christmas that the company is still recovering from. “We feel like the situation is more stable than it was,” he said. He added that he expects Nexon expand a lot more here. Two other Tokyo-based gaming companies, GREE and DeNA, have made a big push on the West Coast through spending more than a half billion dollars on acquisitions of U.S. gaming startups like OpenFeint, Funzio and Ngmoco.

“North America and Europe are really emerging markets for online games,” he said. “Korea really shows the future that’s in store for the U.S.”

In Japan, Mahoney said Nexon is fairly immune to the regulatory crackdown that has sent GREE’s shares down by more than 30 percent over the past week. Earlier this week, the Japanese consumer affairs agency said that it was taking a closer look at a special kind of game mechanic that’s popular in many of GREE and DeNA’s titles. It’s called kompu gacha. It’s kind of like a random lottery where a user pays a little bit to pick up a random item. If they collect many special, rare items, they’ll get an even more valuable and rare item. Under pressure from the government, six of the big Japanese gaming companies this week said they’re abandoning the practice.

Mahoney said the tactic is more popular in mobile games, and not the kind that Nexon builds. “It’s going to have little to no effect on our business,” he said. Indeed, Nexon’s shares are basically flat from a week ago when the story broke.

As for the future, Mahoney said the company is really interested in building and publishing for the Android and iOS platforms. They are looking at acquisitions, but they’re not looking to buy the hot flavor of the moment or a gaming company that’s throwing off a lot of cash.

“We do not go and buy revenue. We are very focused on teams and intellectual property that we think we can grow over time, and that’s where we’re looking today.”