It may now be obscured by all the hoopla surrounding Facebook’s going public, but back in November the popular user-generated review site, Yelp, filed to go public and planned to raise $100 million ahead of its IPO (at an expected $1 to $2 billion valuation). On Friday, Yelp filed an amended S-1 that shows that the company plans to list on the New York Stock Exchange under the symbol “YELP.”

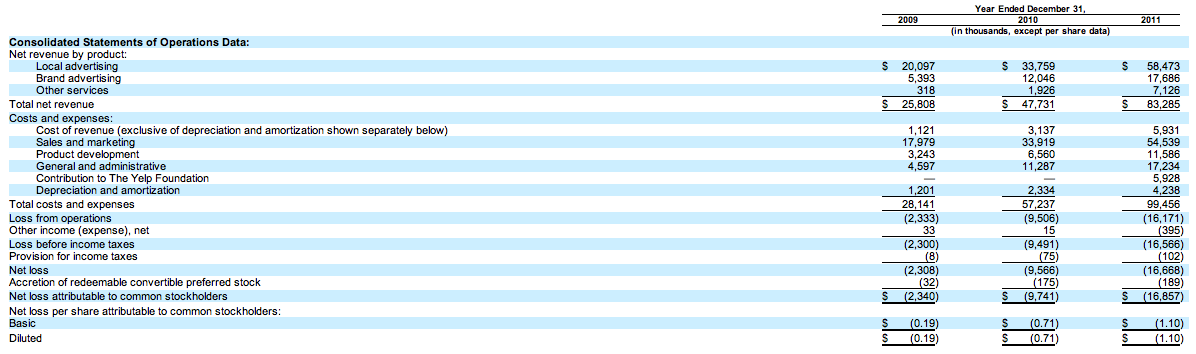

But, of perhaps greater interest to those following Yelp’s trajectory is the fact that the third amendment to the company’s S-1 includes full-year financials for 2011, showing that, while the company’s net revenues have continued to rise since 2009, its operating losses have continued to increase right along with them. Yelp’s total revenues in 2011 were $83.2 million, up 74.6 percent from $47.7 million in 2010 (and 25.8 million in 2009), but net losses were up to $16.9 million in 2011 — a 74.2 percent increase from a net loss of $9.5 million in 2010. (Adjusted EBITDA losses were $1.1 million.)

The amended S-1 also shows some adjustments in Yelp’s traffic for 2011, as it saw 65.7 million unique monthly visitors for the year (with 5.7 million uniques on mobile), up from 39.3 million in 2010. Yelp users left 24.8 million reviews in 2011, up from 15.1 million in 2010.

As to Yelp’s increasing net losses, most of that was incurred from sales, marketing, and product development-related expenses, as sales and marketing costs increased 61 percent to $54.5 million in 2011. Product development costs, in turn, rose 77 percent to $11.6 million, up from $6.5 million in 2010. Of course, revenues increased right along with losses, jumping to $83.2 million, with the majority of revenues coming from local advertising, which accounted for approximately 70 percent, or $58.4 million, of that total.

Yelp was founded Jeremy Stoppelman, a former PayPal exec, in 2004, and follows the public debuts of both Groupon and Zynga late last year, along with the announced IPO of Facebook last week. Yelp may be operating in the red, but it’s not alone, joining the likes of Groupon and LivingSocial. It’s not unusual for fast-growing companies like these to operate at a loss early on their growth, spending big money on acquiring talent and competitors, or getting their message out through advertising.

In terms of the latter company, Amazon’s updated filing with the SEC recently revealed that LivingSocial had sustained $558 million in losses in 2011, which mostly came from acquisitions, stock compensations, and marketing costs. While this was an expected part of LivingSocial’s fast-paced growth cycle, the high number certainly caught many by surprise — and in comparison — Yelp’s losses look slightly more manageable.

As for Yelp, Goldman Sachs is leading the IPO, with Citigroup and Jefferies pitching in on management of the deal.