Believe it or not, 37 million Americans, or about 16 million households, pick up and move every year. Depending on whom you ask, we move as frequently as once every three years. Yes, moving is a part of life, albeit a stressful and emotional one. Unsurprisingly, the many services and operations that go into household moves have collectively come to represent a sizable industry. If you take transportation, warehousing and storage, packaging, processing, distribution, and logistics into account, industry revenues total more than $16.5 billion annually.

Naturally, transporting one’s valued possessions is a delicate (and expensive) operation, and, as with so many things, accidents are bound to happen, which is why insurance is such a necessary part of the process. Of course, with over 8,100 moving companies spread across more than 17K locations in the U.S., the industry is fragmented and the insurance process itself is, unsurprisingly, antiquated and fragmented.

Traditionally, moving companies offer limited liability coverage, or replacement insurance, but coverage tends to vary, with the average coverage limited to just 60 cents per pound. With the average household move weighing in at over 7K pounds, coverage ends up being relatively meagre. Take the example of moving a plasma screen TV, which costs $1,000 and weighs 100-lbs: If the mover were to drop or break the TV, they are only liable for up to $60 worth of its total cost. Clearly, not even close to adequate.

What’s more, moving companies generally fund and adjust their own claims payments, leading to an inherent conflict of interest, as they decide how much to pay you in the event of damages — that they themselves may have caused.

Sounds like the perfect opportunity to apply a little technology, doesn’t it? It was this belief that led a team of entrepreneurs familiar with the space to found MoveInsure late last year. Seeing an industry rife with legacy systems, dominated by a fragmented group of players, the startup has set out to streamline communication between those players and bring efficiency and automation to moving transactions.

MoveInsure recently unveiled its new online service, which is designed to fully automate the process of procuring insurance for a household move online — from purchase to claims filing. Buying coverage for a move and filing a claim in the event the move didn’t go as planned can now be done from the comfort of the couch.

There are a number of parties involved in the insurance transaction, including the end user, insurance carriers and underwriters, claims adjusters, moving companies, insurance agents, and so on. Historically, these parties have all been removed from one another, each existing seemingly in their own vacuum, with little inter-communication beyond the necessary, so MoveInsure has created a web-based interface that that is specifically tailored to each party, allowing each group to track and issue insurance coverage, file and monitor claims, etc.

MoveInsure CEO Boaz Raviv and co-founder Isaac Raviv tell us that by partnering with key industry players, be they insurance companies or claims consultancies, and automating the entire process from start to finish, the startup’s platform not only offers consumers ease-of-use, but ultimately better rates, coverage, and better claims service for what he calls an “oft-misunderstood product.”

Another value proposition lies in the aforementioned fact that moving companies who fund their own claims based on liability per-pound are not subject to certain insurance regulations. But, because MoveInsure’s insurance carriers are subject to Department of Insurance regulations in every state, which protect consumers from bad faith adjusting, users’ claims are assessed by an objective third-party, not by the same company that broke your 42-inch plasma screen TV.

Another value proposition lies in the aforementioned fact that moving companies who fund their own claims based on liability per-pound are not subject to certain insurance regulations. But, because MoveInsure’s insurance carriers are subject to Department of Insurance regulations in every state, which protect consumers from bad faith adjusting, users’ claims are assessed by an objective third-party, not by the same company that broke your 42-inch plasma screen TV.

Again, as many moving companies offer limited liability coverage, consumers end up getting short shrifted. So, MoveInsure set out to offer a wide set of coverage, and now offers Gold, Silver, Pair & Sets, and Storage Extension coverage, giving users flexibility depending on what their moves require. The startup also has multicarrier flexibility, which means that it can insure your move abroad as well.

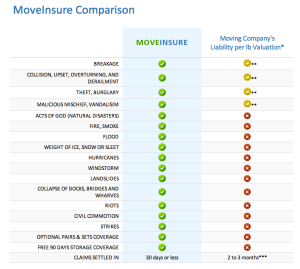

While some moving companies do in fact offer full-replacement valuation and charge similar rates to MoveInsure, the CEO says that the company is one of the few to offer broad coverage that includes acts of god, (hail, fire, wind, rain), accidental collisions, and even falling objects.

The other huge pain in the ass when it comes to insurance is how slow the process of claims settlement has become. The industry average is two to three months, while MoveInsure boasts that 95 percent of its claims are settled in less than 30 days.

This can be big for moving companies, too, who don’t want to be in the business of taking care of claims. What’s more, under the current model, their liability is affected by problems, and by claims, but MoveInsure removes the middle man, so that if there is a claim, it doesn’t effect the moving company’s rating. In turn, they become an affiliate for MoveInsure, and both sides win.

The team has been working on the platform for the last year and a half, before stealth launching in January, and soft-launching the following month. Raviv says that that if one were to boil down the company’s mission it would be to do for the moving space what Esurance has done for car insurance, which is why the startup recently added Esurance Co-founder Chuck Wallace to its board of directors, too.

At the outset, MoveInsure raised a small round of angel funding, but with its launch behind it, the company is setting out to raise its next round to help accelerate its growth.

For more on MoveInsure, check ’em out at home here.