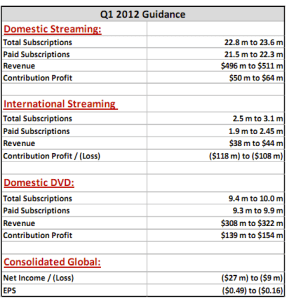

After some fairly sizable blunders last summer, Netflix suffered for the remainder of 2011, as its stock price took a serious dive and subscribers left in droves. That’s why it was at least a bit of a surprise when Netflix bounced back today in its fourth quarter earnings — beating Wall Street’s projections — in spite of expected losses throughout 2012 thanks to the costs of rolling out its service internationally (among other things).

Of course, while the creation of Qwikster (and splitting its DVD and streaming businesses) may seem ill-conceived in retrospect, as Erick pointed out today, Netflix’s Q4 earnings show that the company had some not-so-trivial economic incentives for separating the two. Breaking out DVD vs. streaming for the first time in Q4, Netflix showed that the two businesses have drastically different margins, with streaming at an 11 percent profit margin, compared to 52 percent for its DVD business.

On the other hand, everyone knows that streaming content has a far brighter future than DVDs, so likely Netflix (and others) just have to “bite the bullet” on that front, right? After all, when CEO Reed Hastings was asked about the future of DVD profitability and subscriber share on Netflix’s 4Q earnings call this afternoon, he simply stated: “We expect DVD Subscribers to decline every quarter … forever.”

In the last quarter of 2011, for instance, the DVD business lost 2.76 million subscribers, while streaming gained 220K. While it hopes streaming subscription rates will pick up over the next year (both domestically and internationally), there’s no reason to think that the declining DVD numbers are going to change.

Yet, the DVD business has fixed costs, and Netflix is forced to continuously jockey for rights to streaming content, so, in the near term, one would think that its DVD business would be significantly more profitable; however, Hastings said that, in reality, it’s just the opposite.

Streaming subscribers now outnumber DVD subscribers 2:1, and the CEO said that the marginal streaming subscriber is “almost pure contribution,” whereas the average DVD subscriber leads to a number of variable costs.

“Profitability of each new streaming subscriber is almost twice what it is for DVDs … we’d obviously like them to do both, but if they’re only going to use one, we’d much prefer they use streaming,” he said.

Netflix will continue to focus on international expansion, and even though the cost of expansion will hamstring earnings results over the next year, leadership believes strongly in the opportunity abroad. Although Amazon acquired LoveFilm (the U.K.’s answer to Netflix) last year, the leaders believe that LoveFilm’s business is still predominantly DVD-based. Profitability, Hastings said, is naturally based on competitive barriers and scale.

While they think that LoveFilm and others obviously pose a few competitive barriers, they’re mostly low, so the opportunity to sieze the streaming market internationally is potentially huge, and likely extremely profitable. Basically, Hastings words imply that Netflix doesn’t really see any sizable competition abroad in terms of on-demand video streaming at scale, so they’re investing aggressively to be “early in the game.”

While they think that LoveFilm and others obviously pose a few competitive barriers, they’re mostly low, so the opportunity to sieze the streaming market internationally is potentially huge, and likely extremely profitable. Basically, Hastings words imply that Netflix doesn’t really see any sizable competition abroad in terms of on-demand video streaming at scale, so they’re investing aggressively to be “early in the game.”

Hastings and Chief Financial Officer David Wells made a few other interesting points during the investor call today. One being that, although they now believe that splitting the business was a mistake, they continue to stand by their 60 percent price increase last July, which was really the primary driver behind the exodus of subscribers Netflix experienced for the remainder of the year. Since then, Netflix’s stock dove from around $300 a share to under $70. Yikes.

However, Wells said that if he had it to do all over, he’d make the same decision again. I get it … the whole staying on message thing, hindsight is 20/20, etc. etc., but Netflix is still dangerously close to losing customers if their content doesn’t improve significantly. It’s difficult to compete with the cable networks for exclusivity rights, but their streaming selection still pales in comparison to DVDs.

Another point of interest includes the fact that, while smart TV streaming is the fastest growing segment of its business and 3-D streaming will be a big future play, Netflix has no plans to go into video game rental, which was to be a new feature of Qwikster. Some might think that, with the scale of its distribution, Netflix could easily enter the video game rental market and quickly begin undercutting the competition. But not so, according to the executives. Redbox and Gamefly will obviously quite relieved to hear this news. (At least for now.)

A second inquiry on today’s call asked Hastings and Wells why they weren’t considering a la carte options (i.e. pay-per-view), insinuating that it might help them become a one-stop-shop for movies and TV shows. This is an interesting subject, considering an example many of us have probably experienced. If you don’t have Tivo and you happen to miss an episode of a TV series you love to watch, and you want to watch for free, oft-times you’re out of luck, with Hulu and some of the big cable networks as exceptions. Hastings and Wells seemed to imply that networks are only going to increasingly offer their shows right after they air on their own websites (something which is growing in popularity, check out Fox, for example).

If Netflix were to offer pay-per-view episodes of Mad Men right after they air, isn’t this something that customers would love? Probably, but Hulu has already won a lot of these rights (most of which are exclusive in video streaming). And Hastings said that he thinks that there isn’t a lot of brand strength in “being everything for everyone,” and being unlimited streaming video for a low fee is the core of their brand proposition — adding pay-per-view would confuse both the brand identity and its customers.

With Vudu, Amazon, Blockbuster, and more already in the game there is a huge list of companies already offering pay-per-view, he said, and “we don’t think we have a way to do it any better.”

“In some sense it’s niche,” the CEO said, “but it’s a very big niche, which we think we can lead.” Dolby Digital came to mind, he said, as an example of what Netflix wants to do — be on every platform, and get along with everyone. Clearly, this was another way of saying that, at this point, pay-per-view would put strain on its relationships, and the potential customer acquisition that it could catalyze isn’t worth the cost.