The UK housing market has been on shaky legs for a while now — with tight lending conditions, unemployment and general consumer confidence all playing their part in slowing things down — and that is having the inevitable knock-on to sites built up to serve that sector: today brings news that Zoopla, one of the UK’s bigger property sites, is buying up a smaller competitor / data supplier, UpMyStreet, and folding the latter company’s business into its own.

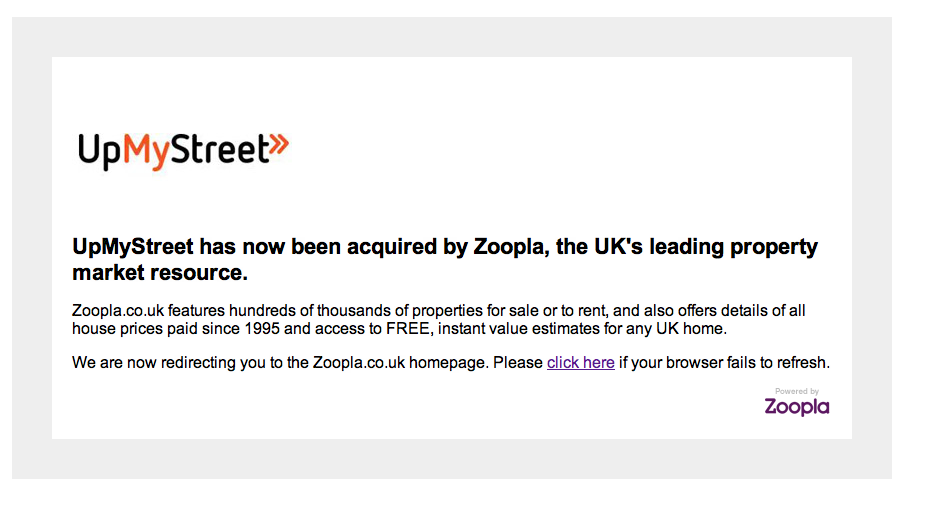

Financial terms of the deal were not disclosed, but it looks like the acquisition means curtains for the UpMyStreet brand, one of the oldest local-listings sites in the UK: if you visit that URL now you will see that the site now automatically redirects to Zoopla’s pages, with no sign of UpMyStreet branding to be seen.

There is a quick splash, however, that appears on some pages that announces the sale:

Prior to the sale, UpMyStreet had switched owners a few times. In 2003, it was bought by USwitch, a consumer price comparison site, when the company had run out of cash. USwitch then got bought by E.W. Scripps, and subsequently sold to the Forward Internet Group, leaving UpMyStreet behind at Scripps.

UpMyStreet had already been a strategic partner of Zoopla’s before the acquisition, providing supplementary information about property locations alongside Zoopla’s core real-estate listings service. “Zoopla has had a commercial relationship with UpMyStreet.com for some time and this acquisition is a natural fit for us and allows us to further extend our audience and reach for the benefit of our members,” said Alex Chesterman, founder and CEO of Zoopla, in a statement.

Providing extra data alongside real-estate prices is an important way for these sites to further set themselves apart from their competitors: it’s an approach that we’ve also seen in the U.S. with companies like Zillow pioneering all kinds of data analysis to make their basic house price service into something a little more special and unique.

GigaOm points to sources saying the acquisition could have been for less than £1 million ($1.6m).

This is not the only bit of consolidation underway for Zoopla, which has raised $10.7 million in funding from Atlas Venture, Octopus Ventures and Silicon Valley Bank.

In April, the company was finally given the go-ahead by the UK’s Office of Fair Trading to complete a proposed merger with A&N Media (DMGT)-owned Digital Property Group — a deal that was first announced in October 2011. The deal should complete any day now, the companies say, and create a property powerhouse to better compete against Rightmove, currently the market leader in the UK.

Founded in 1998, UpMyStreet was one of the first sites to pop up in the UK focused on giving users location-based information. Its earliest iteration worked very simply: you entered a neighborhood — or even better, a postcode — and a category of business, and you were given in return a list of relevant businesses, ordered in terms of distance. It was simple and often very helpful.

UpMyStreet may have been a first-mover but with sites like Google and Qype picking up the idea of local listings and running with it, UMS had to look at ways of offering more enhanced information — and monetizing it.

So, later, the company expanded to include lots of other information that made it, as a service, less about local information for residents of a certain area, and more about information for people considering moving to certain areas. That included housing prices, local school information and local crime statistics. It was around this time that it began partnering with sites like Zoopla to provide this information to supplement that company’s wider database of real-estate listings.

However, on its own site, UpMyStreet didn’t seem to be killing it with traffic: Nielsen reported in March that the site had 600,000 unique users in March — a drop in the bucket considering that competitor Qype says in a typical month it gets 25 million monthly visits in its footprint.