NYC-based financial services startup for families, Tykoon, is exiting its private beta and is launching its first mobile app for iPhone. The company, which aims to change the ways kids think about and use money, is more that your typical allowance tracker application – it’s a platform for earning, saving, giving and spending, the latter which includes kid-friendly access to a curated and controlled Amazon store.

The company was co-founded by two experts in the payments and financial services business, Mark Bruinooge and Doug Lebda. Bruinooge spent 10 years in the industry, including time served as the head of e-commerce strategy as well as digital marketing at Bank of America. Co-founder and Chairman Doug Lebda, meanwhile, founded LendingTree.com, and served as its COO for several years following its acquisition by IAC in 2003.

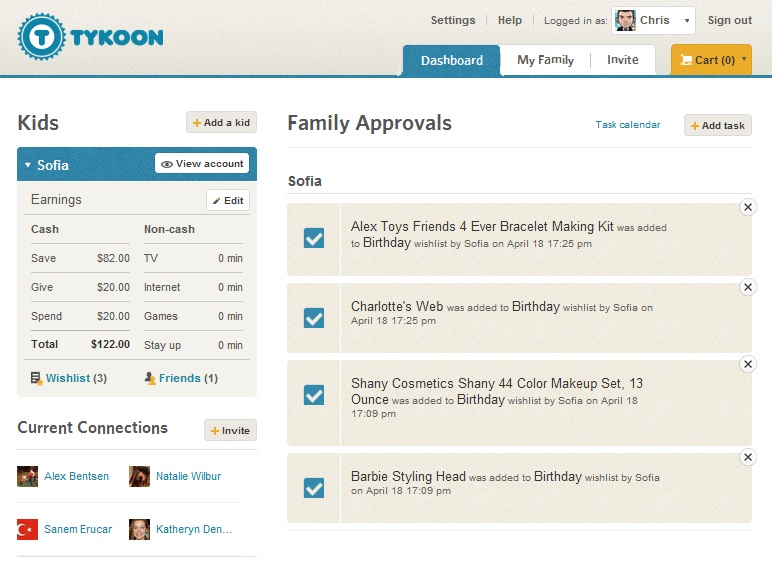

Bruinooge explains Tykoon’s goal as “improving financial literacy by giving kids a real platform that allows them to learn through real experiences.” What that means is kids can earn cash and rewards by performing tasks or chores, or by meeting certain goals set by parents (e.g., make honor roll). Parents also learn about finances, too, in a way, because they use the service to set up what these tasks and goals should be, then dole out the money and rewards upon completion.

While that aspect of the service is similar to some other allowance-tracking programs, one interesting thing that Tykoon is offering is the curated shopping experience it provides for kids. The service includes access to a customized version of the Amazon store which has been curated for “kid friendliness.” (There’s nothing inappropriate or impractical there.) Parents can also further customize the shop by enabling or disabling the categories their kids can see.

As kids earn money, they can then choose to spend it in the online store, or can request a cash-based payout from mom or dad. Currently, the app is targeted towards 8 to 12-year olds, but the addition of a bank-issued, preloaded debit card is planned for Q1 2013, which will extend the platform to teens. Bruinooge says the company is already in talks with MasterCard, Visa and banking partners on this, and the result will be something similar to the Visa Buxx card.

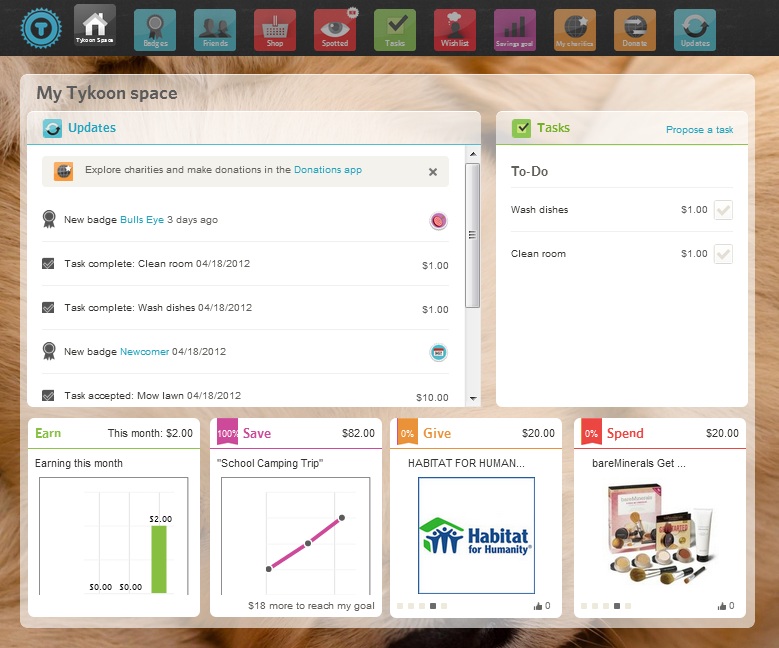

During the beta period, which began in August of last year with around 650 families participating, the company refined the Tykoon’s visual experience from that a virtual, customizable room (kids picked out wallpaper and a pet!) to that of a utility with a dashboard and app tray for access to the platform’s various features, including the Wishlist, Tasks, Badges, Friends, Store, Savings and Goals, and more.

In addition to learning about earning, saving and spending, Tykoon also helps teach children about giving through a donations feature, which allows them to give money to charities like World Wildlife Foundation or Habitat for Humanity, powered by Network for Good.

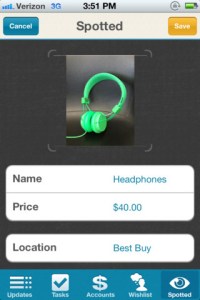

The iOS app, launched last night, now allows both parents and kids to log in via password and PIN-protected accounts, and includes a nifty feature for snapping photos of kids’ wants (i.e.,”buy me that!!”) for adding items to the wishlist.

The iOS app, launched last night, now allows both parents and kids to log in via password and PIN-protected accounts, and includes a nifty feature for snapping photos of kids’ wants (i.e.,”buy me that!!”) for adding items to the wishlist.

The company also plans to introduce an Android app around September, and will add more social sharing options, primarily for wishlist sharing, early this summer.

The web service and application are free, as Tykoon earns affiliate income from the Amazon purchases. In the future, Tykoon is looking into corporate sponsorships and a value-added premium model as additional sources of revenue.

Interested parents and kids can sign up here, and the mobile app is available in iTunes here. Tykoon previously raised $1.4 million in funding last fall from Doug Lebda, RRE Ventures, Rick Thompson, Chamath Palihapitiya, David Bach, and G. Kennedy Thompson.