It’s official: We’re back in boom times from a tech IPO standpoint.

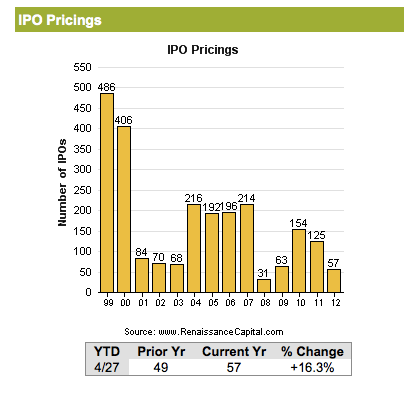

2012 is now on pace to be a record-breaking year for initial public offerings, and technology companies are leading the way. Fifty-seven IPOs have been priced since January 1st, which is the most U.S. IPO pricings the U.S. market has seen during the first four months of year since 2000, according to new data out of IPO-focused investment bank Renaissance Capital. The overall pace seems to be picking up even more, according to the firm — 14 new pricings have been made in the past week alone.

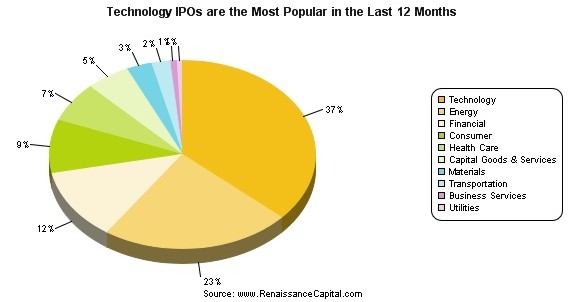

Not surprisingly, the tech sector is a big part of the ongoing IPO boom, with the industry accounting for 21 of the 57 IPO pricings made so far this year. And the biggest deal of them all — Facebook, of course — is still yet to occur.

A lot of people are crying “bubble” right now, which is understandable. But it’s important to remember that just because IPO numbers are up at 2000 levels does not mean we’re all primed for a 2001-like fall. For one thing, as a lot of people who were around in the first Dot Com boom will tell you, things are not nearly as hyped up right now in tech as they were then from a money-spending standpoint (which is good, but also kind of a bummer, as I would selfishly like to go to more epic parties.)

But most importantly, a huge number of people are actually on the Internet this time around — meaning that many of the web-based companies debuting on the stock market now are actually pulling in serious profits that just might justify their big valuations. It’s reasonable to think that this tech wave is one that could actually last.