A new cloud-based service for collecting payments called ZenCash has launched today, with support for integration into popular invoicing applications like QuickBooks, Clio, Freshbooks, Harvest and more. With ZenCash, the goal is to automate a business’s customer relationships surrounding the invoicing process, especially the often uncomfortable part where you have to ask for overdue payments.

The idea for startup comes from serial entrepreneur Brandon Cotter, now ZenCash CEO, who says he realized the need for more automation in the invoicing and collections process after having spent hours calling customers in an attempt to collect money his small business was owed.

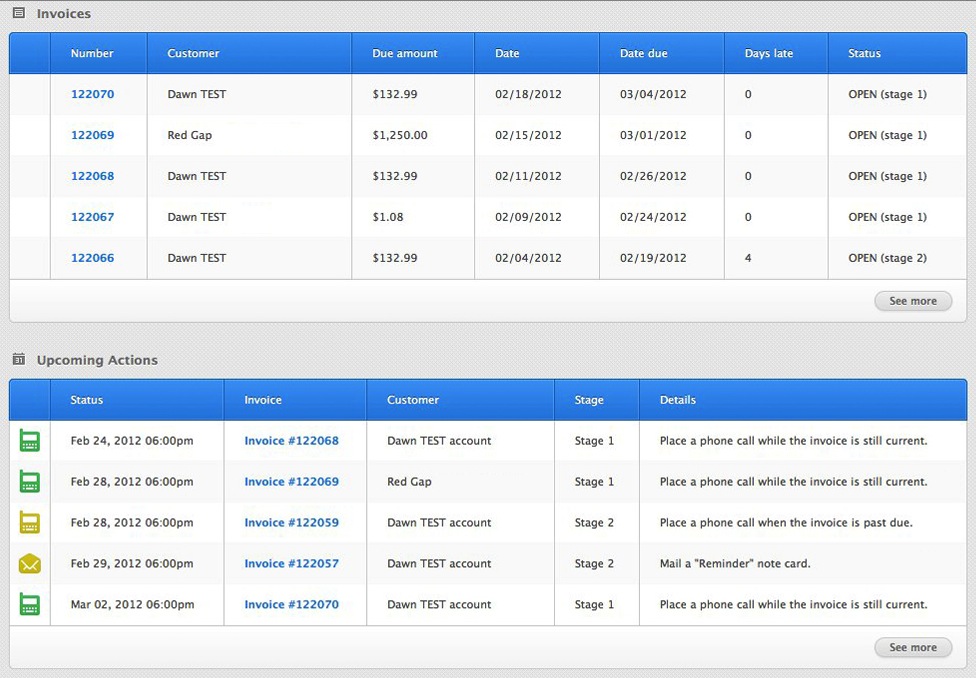

To use the new service, a customer connects ZenCash to their current invoicing system, and sets up what’s called an “Action Timeline.” This is basically the follow-up plan for the various stages of invoicing, and it extends beyond collections. The system can also send out a “thank you for your business” note, reminders when invoices are about to be due, reminders for when the invoice becomes overdue, and it can even place phone calls on the businesses’ behalf.

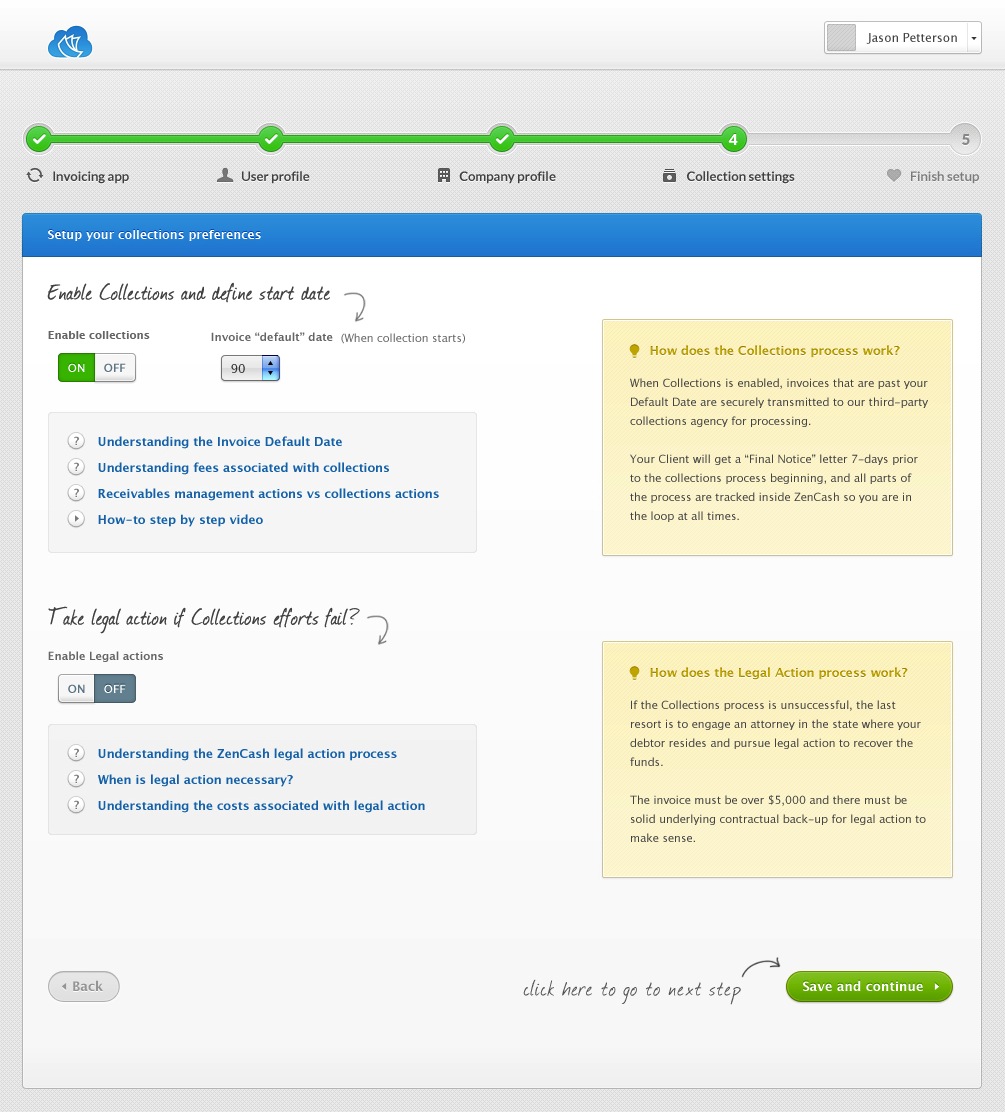

After the invoice remains past due for a set amount of time (as determined by your own company’s procedures), ZenCash can also automate the process of sending the invoice to third-party collections. And when all other traditional collections methods end up failing, ZenCash can then connect customers to a network of attorneys who can initiate legal proceedings on their behalf.

The idea, while obviously a great fit for small business owners, is also useful for early stage startups, says investor Gabriella Draney, the managing partner of Dallas-based Tech Wildcatters, a seed accelerator program. She explains that it can help grow a startup’s business-to-business relationships at the very beginning, freeing up founders to focus on product.

“There is a complete disconnect between thinking about building a business and then thinking about, very much at the later stage, actually collecting a check,” she says. “One of the best ways to reinforce a customer relationship, I think, is by saying ‘thanks.'”

The eight-person team behind ZenCash are spread out, with folks in Dallas, San Diego, Spain and Romania. The service is currently bootstrapped, with a $500K investment from the founder.

For now, the pricing for ZenCash is a la carte – there’s no setup fee and customers will only pay for the services they use. ZenCash, it should be noted however, is U.S.-only at launch.