EveryMove, an alum of TechStars’ Seattle accelerator program building what they’ve dubbed a “mileage plan for health benefits, today announced that it has closed a $2.6 million round of Series A financing. Participating investors include Penera Blue Cross, Blue Cross, Blue Shield of Nebraska, BlueCross BlueShield Venture Partners, Founders Co-op, Summit Capital, Jonathan Sposato, Voyager Capital Partner Geoff Entress, Matt Shobe, William Lohse, BuddyTV Co-founder Andy Liu, Ken Kuntz, and others.

As the startup is currently in private beta, it will be using this infusion of capital to ramp up its team as it prepares to launch into the market more broadly in the third quarter.

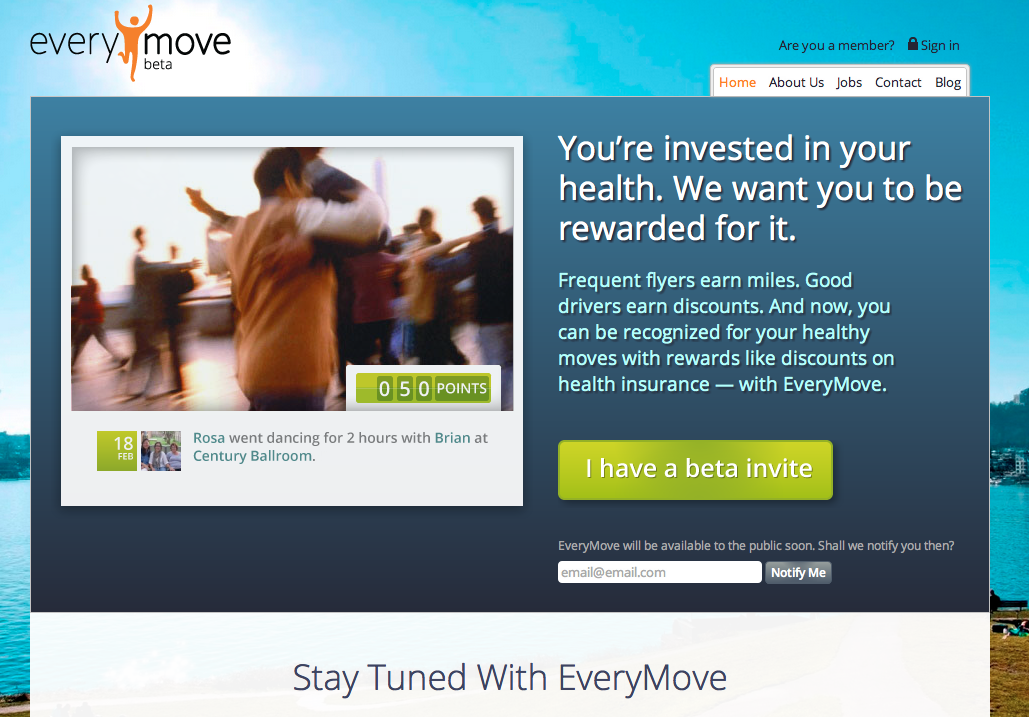

So what is EveryMove all about?

Founder and CEO Russell Benaroya tells us that the way health care is set up (in the U.S.) today, the people making healthy lifestyle choices end up subsidizing those who are making unhealthy decisions; instead, they should be rewarded for it. If the country is going crazy for consumer-centric healthcare, then that inherently demands that people be given control over their health (and healthcare).

EveryMove is looking to give consumers control by way of an interactive web and mobile platform that helps them connect and organize their health and fitness activities while turning their lifestyle actions into rewards and incentives within their health plans. The market has been primarily focused on “wellness” and “behavior change,” but wellness, Benaroya says, happens to crowded and employer-centric, while behavior change is actually really hard to get right because building a “one size fits all,” scalable platform tends to do so by sacrificing the individual.

In turn, health providers have less than growing reputations among consumers (let’s be honest here — just ask Castlight) so they’re looking to build closer/better relationships with their customers. Generally speaking, to do this, they’re looking to partner with them to encourage actions that have a positive outcome on their long-term health — and their wallets. (This latter part is, admittedly, hard to believe given where their interests lie, but again, see our Castlight coverage.)

In other words, U.S. health insurance premiums increased by an average of 8 percent between 2008 and 2009 (which has gotten worse since) and health care costs comprise a bigger portion of America’s household budgets year-over-year than most others as costs rise and income growth remain flat. As a result, Americans are trying to be smarter, make better lifestyle decisions to avoid going to the doctor, and EveryMove wants to reward them for doing so.

Instead of going after wellness or behavior change, EveryMove is taking a different approach: Marketing. The service connects people through their lifestyle actions, which are captured through the passive collection of data via health apps, devices, and platforms, with companies that want to engage those healthy customers. This can be plans, employers, or brands, the EveryMove CEO tells us, but, importantly it’s the consumer that gets to main control of their data — data which is portable and isn’t tied to their employer or insurance company.

EveryMove plans to monetize its platforms on a cost-per-action basis by taking a fee when users redeem rewards or incentives from their plan, brands, or employer. As EveryMove plans to sit in the middle of the marketplace, it takes a toll on each transaction.

Benaroya has been working on EveryMove for the last two years, working closely with Premera Blue Cross, he says, to understand their goals and objectives as the healthcare landscape changes. Benroya himself is a co-founder of Blink Digital Health, REM Medical, and a former senior associate at Blue Point Capital Partners. Taking the customer development work with the insurance plan and his experience with the marketplace, the founder has been looking to build something that’s not just a “nice to have” app, but a “need to have” source of information that will be critical to core business decision making.

The founder also sees real opportunity long-term in big data around lifestyle analytics — how that data and info can help inform decisions companies are making around positioning their products and services.

The ability to offer health plans that provide customized incentives for leading healthy lifestyles “is key to helping meet both employer and individual needs,” says Kent Marquardt, the executive vice president and CFO of Premera Blue Cross. (Premera is also an investor.) Programs like EveryMove, he says, can help them find better ways to do just that.

For more on EveryMove, check them out at home here. Below you’ll find Benaroya’s pitch from TechStars’ Demo Day: