Remember when Groupon raised, like, a billion dollars? We certainly do.

Well, it looks like Groupon’s slide over the past month is bringing its last round of venture investors ever closer to breaking even. The stock has rebounded slightly this morning to $11.49, but the number to watch is $7.90.

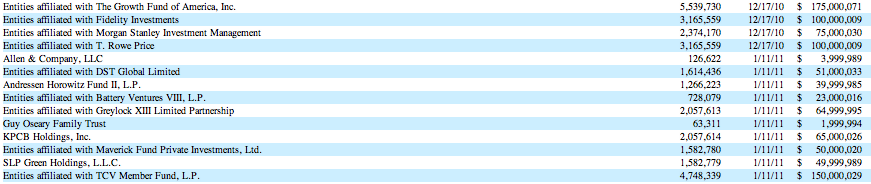

That’s effectively what several top-tier Silicon Valley venture firms including Kleiner Perkins, Greylock and Andreessen Horowitz paid per share when they invested $946 million in Groupon between Dec. 2010 and Jan. 2011. At that point, they bought Series G Preferred Shares for $31.59 each. These later converted into four shares of Class A common stock on Oct. 31 of last year, just a few days before Groupon’s initial public offering on Nov. 4.

All eyes are on May 14, when Groupon will report quarterly earnings for the second time as a publicly traded company. More notably, the end of the lock-up period is coming up soon. That’s the point at which investors will actually be able to sell their stakes in the company. It’s coming up on June 1, after being pushed back from the original date of May 2 because that was too close to their earnings date.

Right now, their stakes in Groupon are up about 45 percent from the price they paid a year and a half ago. It’s the kind of return that would normally sound awesome, but it’s probably not the kind of return late-stage venture investors were hoping for when Groupon looked like an easy win in late 2010 after turning down a $6 billion offer from Google. When Groupon debuted, it shot to $28 on its first day, which would have given investors at least a 3X on their investment. Now it’s down to the kind of margin that a bad earnings report could devour in a heartbeat.

For those who like to keep score, here’s the table of who participated in that round and how much they invested:

It’s worth noting that these shares had preferences or protections, and were senior to several other rounds of preferred shares (meaning these investors had the right to take their money out first before others). But those preferences apply during a “liquidating event” or if the company is dissolved, wound up or liquidated.

Now to be clear, when the lock-up period expires, these investors will merely have the option to sell their shares. They may decide to hold onto them for longer as a bet that this is a short-term stumble and that Groupon will rebound. It would also be silly to lock-in losses at the bottom. The company’s shares took a precipitous slide when Groupon said on March 30 that it had to restate its fourth quarter earnings because of weak accounting controls. The restatement deepened the company’s net loss to $65.4 million from $42.7 million.

For the next report, Groupon has given guidance to expect $510-550 million in first quarter revenue with income from operations coming in at between $15 million to $35 million. That would be up from $295.5 million in revenue and a $117.1 million operating loss from the same time period a year earlier.

There are analysts out there arguing a bull case for Groupon. Goldman Sachs’ research team had a buy recommendation with a 12-month price target of $25 as of April 1. Morgan Stanley analysts say that the company’s relationships with local merchants through its 5,000-person salesforce help make the company’s model defensible. The earnings restatement was “a mild hiccup in Groupon’s compelling long-term story,” Morgan Stanley’s Scott Devitt wrote in a research note.

So it’s quite possible that this very post marks the point at which all negative news has been priced in. Here’s hoping for Groupon’s sake.

P.S. Do you know which late-stage investors would actually be in the red if they could sell today? The ones that bought Zynga’s Series C Preferred shares in February 2011 at $14.03 a pop. They converted one-for-one into Class B common stock with the company’s IPO. Zynga shares currently trade at $8.72. (Ouch!)

These investors include 11 mutual funds associated with Morgan Stanley plus a token investment from Kleiner Perkins, through the firms’ digital growth fund and another digital growth founders fund. Don’t cry for Kleiner though. Bing Gordon, who sits on Zynga’s board, got the firm into the company years ago. Most of Zynga’s investors are subject to a lock-up that ends around May 28, although some employees will be able to start selling their holdings a week from now around April 30, according to the company’s prospectus.

So what do Zynga and Groupon teach us? For highly hyped consumer tech IPOs, public markets have turned out to be far harsher judges of value than previously thought.