Although it’s a year this week since Passion Capital appeared on the tech scene in London, it feels like they have been around a lot longer. It was in July 2009 I sat on the sun-kissed roof of what became known as their White Bear Yard base in London’s Clerkenwell, having had a tour of a vast empty warehouse space which three noted tech angels planned to fill with their invested startups. Unlike one or two other tech angels I knew, these guys were something of a breed apart.

A laid-back German ex-DJ who had killed it in ecommerce, a cool-calm-collected Brit veteran of the Internet and a former Valley maven who had seen the early days of Skype. We expected interesting things from these three musketeers and we got it. Many of their early investments are now seen as Passion Capital portfolio companies, but in truth, whatever the brand they work under, the special sauce that Eileen, Robert and Stefan brings to the party is the essential ingredient.

I mean, how often do you see an investor actually publishing the average founder salary of their invested startups? (BTW the answer is £32,767 per annum up to £54,000).

For those unaware, this is Passion Capital: Stefan Glaenzer (founder of Ricardo.de and first investor/Exec Chairman at last.fm, PhD in derivatives and options trading); Eileen Burbidge (former products director at Yahoo! and Skype, 10 years in silicon valley before that, Computer Science degree from Univ Illinois); Robert Dighero (former CFO of QXL Tradus (publicly listed), acquired in 2007 for £1 billion, Mechanical Engineering MS from Cambridge). Their investments include Flattr, Picklive, Smarkets, StylistPick, Twilio, OnDevice Research, Pusher, Bonfire.fm, Moviepilot, Mendeley, Luluvise, Adzuna, GoSquared and GoCardless.

Where veteran angel and seed funder Robin Klein once saw all the seed deals in London (and, to be frank, the consensus is amongst VCs I know that he still does), he now has competition and ‘co-opetition’ (for often these guys co-invest) in the shape of Passion, which has established itself as one of the “go to” early-stage/seed stage VCs in London. Eden and Octopus and others have lately punched a lot higher too, but Passion’s vibe can’t be denied. If there is scrappy competition at the Seed funding stage in London, it’s often between US Angels / VCs like Dave McClure and Fred Wilson versus the locals – Passion Capital.

And increasingly they are influential in a Pan-European sense as entrepreneurs flock to London from the continent looking for London’s more liquid and Valley-style investors.

Certainly I’ve found them to be similar in tone to Valley VCs: accessible, pretty transparent and former entrepreneurs/operators themselves. To that end, their term sheet is publicly available/downloadable and – if you believe the entrepreneurs I’ve spoken to – pretty founder friendly. You also get the feeling they back people/founders more than ideas.

As one-woman-startup ecosystem Eileen Burbidge tells me: “We like investing in early stage because it’s what we wish to do with our time. We love working with early stage teams and helping to build/up. When a company is at a point where it’s looking to optimize profit margins, it’s less interesting to us. We don’t fly business class.”

But based on the data they have produced for their anniversary, is Passion Capital really the 3rd most active early stage fund in the world? Could that have happened?

Normally you would assume the top 3 (or even 5) most active seed stage funds were all based in Silicon Valley. But it seems that based on the number of investments made over the last 12 months (Passion has made 20), they were third only to SV Angels (Ron Conway’s fund) and First Round Capital.

However you need to factor in that this does not include batch/accelerator programs such as Seedcamp, Springboard, 500 Startups, YCombinator, TechStars, etc. It also does not include slightly “pray and spray” investment teams such as Kima Ventures who make the same size investments for all deals (regardless of valuation) and often don’t even see/meet with the teams they invest in. Kima is astoundingly active for a reason – they invest A LOT. But you don’t get the feeling they are as super hands on as Passion.

Passion also seems to be ‘on trend’ in terms of government/state investment in (and subsidization of) venture capital funds, GigaOm recently noted.

Of Passion’s £37.5 million, £25 million is from the UK government – but it’s hard to see how this cash could be invested more efficiently. It’s in the hands of three amazing experts who can kick the tyres on startups down to the tiniest detail. Imagine if some terrible government ‘board’ had to deploy this money. Disaster.

Other firms are also getting these government funds like Notion Capital (which just announced their first $100 million closing 2 weeks ago), Dawn Capital, Eden Ventures, and Amadeus previous funds. The UK government has done well to secure these guys and the rumblings I hear from Number 10 are that this can only improve.

This government-backed funding really works. The Israeli’s proved it in the 1990s with the Yozma programme which at one point made Tel Aviv produce more tech startups than Silicon Valley.

Passion is also on trend in terms of the “new/next generation” of venture capital funds being established not by financial/investment managers but by former entrepreneurs and operators.

It’s a positive trend and particularly for early stage one that will generate better returns. In this camp there is Notion Capital, Atomico, PROfounders (all here in the UK) and quite a lot more in the US including. First Round Capital, Lowercase Capital, True Ventures, Felicis Ventures.

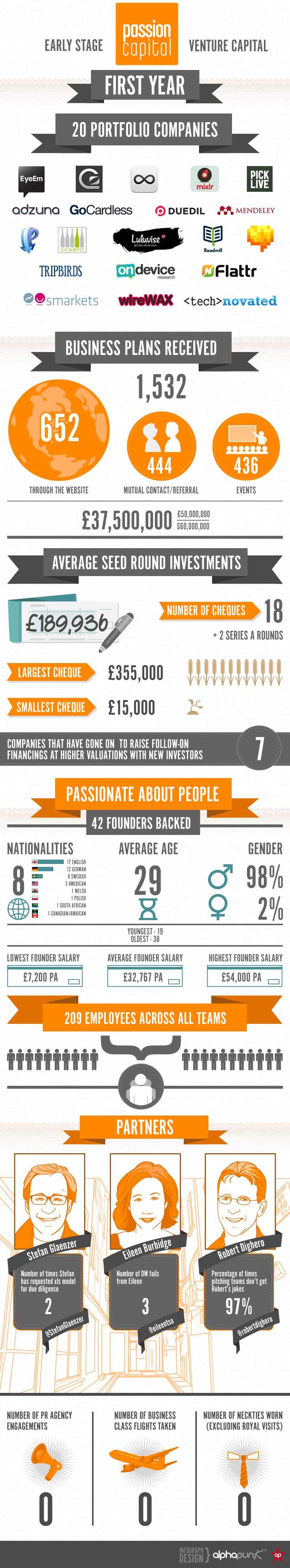

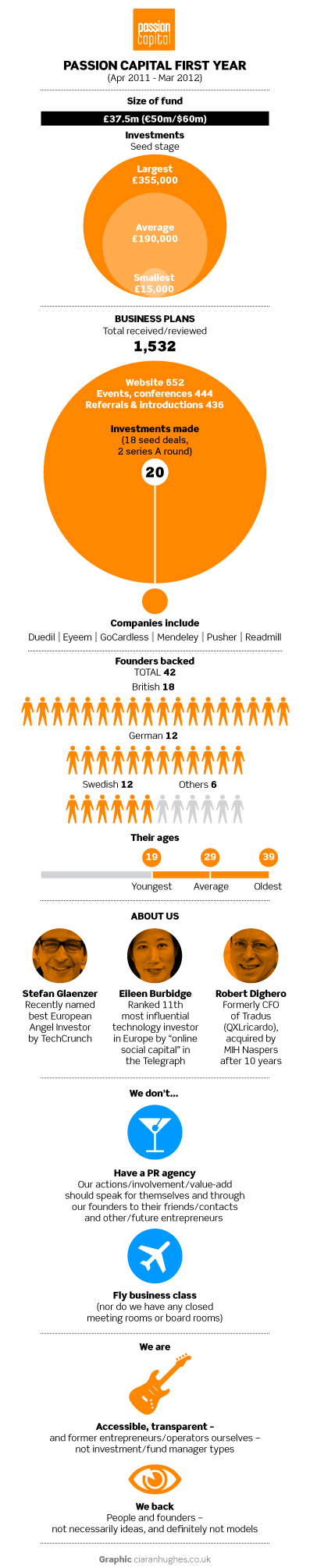

As part of their one year anniversary Passion has produced a couple of interesting info graphics (see below) from data they’ve collected. I dare say we could get some nice stats from other players, but it’s possibly the first time I’ve seen this done in Europe and especially from a VC.

Data points from Passion Capital: 1 year on (Apr 2011 – Mar 2012):

• 1532 business plans received/reviewed

• 652 through our website

• 444 conferences and events

• 436 through personal referrals/introductions through our website

• 20 investments made (18 seed investments, 2 Series A rounds)

• average seed round check size £189,936, smallest £15,000, largest £355,000• £37.5 million / € 50 million / $60 million size of fund

• 3 partners

• 1 associate

• 1 accountant• 20 investments

• 42 founders backed

• 2% female (1 of 42)

• 29 average age (oldest was 39, youngest were 19)

• 8 nationalities (40% British, 29% German, 14% Swedish,…)

• 17 English

• 12 German

• 3 American

• 1 Welsh

• 1 Polish

• 1 South African

• 6 Swedish

• 1 Canadian-Jamaican• 209 employees across all 20 companies. (Average company size is 10 people; largest is 19 people; smallest is 3 people.)

Other data points:

• Average founder salary is £32,767 per annum, lowest is £7,200 per annum; highest is £54,000 per annum

• 7 companies have already gone on to raise follow-on financings at higher valuations w/new investors

__________________________________________________________________________________________